After setting a daily trading volume record this year in September, cryptocurrency trading platforms have seen spot trading volumes decline. In October, top trading platforms saw their volumes plunge.

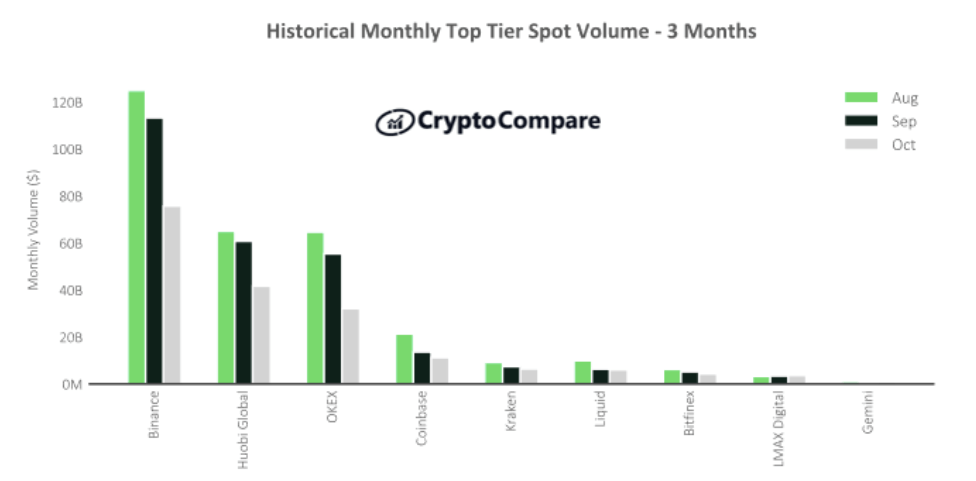

According to CryptoCompare’s October 2020 Exchange Review, Top-Tier cryptocurrency exchanges, defined by the firm’s Exchange Benchmark, saw larges decreases in monthly spot trading volumes in October, with some top platform losing as much as 40% of their trading volume.

The decline was so significant that while derivatives trading volumes across the crypto space only decreased by 2.4% in October to $619.9 billion, total spot trading volumes decreased by 17.6% to $557.7 billion.

Binance was the largest Top-Tier exchange by volume in October, the report adds, trading a total f $75.7 billion. Binance’s volume dropped 33.1% compared to September. Behind it was Huobi Global, which traded $41.7 billion, down 31.4%. Next came OKEx, which traded $32.1 billion, enduring a 42% decline when compared to the previous month.

Kraken, Coinbase, and Liquid followed but with less considerable declines. Coinbase’s volume dropped by 17.5%, while Kraken’s dropped 13%. Liquid’s volume dropped by 4.3%. Despite BTC’s price moving above the $13,000 mark towards the end of October, the daily maximum traded was $29.84 billion on October 21.

The top three Top-Tier exchanges, Binance, Huobi, and OKEx, maintained their positions in October, and out of the top 15 Top-Tier trading platforms they represented 77% of the volume last month, down from 82% in September.

At the beginning of September, the maximum for that month was set at $39.92 billion. Top-Tier exchanges traded a daily maximum of $20.14 billion last month, compared to $27.6 billion in the previous month.

Cryptocurrency trading platform charging the traditional taker fees represented 83.8% of the total exchange volumes in October, down from 84.4% in September, while those implementing the controversial trans-fee mining (TFM) model represented less than 15% of the total trading volumes.

The report details that fee-charging exchanges traded a total of $567.2 billion in October, while exchanges implementing the TFM model traded $84.2 billion that month. Fee-charging exchanges saw their trading volumes plunge 18.2% last month, while TFM exchanges’ volumes plunged by 34.5%.

Featured image via Pixabay.