U.S. stocks did well on Wednesday (November 4), with the Nasdaq Composite closing 3.85% higher. However, Bitcoin seems to be rallying even harder. This article tries to explain why both U.S. stocks and Bitcoin are going up.

Although the election results in the U.S. are not quite clear yet and it might be some time before we know for sure who will be the next U.S. president—especially since President Trump’s campaign team has already filed lawsuits in three battleground states—it’s currently looking like Joe Biden will win the presidential race by a small margin. As for the U.S. Congress, it appears that the House of Representatives and the Senate will remain in control of the Democrats and the Republicans respectively.

On Wednesday, the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite finished the regular session with gains of 1.34%, 2.21%, and 3.85% respectively.

Lindsey Bell, Chief Investment Strategist at Ally Invest, told CNBC:

“It looks likely that we’ll see a split Congress, which, based on history, has been the preference of the stock market. You can see this expectation being priced into the market [Wednesday] with health care, communication services and technology stocks are leading the market.”

And Brad McMillan, Chief Investment Officer at Commonwealth Financial Network, told CNBC:

“With no blue wave, we are likely to see the Senate remain very closely divided, which will constrain the policy options of whoever wins the presidency. That probably rules out any substantial activity on taxes, as well as limiting any actions to control the major tech firms.”

A GOP-controlled Senate is both good news and bad news for U.S. companies.

On one hand, Senate Major Leader Mitch McConnell will make it very difficult if not impossible for Biden (should he become President) to increase corporation tax or to impose any heavy regulations on American businesses (especially those that might affect the oil and gas sector).

On the other hand, the Republicans do not like the idea of further multi-trillion dollar fiscal stimulus packages. So, even if during the “lame duck session” of Congress, the Senate might approve a trillion-dollar stimulus package to give the U.S. economy a much-needed boost, it seems highly unlikely that next year they will be willing to go along with any future fiscal stimulus bills that Biden and the House come up with if they consider these bills to be overly generous.

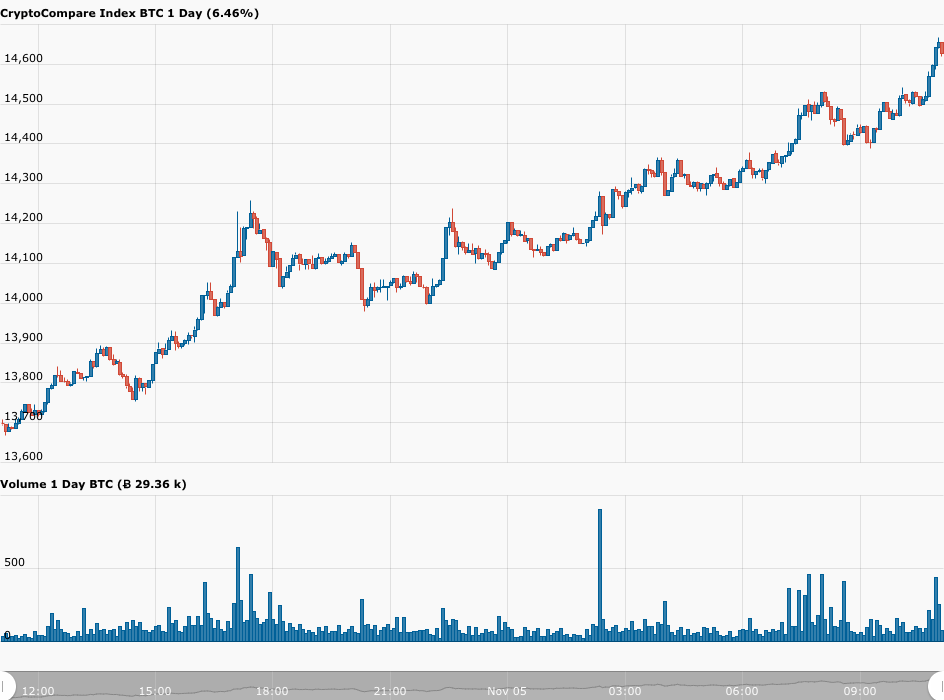

As for Bitcoin, which tends to behave like a risk-on asset, it is rallying even harder even harder than U.S. equities. According to data from CryptoCompare, currently (as of 11:08 UTC on November 5), BTC-USD is trading around $14,625, up 6.52% in the past 24-hour period.

It is worth noting that this is the highest Bitcoin price we have seen so far in 2020 and that the last time Bitcoin was seen at such price levels was in January 2018.

According to a report by Business Insider, yesterday, during an interview on CNBC’s “Squawk Box”, Michael Novogratz, Founder and CEO of Galaxy Digital, explained why he thinks investors in U.S. equities and Bitcoin seem happy with the U.S. election results:

“The markets are liking this… Stocks are gonna do well… Less fiscal, more Fed, good for crypto… We have crossed the Rubicon in its adoption… We’re at the start of a really big bull market there… You’re going to have every central bank issuing a digital currency within the next five years.”

What Novogratz appears to be thinking is that although we might see less fiscal stimulus with a Republican-controlled Senate, the Federal Reserve will have to step with with more monetary stimulus, which should help to push up the prices of U.S. equities, as well as the Bitcoin price, since many people believe that the latter might be a great inflation hedge. Furthermore, Novogratz seems to think that institutional FOMO (following announcements by MicroStrategy, Square, and PayPal in the past few months) and the inevitability of central bank issued digital currencies (CBDCs) will act as two other positive catalysts for the Bitcoin price.

Featured Image by “Skitterphoto” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.