On Monday (November 16), the day that Bitcoin’s price surged over $16,800 to yet another new high for 2020, Bloomberg pointed out that “almost no one’s talking about” Bitcoin’s “notable rally.”

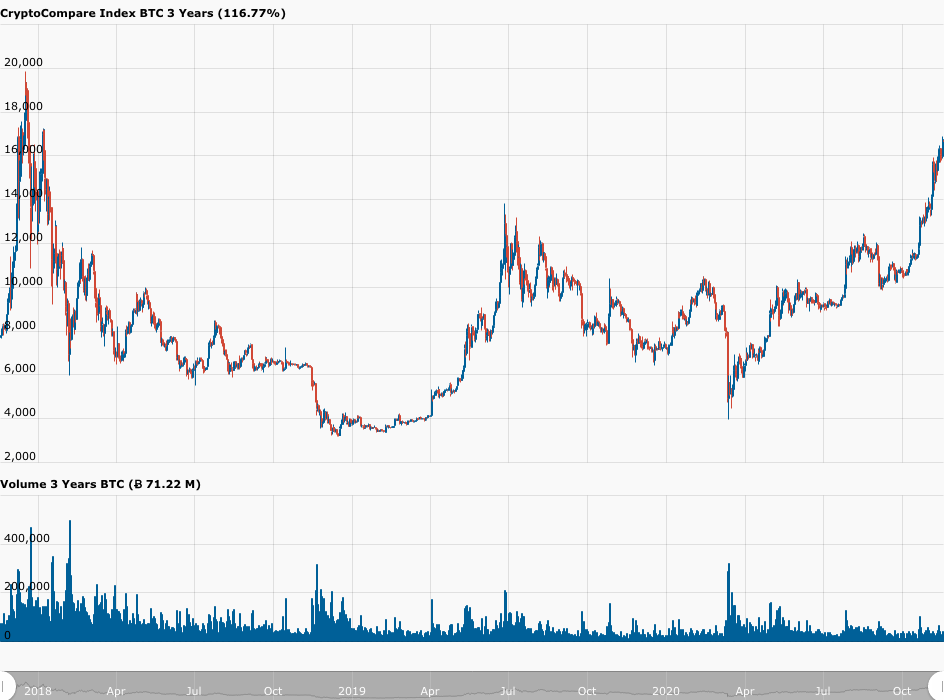

According to data from CryptoCompare, around 19:20 UTC on Monday, the Bitcoin price reached $16,844, which is the highest it has been since 7 January 2018.

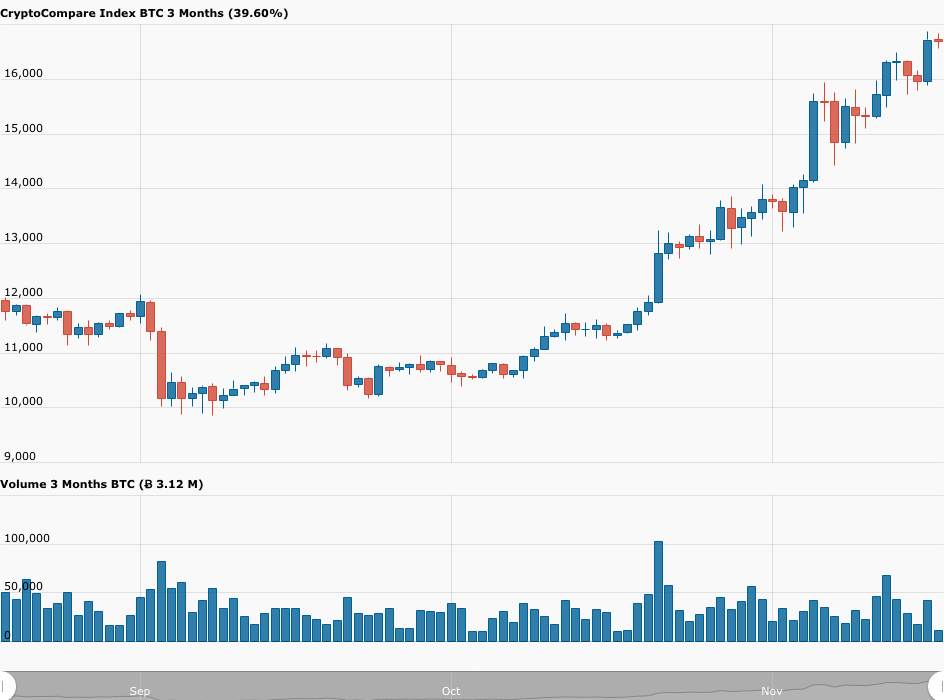

Since October 1, when the Bitcoin price was trading as low as $10,454, Bitcoin has had a remarkable bull run.

Currently (as of 10:20 UTC on November 17), Bitcoin is trading at $16,690, up 1.88% in the past 24-hour period, and up nearly 60% since it started (on October 1) its current rally.

According to a Bloomberg report published yesterday, despite the impressive recent gains and the fact that Bitcoin is only “about 15% shy of its vaunted record highs,” the “mania that surrounded digital currencies” back in 2017 is “largely absent.”

Kathy Jones, chief fixed income strategist for Schwab Center for Financial Research, told Bloomberg:

“The fascination with it has worn off. You have the hardcore ‘I’m a cryptocurrency investor’ group but it hasn’t really expanded because it’s been so volatile, there have been so many questions around security and what regulations might do…

“The number of questions I get on it now is a fraction of what I got a couple of years ago when it was really hot.”

And Bryce Doty, portfolio manager at Sit Fixed Income Advisors, told Bloomberg:

“It’s kind of in the shadows right now… Bitcoin gets attention when it looks like the world is coming to an end, it’s the anti-vaccine trade. As stocks and everything else have done better and people have forgotten about trade wars and things have been eclipsed by the pandemic, Bitcoin has taken a back seat to all of that.”

The Bloomberg report also mentions that Matt Maley, chief market strategist at Miller Tabak + Co., says that this seems to be a largely institution-led rally rather than a retail-driven one:

“The individuals — a lot of those people got burned badly — they’re less excited about it now… It’s certainly not the huge hoopla we had back in 2017 — that could change if it breaks above the 2017 highs.”

Finally, it is worth noting what Mike McGlone, Senior Commodity Strategist at Bloomberg Intelligence (BI), Bloomberg’s research arm on the Bloomberg Terminal,has to say about Bitcoin’s price action:

Featured Image by “Free-Photos” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.