The total market capitalization of all cryptocurrencies has surpassed the $500 billion mark for the first time since February 2018 as the price of several altcoins is moving up, while BTC’s price is still above the $17,800, after hitting $18,000 yesterday.

While there are several cryptoassets moving up in the last 24 hours, according to CryptoCompare data some in the decentralized finance (DeFi) space currently stand out with gains above 20% in that same period.

Ethereum, the blockchain network on which most decentralized finance projects are built on top of, moved up less than 0.7% in the last 24 hours, as one ETH is currently trading at $477.

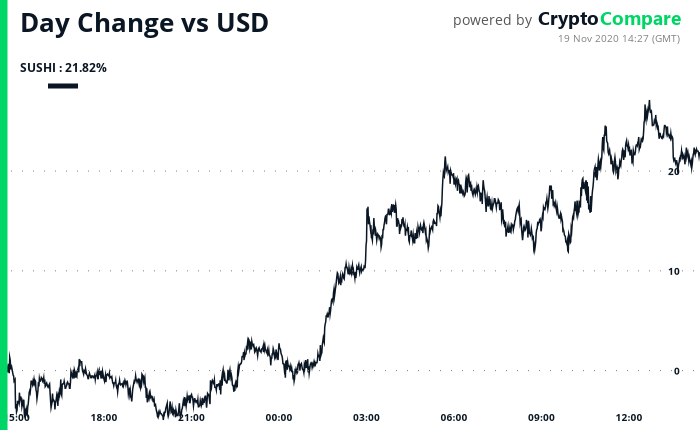

SushiSwap Benefits From Uniswap’s Rewards Ending

SushiSwap’s SUSHI token, for example, is up over 21% in the last 24 hours after liquidity mining rewards on decentralized exchange Uniswap ended. Uniswap’s rewards ended on November 17 and that same day SushiSwap, a fork of Uniswap, announced a new incentive scheme for the four pairings Uniswap was incentivizing.

As a result, the total value locked on Uniswap dropped by more than $1 billion in less than 24 hours, while the total value locked on SushiSwap surged by nearly 160% from $407 million to over $1 billion.

As a result, SUSHI is now trading at $1.38, up from little over $0.5 at the beginning of November. It’s worth noting other decentralized exchanges, including 1inch and Bancor, launched incentives to their programs to grab some of the liquidity moving away from Uniswap.

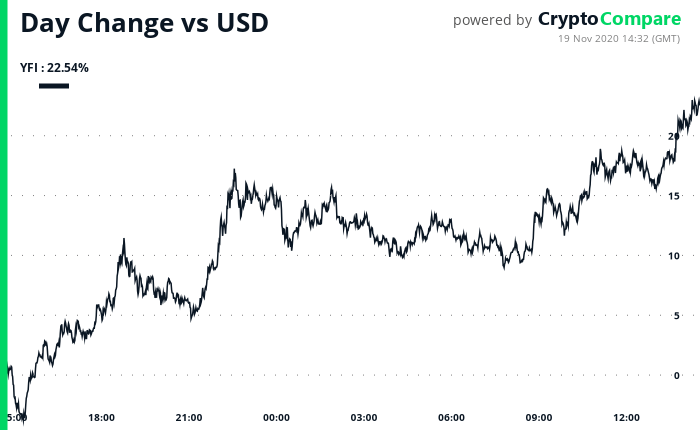

Yearn.Finance’s YFI Keeps Moving up

Yearn.Finance, a decentralized finance protocol that aggregates yields from lending platforms that rebalances for the highest yield during contract interaction, has also seen the price of its YFI token move up 22.53% in the last 24 hours.

The cryptocurrency’s price likely surged after rewards on Uniswap ended. While liquidity providers on Uniswap are rewarded with a share of the 0.3% fee charged on orders, they risk suffering from the impermanent loss effect.

On Yearn.Finance, users can earn relatively high yields on their cryptocurrency holdings without risking impermanent loss. YFI is now trading at $26,990 and is on its way back to its previous all-time high above $43,000.

