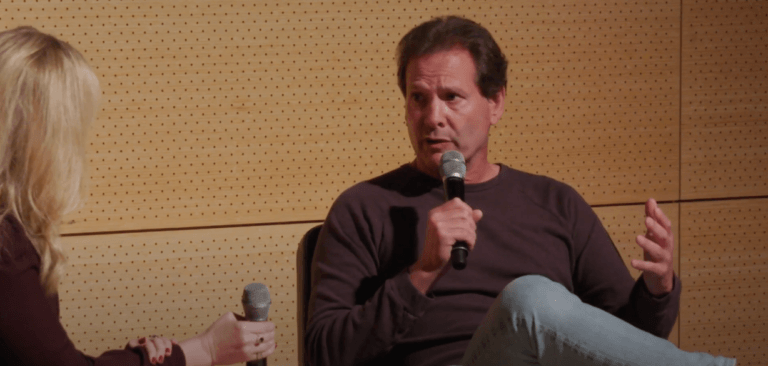

In a recent interview, PayPal President and CEO Daniel Schulman, talked about the value proposition of Bitcoin.

As you may remember, on October 21, PayPal announced “the launch of a new service enabling its customers to buy, hold and sell cryptocurrency directly from their PayPal account, and signaled its plans to significantly increase cryptocurrency’s utility by making it available as a funding source for purchases at its 26 million merchants worldwide.”

Schulman’s comments during an interview last Monday (November 23) with Andrew Ross Sorkin on CNBC’s pre-market news and talk program “Squawk Box“.

Sorkin started the interview by asking the PayPal CEO how he values Bitcoin.

Schulman replied:

“I think all forms of money are based on trust and and set values that come from that trust.

“I think if you take a step back, especially with the pandemic, you’ve seen the use of cash decline precipitously. Something like forty to seventy percent of consumers no longer want to handle cash and just like every industry is digitizing right now, that is also happening in the financial services world.

“There’s no question that people are flocking to digital payments and digital forms of currency, and one of the things that we looked at and we talked to regulators around the world, central banks around the world, and it became clear to me that it’s a matter of not if but when and how you’ll start to see more and more central banks issue forms of digital currencies, and I think you’ll have more and more utility happen with cryptocurrencies.

“One of the things that we allow is not just making it easy to buy, sell, and hold cryptocurrencies, but very importantly early next year, we’re going to allow cryptocurrencies to be a funding source for any transaction happening on all 28 million of our merchants, and that will significantly bolster the utility of cryptocurrencies.”

Sorkin asked the PayPal CEO about JMorgan Chase CEO Jamie Dimon’s recent comment that once Bitcoin’s market cap becomes much bigger, it will get regulated.

Schulman answered:

“Well, I think it’s foundational that we work hand in hand with regulators. I mean our move into the crypto space happened because we worked hand in hand with New York Department of Financial Services — received the first Conditional BitLicense to go and do this.”

On November 2, we got more details about PayPal’s crypto capabilities courtesy of the company’s Q3 2020 earnings conference call. As usual, first we had the “Prepared Remarks” from the executives and then the “Questions and Answers”.

With regard to support for crypto, here is what Schulman had to say during the “prepared remarks” segment of the earnings call:

“Finally, I’d like to discuss our recent announcement to increase the utility of cryptocurrencies, as well as embrace new forms of Central Bank digital currencies. We are entering a new era of financial services where our wallets and all the services around them are moving from physical to digital. These include identity management, new forms of commerce and fully digital payments and financial services.

“As such, we recently announced that PayPal will allow account holders to buy, sell and hold cryptocurrencies first, in the U.S. and then expanding to international markets in the Venmo platform in the first half of next year.

“Importantly, we are doing this in close partnership with regulators. As you saw, the New York Department of Financial Services granted PayPal, a first of its kind conditional bit license.

“With this foundation in place, we will rapidly move at the beginning of next year and allow consumers to use cryptocurrencies as a funding instrument to shop across all 28 million of our merchants.

“This solution will not involve any additional integrations, volatility risk or incremental transaction fees for either consumers or merchants and will fundamentally bolster the utility of cryptocurrencies.

“This is just the beginning of the opportunities we see as we work hand in hand with regulators to accept new forms of digital currencies.”

Next, in the Q & A section of the earnings call, David Togut, Equity Research Analyst at Evercore ISI, asked about “the impact on PayPal’s ecosystem from introducing cryptocurrencies.”

Schulman replied:

“So, I’ll just take a step back clearly, the world is rapidly moving from physical to digital on that, so true for payments and financial services. My conversations with central banks, with the regulators, with a number of folks in the crypto field, there’s no question that digital currencies are going to be rising an importance, having increasing functionality and increasing prominence CBDCs, from my perspective and all my conversations, are a matter of when and how they’re done…

“And I think that our platform with its digital wallets and the scale that we have right now, can help shape the utility of those currencies that can range from interoperability, between wallets, between the currencies themselves, and importantly, into our network of merchants for commerce.

“And I do think that our platform and all the new digital infrastructure that we’re putting in place right now can help make that management and movement of money more efficient, and less expensive and faster…

“Now, we’ve only rolled this out to 10% of our base. We did that a couple of days ago, but our waiting list was two to three times of what our expectations were. We’re going to take up our $10,000 limit per day to $15,000 per day, based on the demand that we’re seeing and we’ll roll out to 100% in the U.S. in the next two weeks to three weeks. They’re going to expand internationally and we’ll expand into Venmo on the first half of next year.

“So that’s what we’re starting off with and we’re seeing people who have already bought crypto open their wallet several times a day to check on what’s happening with their crypto investments. We’re beginning to already see some halo effects that go on with that.

“But what I’m really excited about is what we’re going to introduce next year, which is, I think going to dramatically increase the utility of cryptocurrencies by enabling somebody, who holds a cryptocurrency in a PayPal account to instantaneously transfer that crypto into fiat currency at a set rate. So, volatility is taken out of the equation. No incremental fees charged for them to do that transaction from crypto into a fiat and then immediately settle in fiat with all 28 million of our merchants at our current take rates.

“And so you have no additional integration needed at any of our merchants and this is just an elegant way of using cryptocurrencies as a funding mechanism, and yes, it is a lower cost funding mechanism for us in terms of those transactions.

“But that’s just the start of things that we want to go and do with crypto capabilities over the course of next year you’ll see us move into a couple of different areas. Those are the only two we’re talking about right now, but I see a lot of interesting things we can do with cryptocurrencies, with functionality, increasing functionality, and again, working hand in hand with regulators every step of the way, which is so important and what they expect from us in order to be a market leader in the digital currency space.”