On Tuesday (November 24), as the Bitcoin price went above $19,300 (which is less than $600 shy of Bitcoin’s all-time high price of $19,870, which was reached on 17 December 2017), CNBC’s Jim Cramer said that that it is not too late to buy Bitcoin.

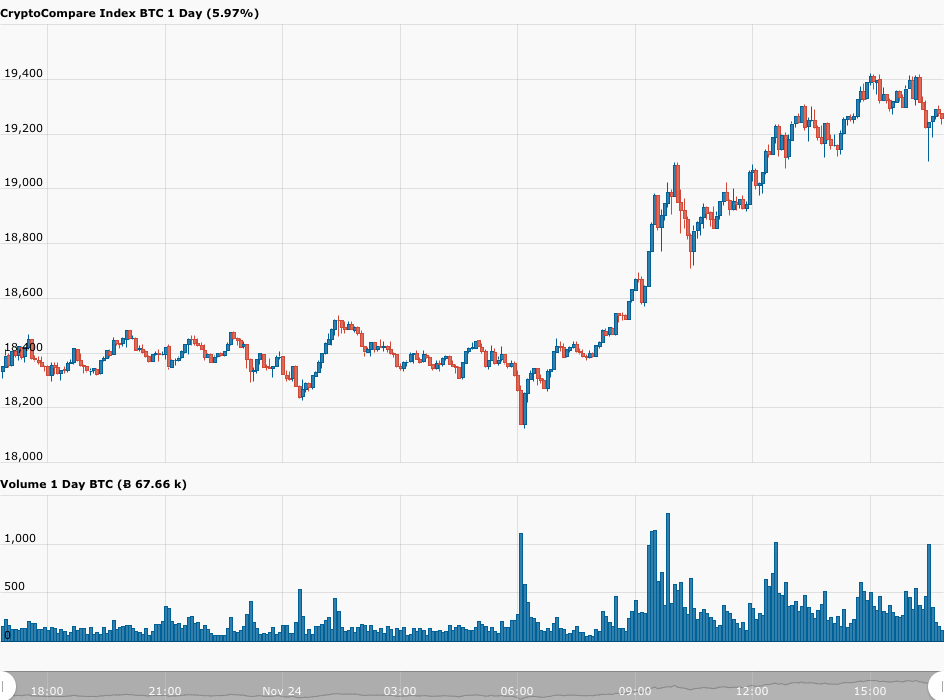

According to data by CryptoCompare, currently (as of 16:55 UTC on November 24), Bitcoin is trading around $19,250, up 4.69% in the past 24-hour period and up 78.58% since Bitcoin’s current bull run started on October 1.

Former hedge fund manager Cramer is the host of CNBC show “Mad Money w/ Jim Cramer“. He is also a co-anchor of CNBC’s “Squawk on the Street“, as well as a co-founder of financial news website TheStreet.

On 7 June 2017, when Bitcoin was trading around $2,800, after being told on “Squawk on the Street” that Business Insider CEO Henry Blodget had predicted that Bitcoin would one day be worth $1 million, this is how Cramer responded:

“I think it [Bitcoin] could [reach $1 million] because the European banks are frantically trying to buy them so they can pay off ransomware. It’s a short-term way to be able to deal with cybersecurity. It is the way to pay off the bad guys.“

However, on 14 August 2018, at a time when Bitcoin had just fallen below the $6K level, we found out that Cramer had gone from being super bullish to bearish:

“I think the tide has turned against it… I’m not saying its time has passed, but there is a notion that the sun seems to be setting.“

Then, on September 10, Anthony Pompliano (aka “Pomp”), who is a co-founder of Morgan Creek Digital as well as the host of “The Pomp Podcast”, told his almost 370K followers on Twitter that he had convinced Cramer to buy some Bitcoin (apparently during a recent podcast interview with Cramer):

Well, it seems that the institutional support/adoption of Bitcoin over the past few months, as well as the strong parabolic rally that has resulted in the price of Bitcoin already breaking all-time highs on multiple crypto exchanges earlier today, may have convinced Cramer to become much more bullish on Bitcoin since he sent the following tweets earlier today to his 1.4 million followers:

It is not surprising that Cramer is calling Bitcoin a “great alternative to gold” since Bitcoin has vastly outperformed gold in 2020 (+168% to +19%), and in fact more and more people (especially the millennials) and institutions seem to be coming to the same conclusion. The fact that Bitcoin’s market cap is still only around $360 billion, i.e. 1/30 of all the value of all the gold that has been mined so far, suggests that Bitcoin’s price could go a lot higher, which is why strategists from both Bloomberg and JPMorgan Chase have stated over the past few months that they see considerable long-term upside potential for Bitcoi.

Featured Image by “WorldSpectrum” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.