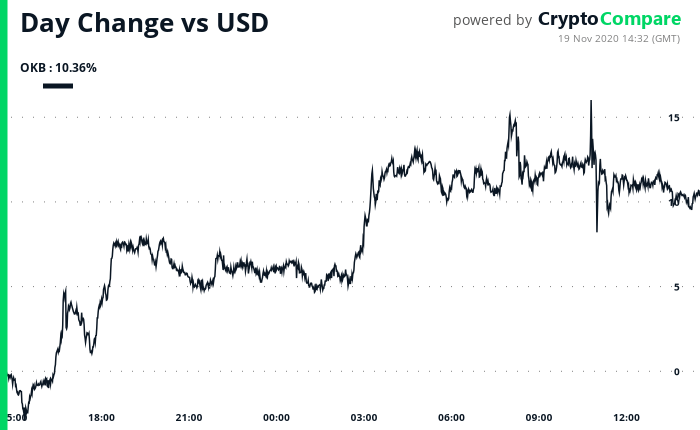

OKB Jumps After OKEx Announces Withdrawals Will Be Resumed

OKEx’s cryptocurrency, OKB, has seen its price jump after the cryptocurrency exchange announced it will reenable withdrawals “on or before” November 27 of this year, as the private key holders it had lost contact with who was cooperating with an investigation has “completed assisting the authorities.”

The person OKEx is believed to have lost contact with is the firm’s founder Mingxing “Star” Xu. The exchange suspended withdrawals in October as Xu was cooperating with an investigation, in which OKEx says the firm was “confirmed not to have been involved in any wrongdoing or illegal activities, and the private key holder has now returned to his normal business functions.”

OKB’s price went up 10.76% in the last 24 hours based on the development. Data shows that before withdrawals were suspended OKB was trading at about $6, but then dropped to a $4.15 low, before recovering slightly. After OKEx revealed withdrawals will be reenabled, OKB jumped back to $5.8.

The primary use of OKB are discounts on trading fees and collateral for margin trading at OKEx, but the token can also be used outside of OKEx, in an ecosystem made of partners of the exchange that accept OKB as a payment method.

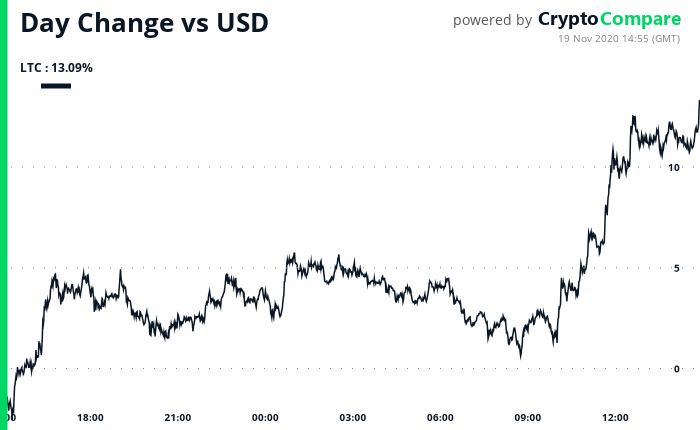

Litecoin Solidifies Lead over Bitcoin Cash

The price of Litecoin (LTC) has been rallying over the last few days, and in the last 24-hour period kept on moving up to surpass the $80 mark and solidify its lead over Bitcoin Cash as the sixth-largest cryptocurrency by market capitalization.

Litecoin is up 13.09% in the last 24 hours while BCH is up less than 1%. The market cap of the cryptocurrency often described as the “silver to bitcoin’s gold” is now at $5.28 billion, while that of BCH is at $4.62 billion.

LTC’s price has been moving up steadily after hitting $44 lows in September. While the rally has allows it to make a new high this year, litecoin is still far from its $400 all-time high seen in December 2017.

Featured image via Unsplash.