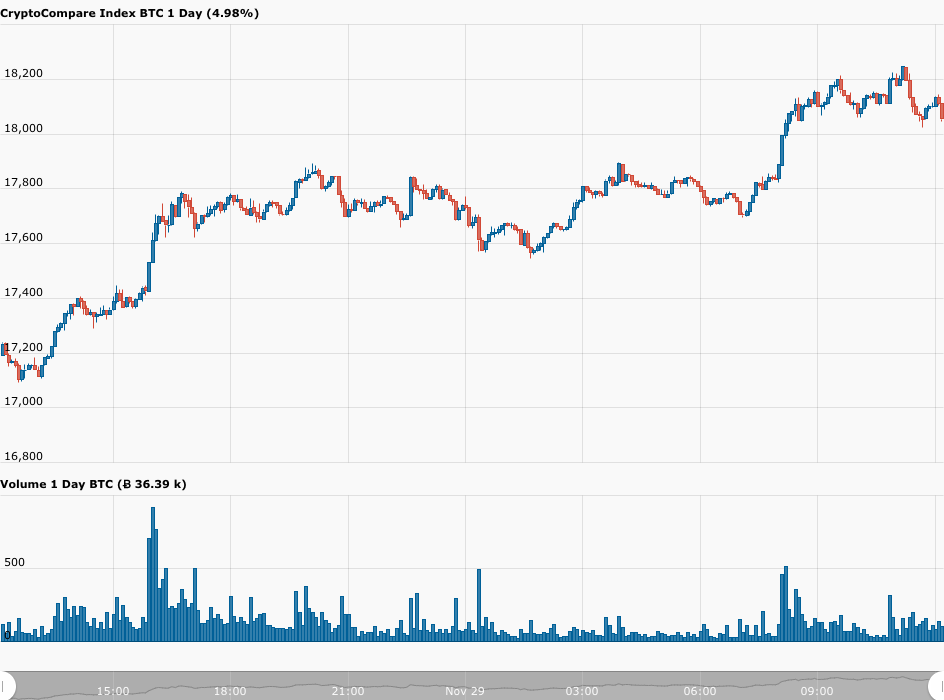

At 08:10 UTC on Sunday (November 29), the Bitcoin price surged past the $18,000 level, seemingly on another run toward its all-time high of $19,870 (which, according to the CryptoCompare Index, was reached on 17 December 2017).

Although last Wednesday (November 25), the Bitcoin price reached the intraday high of $19,488, a tweetstorm by Coinbase CEO Brian Armstrong regarding rumored upcoming regulations on transfers from crypto exchanges to non-custodial wallets led to some panic selling, which caused massive liquidations of highly leveraged long positions on exchanges such as Binance; this resulted in the Bitcoin price crashing to the intraday low of $16,270 on November 26.

Since then, the Bitcoin price has surged almost 11%; currently (as of 12:15 UTC on November 29), Bitcoin is trading at $18,053, up 5.26% in the past 24-hour period.

One major piece of news that could have contributed to Bitcoin’s recovery during this weekend is the decision by global asset management firm Guggenheim Investments to allow one of its fixed income mutual bonds — the Guggenheim Macro Opportunities Fund — to “seek investment exposure to bitcoin indirectly through investing up to 10% of its net asset value in Grayscale Bitcoin Trust (‘GBTC’), a privately offered investment vehicle that invests in bitcoin.”

On Friday (November 27), Ethereum creator Vitalik Buterin said that Bitcoin was “cool”:

And the cascade of news regarding institutional interest in Bitcoin seems to have caused well-known goldbug and Bitcoin skeptic Peter Schiff to realize that institutional Fear of Missing Out (FOMO) might be on its way:

On Saturday (November 28), Tyler Winklevos, Co-Founder and CEO of digital asset exchange Gemini, had this to say about Bitcoin:

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.