Cryptocurrency cloud mining firm Genesis Mining has published the results of a survey it conducted with 1,000 cryptocurrency investors in the United States with over 24 questions. It showed 17% of investors believe the price of bitcoin will be above $50,000 by 2030.

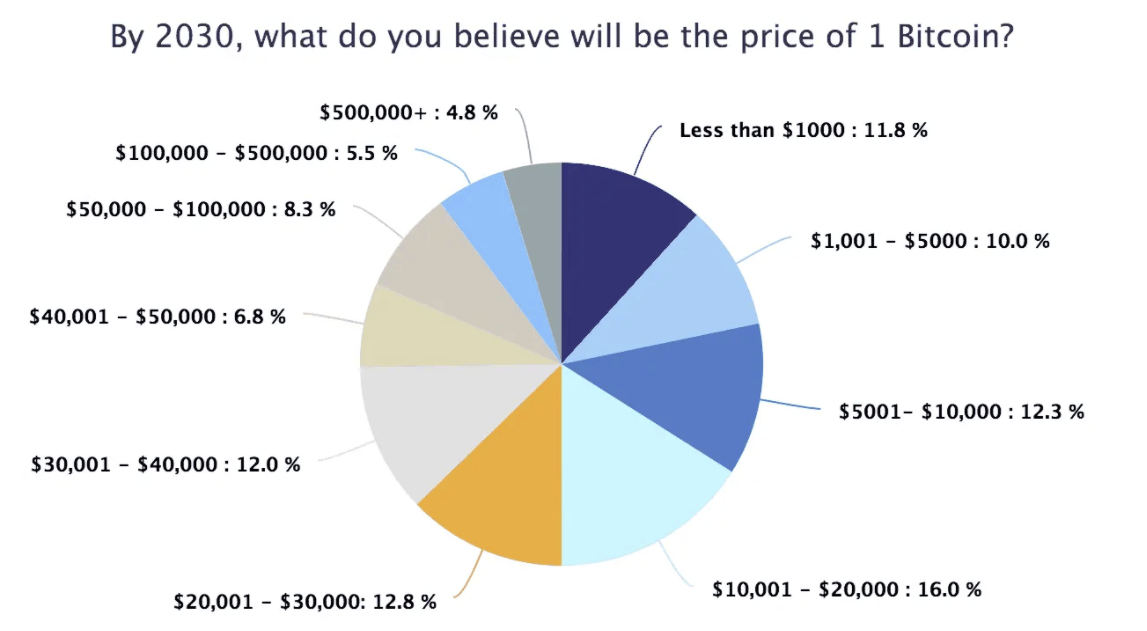

According to the published findings, about 5.5%% of investors expect the price of the flagship cryptocurrency to go over $100,000 in the next decade but stay below $500,000, while 4.8% pointed toward the $500,000 mark. 8.3% said it would trade between $50,000 and $100,000.

Other respondents were less bullish, with only 10% saying BTC will trade between $1,000 and $5,000 by 2030, and 11.8% saying it will be under the $1,000 mark. 16% of respondents pointed towards the cryptocurrency’s current range between $10,000 and $20,000.

Bullish reasons for the price of BTC to rise exponentially over the next dace include growing adoption, cited by 43.2% of respondents, declining trust in alternative currencies for nearly 30% of respondents, and a rise in BTC investment sparked by a major economic depression, cited by 25.8% of respondents.

Those who believe the price of bitcoin will fall in the future pointed to various potential reasons. 32.4% of respondents who said the price of BTC will either remain stagnant or fall in the next 1’ years pointed to the threat of regulation, while 20.6% said government-issued bans would hinder its growth.

A further 17.6% said BTC will be replaced by another cryptocurrency – potentially even one issued by a government – while 16.2% said the hype surrounding the cryptoasset space will wind down. Only 9.6% said BTC’s price won’t grow because of a lack of practicality.

Overall, 65% of bitcoin investors remain bullish with 57% of them believing bitcoin is a better long-term investment than gold. 55% prefer the flagship cryptocurrency to stocks of giants like Apple, Google, and Facebook.

Commenting on the results the CEO of Genesis Mining, Marco Streng, said:

We’ve been long term Bitcoin bulls since we started mining back in 2013. These findings support our belief that there are many others out there who are bullish about Bitcoin as well

In addition to their price predictions, investors also revealed their current exposure to BTC. Nearly 20% said that they have 60% or more of their savings in bitcoin, while only 7% of investors had no allocation to the cryptocurrency.

Featured image via Pixabay.