Although the Bitcoin price dropped to as low as $16,270 last Thursday (November 26, also known as U.S. Thanksgiving Day), the Black Friday sale seems over now, and it does not appear that there will be any Cyber Monday discounts today.

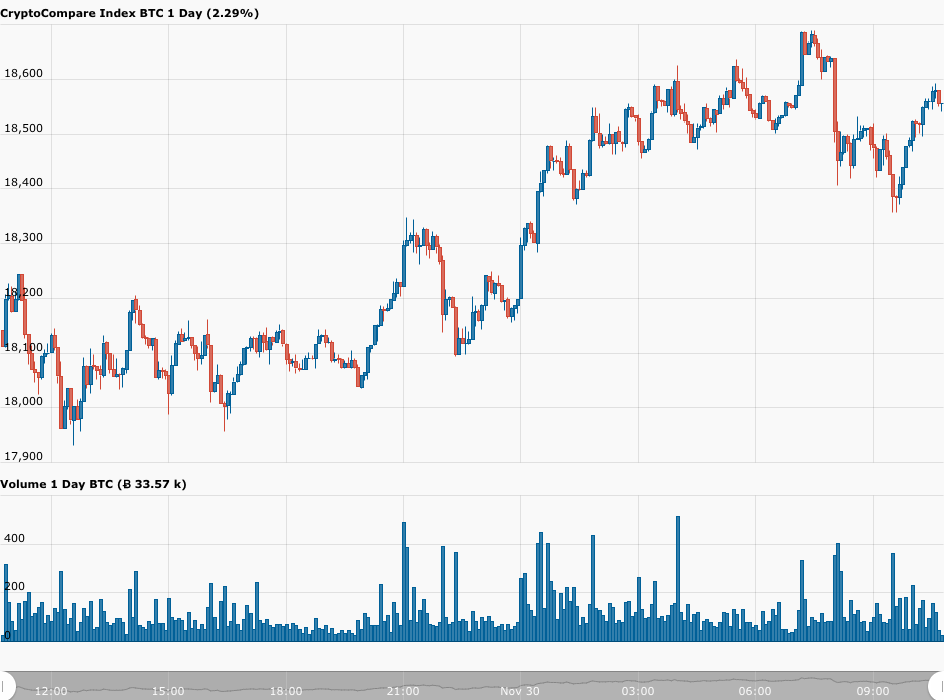

Currently (as of 10:48 UTC on November 30), Bitcoin is trading around $18,537, up 1.84% in the past 24-hour period:

One thing that is contributing a lot to the current bullish market sentiment is the U.S. SEC post-effective amendment filing made by Guggenheim Funds Trust on Friday (November 27), which revealed that one of its fixed income mutual funds (“Macro Opportunities”) is considering investing in Bitcoin.

This filing stated that the fund is considering getting some cryptocurrency exposure:

“Cryptocurrencies (also referred to as ‘virtual currencies’ and ‘digital currencies’) are digital assets designed to act as a medium of exchange. The Guggenheim Macro Opportunities Fund may seek investment exposure to bitcoin indirectly through investing up to 10% of its net asset value in Grayscale Bitcoin Trust (“GBTC”), a privately offered investment vehicle that invests in bitcoin.”

Another piece of news that today has many BTC and ETH HODLers excited was the announcement by former hedge fund manager Raoul Pal that he is irresponsibly going long on crypto by having 98% of his liquid net worth invested in Bitcoin and Ether:

Scott Melker, a crypto analyst/trader at Texas West Capital, explained earlier today why it is important to have exposure to both BTC an ETH.

Angel investor Qiao Wang, a former Director of Products at Messari, says that Buying BTC at these price levels could be considered less risky than buying BTC back in March when it briefly fell to around the $4,000 level on some exchanges, which makes given how much institutional interest, adoption, and support has improved over the past few months.

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.