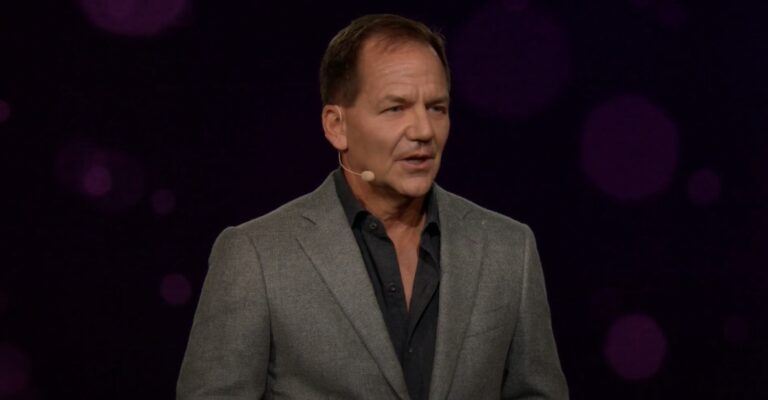

On Thursday (December 3), with Bitcoin consolidating around $19,400, legendary billionaire macro investor Paul Tudor Jones II (aka “PTJ”), explained why he believes that Bitcoin is currently undervalued.

PTJ, who is the Founder and the Chief Investment Officer (CIO) of asset management firm Tudor Investment Corporation (aka “Tudor”), made his comments regarding Bitcoin during an interview earlier today with Yahoo Finance correspondent Julia La Roche.

La Roche started this segment of the interview by asking PTJ what he thinks about cryptocurrencies in the context of his portfolio.

PTJ replied:

“Again, I’m not an expert on Bitcoin by any stretch. It’s just what the market cap of $500 billion… it’s the wrong market cap in a world where you’ve got $9 trillion worth of equity market cap and God knows how many trillions of fiat currency etc… so it’s the wrong market cap for instance relative to gold, which is eight or nine trillion [dollars].

‘Bitcoin reminds me so much of the internet stocks of 1999 because the internet was in its infancy. No-one knew how to value it because of the world of possibility that lay ahead. What you can be certain of is that probably 20 years from now our kids and grandkids, whatever, all of us, will be using some type of digital currency.

“Digital currency will be will be used by every sovereign. They may have their own digital currency, whatever. They’ll be very very very commonplace at that point in time. Cash may be gone, and so in that world, where does Bitcoin fit in as well as some of the other cryptocurrencies?… I don’t know. I’m not smart enough to figure that out.

“I think Bitcoin if I really had to kind of guess what the future is going, to be it’s going to be a lot like the metals complex, where you have precious crypto… that might be Bitcoin, it’s the first crypto…

“Because of its finite supply, that might be the precious crypto. Then you’re going to have transactional cryptocurrencies along with the sovereigns, and they may be more like the industrial metals, so where you have gold as a precious metal… you may have precious crypto and you may have industrial crypto…

“So, what I do know is that it’s no way possible today to know what the next ten or twenty years are going to be like, and I know that if I had to take a position on it, I’m going to take the brand name, which is Bitcoin. I’m going to assume that it’s the wrong price for the possibilities it has, and I’m going to assume that the path forward from here is north.”

Back in early May, PTJ made some very bullish comments about Bitcoin (as an inflation hedge) in the investment letter (“Market Outlook — Macro Perspective”) sent out to clients of the $22 billion macro hedge fund “BVI Global Fund”, which is managed by his asset management firm Tudor Investment.

Bloomberg was the first to report (on May 7) that according to this investment letter, the offering memoranda for the Tudor BVI Global Fund had been updated to disclose that Tudor Investment Corporation “may trade Bitcoin futures” for the fund and that the “initial maximum exposure guideline for purchasing Bitcoin futures” had been set to “a low single digit exposure.”

Naturally, this highly bullish thesis on Bitcoin got everyone in the crypto community very excited.

This is why CNBC’s “Squawk Box” decided to invite PTJ for an interview on May 11.

Below, we highlight the most interesting things that the Tudor CIO said about Bitcoin during this interview.

Squawk Box co-anchor Andrew Ross Sorkin asked PTJ what had changed his mind about Bitcoin (since PTJ for a long time used to be skeptical of Bitcoin).

PTJ replied:

“Well, Covid happened, and the great monetary inflation happened, and that made me begin to think about how do you want to be positioned in your portfolio going forward.

“So, that’s really what trip my interest in Bitcoin, and you have to realize if you just think about say Bitcoin versus cash, right?

“When I think of stores of value, I think of it in four ways: purchasing power; trustworthiness; liquidity; and portability…

“When it comes to trustworthiness, Bitcoin’s 11 years old; there’s very little trust in it. We’re watching the birthing of the store value and whether that’s exceeds or not only time will tell.

“What I do know is that every day that goes by and Bitcoin survives, the trust in it will go up.

“If you take cash, on the other hand, and you think about it from a purchasing power standpoint, if you own cash in the world today, you know your central bank has the goal of depreciating its value 2% per year. So you have in essence a wasting asset in your hands.

“So, Bitcoin, I think it’s a great speculation… I’ve got just over one percent of my assets in Bitcoin, maybe it’s almost two. That seems like the right number right now.

“For me, it’s not the great cure for all the monetary ills. It’s a great speculation, that’s what I would say what Bitcoin is.”