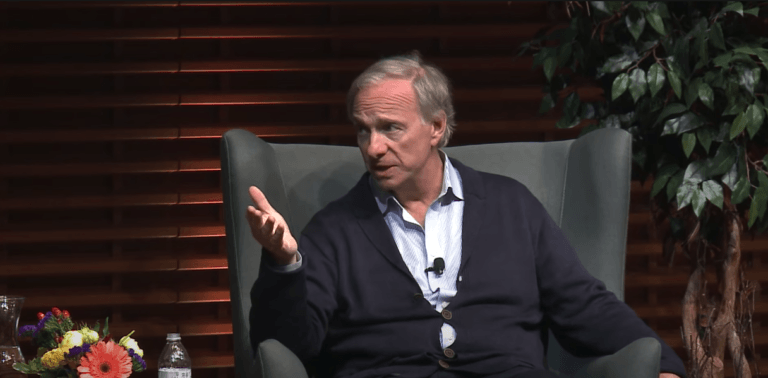

During a recent interview with Yahoo Finance, legendary billionaire hedge fund manager Ray Dalio, founder, chairman, and co-chief investment officer of Bridgewater Associates offered his take on digital currencies.

The 71-year American whose net worth is estimated to be around $18.7 billion created asset management firm Bridgewater Associates from his New York City apartment just two years after receiving his MBA from Harvard Business School. Bridgewater Associates had $138 billion in assets under management as of April 2020 and its many institutional clients include “pension funds, endowments, foundations, foreign governments, and central banks.”

Dalio’s interview with Yahoo Finance correspondent Julia La Roche took place on October 26 at a virtual event called “Yahoo Finance All Markets Summit: Road to Recovery“.

Near the end of the interview, Dalio was asked for his take on digital currencies.

This is how he replied:

“Digital currencies — let me break them down into two types. There’s the type in which it’s like a Bitcoin type of currency that’ll be an alternative currency in terms of its supply/demand and an alternative storehold of wealth… and then there’s digital currencies — that means they’ll be other types of currencies, let’s say the dollar or the euro or the Chinese Renminbi be that is digitalized.

“I think we’re going to see a lot more of that second type, but I think that there are three main problems of the first type… Theoretically it’s good, but the three basic things are a currency has to be an effective medium of exchange, storehold of wealth, and the governments want to control it.

“So, I today can’t take my bitcoin yet and go buy things easily with it, and as a storehold of wealth, it’s so volatile that its volatility based on speculation is so much greater that it’s not an effective storehold of wealth and which is also one of the reasons it’s a problem to be a transaction vehicle because if a vendor says I’m going to get paid in Bitcoin and they don’t know what that means in terms of their other liabilities — that’s a problem.

“And then thirdly… if it becomes material, governments won’t allow it. I mean, they’ll outlaw it, and they’ll use whatever teeth they have to enforce that. They would say, okay, you can’t transact with Bitcoin, you can’t have Bitcoin.

“So, then you have to sort of be almost like ‘is it a felony and I’m gonna have to be a felon in order to transact?’

“They outlawed gold, you know, what’s what’s wrong with gold? But gold was a storehold of wealth, and so if I was to say would I prefer bitcoin to gold, no, I wouldn’t prefer Bitcoin to gold. Gold will be the vehicle that central banks and countries use as an alternative to the regular cash because each central bank can print cash but through transactions, through time, when countries dealt with each other, they used gold because they didn’t have to worry about being devalued by some country that’s going to print the gold.

“And so it still is our third largest reserve [asset]. If you take central bank reserves, the largest is the dollar, the second largest is the euro, and the third largest is gold…

“But I don’t think digital currencies will succeed and in the way people hope they would for those reasons.”