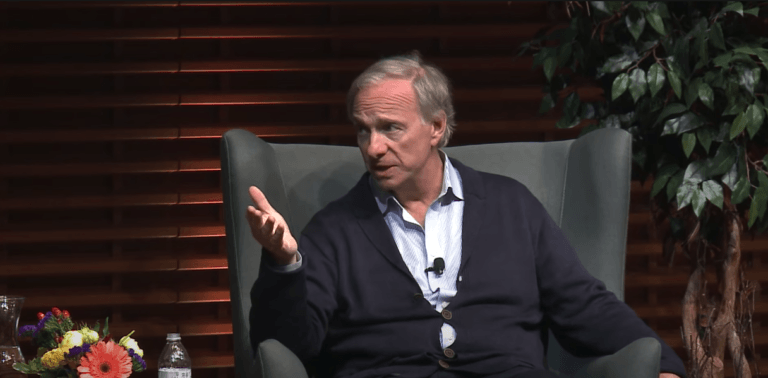

On Tuesday (December 8), legendary billionaire hedge fund manager Ray Dalio said during a Reddit Ask Me Anything (AMA) session that Bitcoin “could serve as a diversifier to gold and other such storehold of wealth assets.”

Dalio is the founder, chairman, and co-chief investment officer of Bridgewater Associates.

The 71-year American whose net worth is estimated to be around $18.7 billion created asset management firm Bridgewater Associates from his New York City apartment just two years after receiving his MBA from Harvard Business School. Bridgewater Associates had $138 billion in assets under management as of April 2020, and its many institutional clients include “pension funds, endowments, foundations, foreign governments, and central banks.”

Dalio started by saying:

“Many of the things now happening the world—like the creating a lot of debt and money, big wealth and political gaps, and the rise of new world power (China) challenging an existing one (the US)—haven’t happened in our lifetimes but have happened many times in history for the same reasons they’re happening today. I’m especially interested in discussing this with you so that we can explore the patterns of history and the perspective they can give us on our current situation.”

With regard to the current state of the financial markets, he said:

“We are in a flood of money and credit that is lifting most asset prices and distributing wealth in a way that the system that we’ve come to believe is normal is unable to, and that is threatening to the value of our money and credit. Most likely that flood will not recede, so those assets will not decline when measured in the depreciating value of money.

“It is important to diversify well in terms of currencies and countries, as well as asset classes. Internally, this is taking place in a politically and socially threatening environment, which will affect taxes, spending, and how we are with each other. Externally, there will be greater competition, particularly by China. If done well, the competition will bring us better alternatives, and if done poorly, will bring us a terrible conflict. I want excellent diversification at this time.”

With regard to Bitcoin, although he does prefer gold to Bitcoin (since central banks currently hold gold and not Bitcoin as a reserve asset), he acknowledges that Bitcoin could be seen as a gold alternative:

“I think that bitcoin (and some other digital currencies) have over the last ten years established themselves as interesting gold-like asset alternatives, with similarities and differences to gold and other limited-supply, mobile (unlike real estate) storeholds of wealth. So it could serve as a diversifier to gold and other such storehold of wealth assets.

“The main thing is to have some of these type of assets (with limited supply, that are mobile, and that are storeholds of wealth), including stocks, in one’s portfolio and to diversify among them. Not enough people do that. As far bitcoin relative to gold, I have a strong preference for holding those things which central banks are going to want to hold and exchange value in when they are trying to transact.”