This past summer, Nasdaq-listed business intelligence company MicroStrategy Inc. “purchased a total of 38,250 bitcoins at an aggregate purchase price of $425 million.” Could this be one of the greatest bets ever made by a publicly listed company?

When and How Did MicroStrategy Get Into Bitcoin?

On August 11, Nasdaq-listed business intelligence company MicroStrategy Inc. (NASDAQ: MSTR) announced via a press release that it had “purchased 21,454 bitcoins at an aggregate purchase price of $250 million” to use as a “primary treasury reserve asset.”

Michael J. Saylor, Co-Founder, Chairman, and Chief Executive Officer of MicroStrategy, said at the time:

“This investment reflects our belief that Bitcoin, as the world’s most widely-adopted cryptocurrency, is a dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash.

“Since its inception over a decade ago, Bitcoin has emerged as a significant addition to the global financial system, with characteristics that are useful to both individuals and institutions.

“MicroStrategy has recognized Bitcoin as a legitimate investment asset that can be superior to cash and accordingly has made Bitcoin the principal holding in its treasury reserve strategy.”

Saylor went on to say:

“Our decision to invest in Bitcoin at this time was driven in part by a confluence of macro factors affecting the economic and business landscape that we believe is creating long-term risks for our corporate treasury program ― risks that should be addressed proactively.

“Those macro factors include, among other things, the economic and public health crisis precipitated by COVID-19, unprecedented government financial stimulus measures including quantitative easing adopted around the world, and global political and economic uncertainty.

“We believe that, together, these and other factors may well have a significant depreciating effect on the long-term real value of fiat currencies and many other conventional asset types, including many of the assets traditionally held as part of corporate treasury operations.”

Then, on September 15, the MicroStrategy CEO tweeted that his company had bought another 16,796 bitcoins:

Here is what Barry Silbert, the CEO of Digital Currency Group (DCG), the world’s largest digit asset manager and the parent of Grayscale Investments, had to say about MicroStrategy’s latest Bitcoin purchase:

MicroStrategy’s Q3 2020 Earnings Call

On October 27, MicrosStrategy announced its financial results for Q3 2020. In its press release about these results, here is what MicroStrategy said about its digital asset holdings:

“As of September 30, 2020, the carrying value of MicroStrategy’s digital assets (comprised solely of bitcoin) was $380.8 million, which reflects cumulative impairments of $44.2 million since acquisition.

“MicroStrategy accounts for its digital assets as indefinite-lived intangible assets, which are initially recorded at cost. Subsequently, they are measured at cost, net of any impairment losses incurred since acquisition. MicroStrategy determines the fair value of its bitcoin based on quoted (unadjusted) prices on the active exchange that MicroStrategy has determined is its principal market for bitcoin.

“MicroStrategy considers the lowest price of one bitcoin quoted on the active exchange at any time since acquiring the specific bitcoin. If the carrying value of a bitcoin exceeds that lowest price, an impairment loss has occurred with respect to that bitcoin in the amount equal to the difference between its carrying value and such lowest price. Impairment losses are recognized as “Digital asset impairment losses” in MicroStrategy’s Consolidated Statements of Operations.

“As of September 30, 2020, the average cost and average carrying value of MicroStrategy’s bitcoin were approximately $11,111 and $9,954, respectively. As of October 26, 2020, at 4:00 p.m. EDT, MicroStrategy had 38,250 bitcoins and the market price of one bitcoin in the principal market was approximately $13,023.”

At 17:00 ET on October 27, MicroStrategy had its Q3 2020 earnings call. According to the transcript (provided by The Motley Fool) of this call, both Saylor (the company’s CEO) and Phong Le, the company’s President and CFO, were there to provide analysts with additional insights on the Q3 2020 results. As usual, first we had the “Prepared Remarks” from the executives and then the “Questions and Answers”.

With regard to Bitcoin, here is what Le had to say:

“… during the quarter, we purchased approximately 38,250 bitcoins for an aggregate price of $425 million. This equates to an average price of approximately $11,111 per bitcoin. We’ve been gratified by the market’s reaction to our nontraditional treasury strategy and believe our bitcoin holdings can provide our investors with a more stable treasury asset and one that holds a greater return potential than cash held in U.S. dollars.

“Our investment in bitcoin has also allowed MicroStrategy to tap into the passion of the broader crypto market and the smart sophisticated technologists to advocate for the independent and open markets, whether for financial assets or digital ones. We’ve seen a notable and unexpected benefit from our investment in bitcoin and elevating the profile of the company in the broader market. This is benefiting our company reputation overall and raising our mine share among prospective customers.”

He then went on to make two very interesting statements:

- “Per our treasury reserve policy, you should expect that we will purchase additional bitcoins as we generate cash beyond what we need to run the business on a day-to-day basis or to deploy for other corporate purposes.”

- “Compared to an average purchase price of $11,111, the recent price per bitcoin has been over $13,500.”

As for Saylor, he spoke at length about Bitcoin. Here are a few highlights:

- “I think Square selling bitcoin and support in the Square Cash application is a big deal. Now that PayPal has announced that they’re going to do it in the PayPal app, I think that’s legitimizing. When PayPal delivers that in Venmo next year, I think that will be a big plus. What I have said on a number of occasions is bitcoin is digital gold.”

