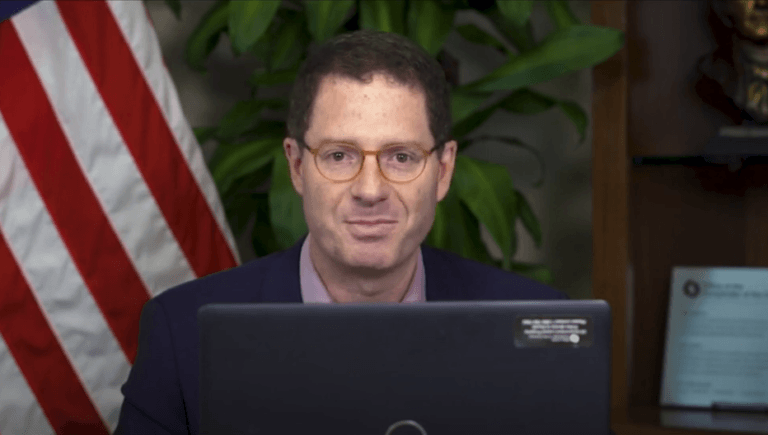

On Tuesday (November 10), Brian P. Brooks, Acting Comptroller (since May) at the Office of the Comptroller of the Currency (OCC), testified before the U.S. Senate Committee on Banking, Housing, and Urban Affairs, and as part of his prepared statement, spoke about cryptoassets.

Brooks was appearing as a witness at a committee hearing titled “Oversight of Financial Regulators“. The other witnesses were the Honorable Randal K. Quarles, Vice Chairman for Supervision, Board of Governors of the Federal Reserve System, the Honorable Jelena McWilliams, Chairman, Federal Deposit Insurance Corporation, and the Honorable Rodney E. Hood, Chairman, National Credit Union Administration.

Brooks is currently also a member of the Board of Directors of Federal Deposit Insurance Corporation (FDIC). Between September 2018 and March 2020, he served as Chief Legal Officer at crypto exchange Coinbase.

Brooks was appearing at the hearing “to discuss the activities underway at the Office of the Comptroller of the Currency (OCC) to ensure that the national banks and federal savings associations that we regulate operate in a safe, sound, and fair manner.”

The OCC is “an independent bureau of the U.S. Department of the Treasury that charters, regulates, and supervises all national banks, federal savings associations, and federal branches and agencies of foreign banks. Its goal is to ensure that the banks it supervises “operate in a safe and sound manner, provide fair access to financial services, treat customers fairly, and comply with applicable laws and regulations.”

With regard to crypto, here is what Brooks had to say about usage of cryptocurrencies (including stablecoins) in the U.S and what actions the OCC has taken to respond to this usage:

“Today, roughly 60 million Americans own some type of cryptocurrency, with a total market cap of nearly $430 billion. These figures clearly illustrate that this payment mechanism is now firmly entrenched in the financial mainstream. Cryptocurrency has become a popular mechanism for sending and receiving payments for goods and services because transactions post in real time and provide convenience and security. Cryptocurrency also describes categories of specific currencies of value, and the rise in the use of stablecoins demonstrates consumers’ comfort with its use.

“This year, the OCC took two actions to respond to specific questions from the industry regarding cryptocurrencies, distributed ledger technology and stablecoin activity already being conducted or considered by banks the OCC oversees. Our actions have clarified authority and regulatory expectations for banks in ways that reduce the overall risk to the banking system and support its continuous evolution and innovation.

“On July 22, 2020, the OCC published an interpretive letter clarifying national banks’ and federal savings associations’ authority to provide cryptocurrency custody services for customers. National and state banks and thrifts have long provided safekeeping and custody services, including physical objects and electronic assets. The OCC has specifically recognized the importance of digital assets and the authority for banks to provide safekeeping for such assets since 1998. The July letter simply concludes that providing cryptocurrency custody services, including holding unique cryptographic keys associated with cryptocurrency, is a modern form of traditional bank activities related to custody services.

“On September 21, 2020, the OCC published a second interpretive letter to clarify bank’s authority to hold reserves on behalf of customers who issue certain stablecoins. The letter responded to questions from the industry and concluded that banks may hold ‘reserves’ on behalf of customers who issue stablecoins in situations where the coins are purchased by customers through hosted wallets. The letter addresses the use of stablecoins backed by a single fiat currency on a one-to-one basis where the bank verifies at least daily that reserve account balances meet or exceed the number of the issuer’s outstanding stablecoins.

“The agency continues to consider other issues relevant to cryptocurrency assets and distributed ledger technology including the application of the technology to support payments services conducted within the federal banking system.”

Unfortunately, not everyone at the U.S. Congress was pleased with Brooks’ testimony at the U.S. Senate. In particular, six Democratic members of the House of Representatives were so unhappy with Brooks’ focus on FinTech and crypto that later that day they decided to sent a letter to Brooks concerning the OCC’s “recent unilateral actions in the digital financial activities space, including interpretive letters on cryptocurrency custody, stablecoins, and its announced plans to start offering special purpose ‘payments’ charters.”

According to a press release by the office of Congresswoman Rashida Tlaib (MI-13), this letter was co-signed by Stephen Lynch (MA-08), Jesús G. “Chuy” García (IL-04), Deb Haaland (NM-01), Barbara Lee (CA-13), and Ayanna Pressley (MA-07).

In this letter, the six members of the House wrote:

“Arguably, the immediate needs of millions of at-risk individuals who have not yet received an economic stimulus check and/or cannot deposit their funds in a bank, deserve greater attention than an effort to increase access to financial services to the ‘banked community’ via mobile phones…

“Our concern regarding the OCC’s excessive focus on crypto assets and crypto-related financial services is shared by the American Bankers Association and other trade groups who have expressed similar reservations that such services move too far away from the core business of banking.”

The lawmakers have asked for answers to their questions (such as “what consumer protections the OCC will impose on the stablecoin providers”) by December 10.