On Tuesday (November 3), Simon Peters, a crypto analyst at eToro, the world’s leading social trading platform, talked about the wide gap between Bitcoin and altcoins.

In a note shared with CryptoGlobe, Peters said:

“Whilst bitcoin has been soaring, altcoins have been sinking, and some are now 50% below their all-time-highs after a rough three months.

“Conversely, many of them now trade at far more attractive levels, providing potential opportunities for investors. Indeed, some of the dips we have seen in these other cryptoassets have been entirely unjustified, and we don’t expect the discount between bitcoin and the other altcoins to remain this wide.

“Looking ahead, coronavirus continues to strike fear into the hearts of investors, particularly in Europe and the US, and many investors may be looking to move back in to bitcoin as an alternative to volatile equity markets.

“Whether this means a sustained bull run for bitcoin depends on a number of factors. Firstly, the US election result expected tomorrow morning is crucial, as is the negotiation of a fiscal stimulus package. A dispute in the US over the Presidency post the election result remains a clear and present danger for many assets, including Bitcoin. In the background though, positive developments – such as PayPal’s upcoming crypto service – provide plenty of reasons to be cheerful, and in the medium to long-term, investors should expect higher highs (and higher lows) for bitcoin.

“Prices have been strong this year already for bitcoin in particular, and while the price is yet to breach $14,000, once it does – as it has with previous resistance levels at $10,000 and $12,000 – then a potentially bumpy drive upwards towards $20,000 is on the cards.

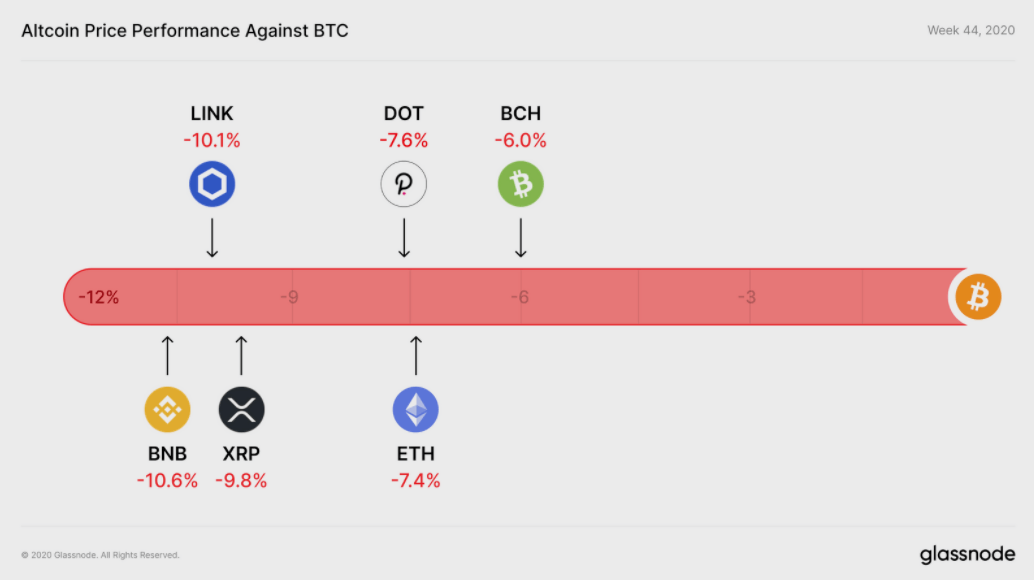

On-chain market intelligence startup Glassnode commented in the 2 November 2020 issue of its “The Week On-Chain” newsletter on the performance of top altcoins against Bitcoin:

“The top altcoins all performed poorly next to BTC throughout Week 44. For the second week in a row, they lost value in BTC terms, with the biggest loser once again being BNB, at -10.6% next to bitcoin.

“Meanwhile, ETH, which saw some gains the previous week, lost 7.4% next to BTC over the past week.”

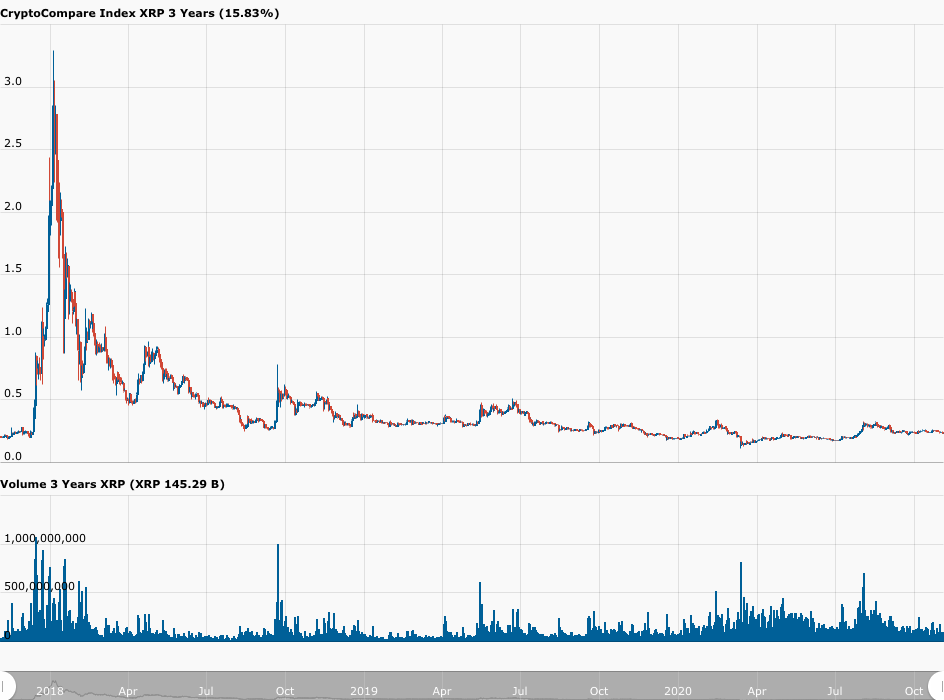

With regard to XRP, here is the three-year XRP-USD price chart from CryptoCompare:

One popular pseudo-anonymous contrarian crypto trader (@CryptoWhale on Twitter) seems to think that, with XRP trading at historically low prices, it might not be a bad time to accumulate.

Featured Image by “WorldSpectrum” via Pixabay.com