With less than one day left until the U.S. presidential election, many Bitcoin investors and traders must be wondering how the outcome of the election could impact the price of Bitcoin.

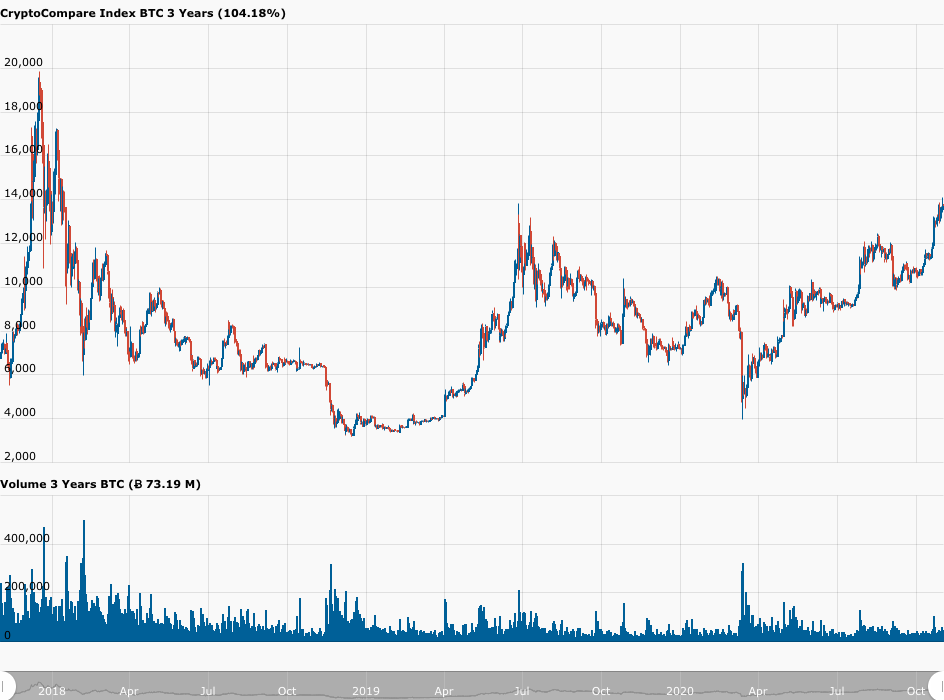

Before we discuss the U.S. presidential election, it is worth taking a moment to point out on Sunday (November 1), the day after the 12th anniversary of its white paper, Bitcoin managed to close the month of October at $13,801, which was its second highest monthly in history.

Bitcoin recorded its highest ever monthly close — $13,850 — on 31 December 2017, the same month in which Bitcoin’s price reached its all-time high (ATH) of $19,870 (which occurred on 17 December 2017).

Yesterday, prominent veteran trader Peter Brandt explained why monthly closing prices matter:

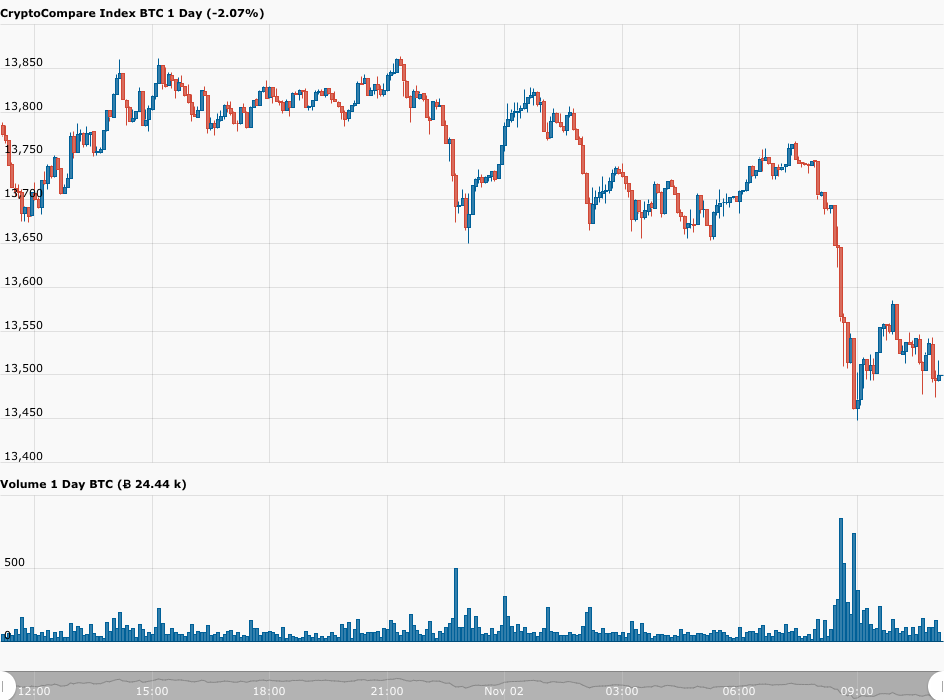

According to data from CryptoCompare, at 11:10 UTC on Monday (November 2), Bitcoin is trading around $13,492, down 1.58% vs USD in the past 24-hour period.

With regard to the U.S. presidential election, these are the main potential outcomes:

- Trump wins

- Biden wins by a small margin

- Biden has a landslide victory

If Trump wins, even though most polls tell us that this is quite an unlikely scenario, then Biden is highly likely to accept this result. Markets will breathe a sigh of relief, and U.S. stocks and Bitcoin should go up since generally Trump is seen as more pro business than Biden and if he wins, then U.S. corporations will continue to enjoy the cut in the rate of corporation tax that Trump managed to pass through Congress near the beginning of his presidency.

But what if Biden wins by a small margin? This could definitely easily happen since Trump supporters realize that Trump is behind in most state polls and his only chance of victory is if they all turn up on election day to vote for him, whereas most Democrats know that Biden is leading in most polls and their concerns over catching COVID-19 might dissuade them from voting in person tomorrow.

In this scenario, it is very likely that President Trump will reject this result, claim that mail-in ballots — which he says are a “scam” — are to blame, and try to mount some kind of legal challenge, which might need the U.S. Supreme Court to get involved.

A contested election could get very messy and it would be bad news in the short term for the prices of U.S. stocks and Bitcoin, and could easily result in a ten to twenty percent correction.

And finally, if Biden has a landslide victory, then even a 6-3 conservative Supreme Court would find it extremely difficult to find a way to help President Trump. Wall Street would be quite OK with this result.

According to a report by Fortune, this is what Goldman Sachs’ Chief Economist Jan Hatzius wrote in a note to clients on October 5 that if there is a Democratic “blue wave” (i.e. the Democrats take control of both chambers of the U.S. Congress), this could help the U.S. and global economy in early 2021:

“All else equal, such a blue wave would likely prompt us to upgrade our forecasts. The reason is that it would sharply raise the probability of a fiscal stimulus package of at least $2 trillion shortly after the presidential inauguration on January 20, followed by longer-term spending increases on infrastructure, climate, health care and education that would at least match the likely longer-term tax increases on corporations and upper-income earners.”

Therefore, we can expect third potential outcome to be bullish for U.S. stocks and Bitcoin in the short term.

As for the long term, as some other commentators have already explained, regardless of who is sworn in as the next U.S. president on 20 January 2021, the current COVID-19 pandemic is not going away anytime soon and fighting its huge economic impact — which is likely to increase as the second/third wave of COVID-19 in Europe and the U.S. leads to more lockdown measures — will require much more monetary and fiscal stimulus, which can only push up the prices of U.S. stocks and Bitcoin.

According to Morning Consult’s final pre-election poll, Joe Biden seems set to have a landslide victory:

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.