- “I don’t think people really understand completely what we mean by that, and I think it bears mention right now that if you virtualize gold, if you take the theoretical safe haven asset of gold and if you virtualize it and you take the mass out of it and then you put it on an open protocol and you make it possible to program it, then the fact that it’s programmable gold or a programmable asset means that it is going to be smarter. It is going to be faster. It is going to be stronger. It is going to be harder than the physical version of itself.”

- “I personally believe bitcoin is — it represents the first example of a digital monetary network. It’s a software network that is capable of storing and channeling monetary energy. And if you compare that to what Facebook was, which is a digital social network, a software network to store and channel social energy, you see it’s a profoundly new idea.”

What Are MicroStrategy’s Long Term Plans for Its Bitcoin Holdings?

Last month, during an interview with Real Vision CEO Raoul Pal, Saylor explained that despite what some people think, MicroStrategy has no intension os selling its Bitcoin holdings any time soon:

“I see these guys on crypto Twitter. And they’re like, ‘Saylor’s going to buy it and he’s going to dump it. He’s going to buy it and then buy another company with it. He’s going to buy it until he gets this profit and do whatever.’

“There’s a lot of traders in the market. They don’t understand the mindset of long. I’m buying it for the dude that’s going to work for the dude that’s going to get hired by the guy who takes over my job in 100 years. I’m not selling it. When it goes up by a factor of 100, I might be borrowing a little to go buy something that I want, but what am I going to buy with it that’s better than what I’m buying?

“Every other treasury asset… has got a negative real yield. What am I going to buy with it? There’s no other asset to buy with it.”

How Much Unrealized Profit Has MicroStrategy Made So Far on Its Bitcoin Investment?

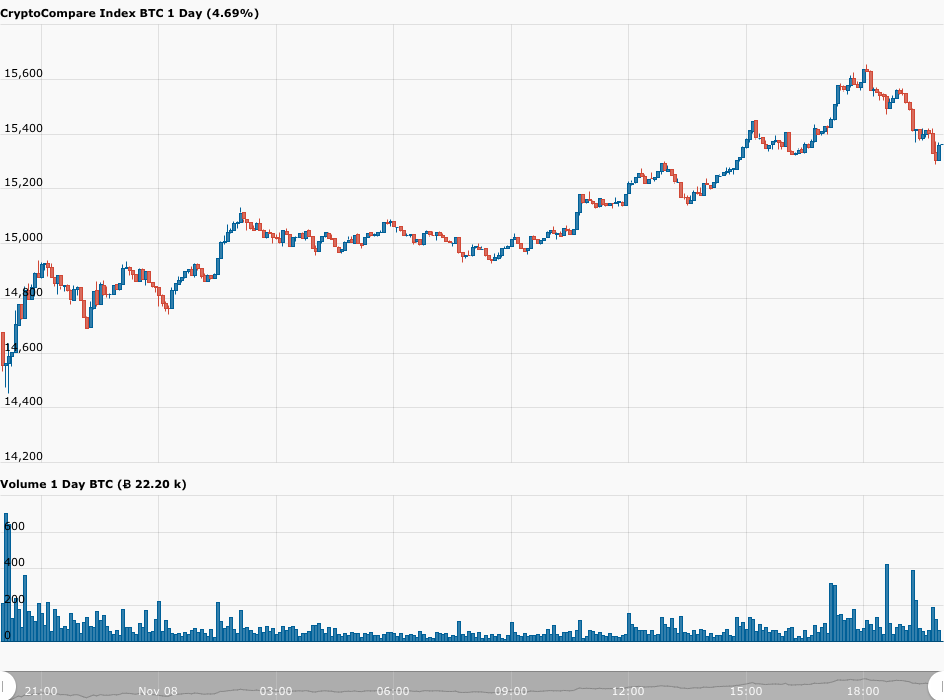

According to data by CryptoCompare, currently (as of 20:00 UTC on November 8), BTC-USD is trading around $15,393, up 3.5% in the past 24-hour period:

To work out MicroStrategy’s unrealized gains on its BTC investment, we need to remember that Phong Le, the company’s President and CFO, made the following remark during the Q3 2020 earnings call:

“… during the quarter, we purchased approximately 38,250 bitcoins for an aggregate price of $425 million. This equates to an average price of approximately $11,111 per bitcoin.”

Since the current price of Bitcoin is $4,282 higher (i.e. +38.53%), this means that the total unrealized gains in USD on those 38,250 bitcoins is approximately $163,786,500.

An unrealized profit of over $163 million in one quarter is not bad at all, and not only MicroStrategy is not planning to sell its BTC holdings any time soon, according to MicroStrategy’s President, the company plans to continue to “purchase additional bitcoins.”

Also, there is no real limit on how high the price of Bitcoin will go in the years to come since the maxium supply of Bitcoin is fixed at 21 million. For example, Mike McGlone, who is a Senior Commodity Strategist at Bloomberg Intelligence (BI), said late last month that he expects the price of Bitcoin to reach $100,000 by 2025.

As legendary American value investor William H. Miller III pointed out last week, Bitcoin’s “staying power gets better every day”, with the likelihood of regulatory action that might severely impact Bitcoin’s price decreasing as institutional and mainstream adoption continues to grow.

This is why it seems that MicroStrategy may just have made one of the smartest decisions any publicly listed company has ever made during a financial quarter.

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.