Investors in Bitcoin and other cryptoassets have good reason to feel more bullish after recent developments in the U.S. relating to negotiations over the next COVID-19 fiscal stimulus package.

But why would a deal on the next COVID-19 relief package affect the crypto market? Well, if the White House and the U.S. Congress manage to reach a deal, that would provide a nice boost for both the U.S. stock market (and presumably other major equity markets around the world) and the crypto market since these days Bitcoin seems to be having like a mega-cap tech stock and therefore would benefit from risk-on investor sentiment.

When all those traders on trading platforms such as Robinhood receive more money (either in the form of a second stimulus check or perhaps via the return of the $600 weekly federal unemployment benefit boost), what are they going to spend it on? With lockdowns likely to continue/return in many places, it is quite possible that some of the increased discretionary spending power will be spent on stocks and crypto.

Even if this does not happen, as we have seen during the last few months, when the next COVID-19 relief package arrives, it should boost investors’ confidence and result in more money going into both equities and crypto, which should result in the prices of both going higher.

So, what has happened recently that should cause us to feel optimistic that the White House and Washington lawmakers will reach agreement on a new coronavirus relief package?

Well, let’s have a quick recap of some of the relevant events of the past several weeks.

- On July 27, Senate Republicans formally proposed a $1 trillion relief package (this proposal cut enhanced federal unemployment benefits from $600 per week to $200 per week).

- Meanwhile, House Democrats were continuing to push their own $3 trillion relief proposal that passed the Democrate-controlled House back in May.

- On August 18, Senate Republicans proposed a $500 billion relief package that “would revive extra unemployment benefits at half the original rate, shield businesses from lawsuits related to the virus and provide funding for testing and schools.”

- On September 1, Treasury Secretary Steven Mnuchin indicated that the White House may be OK with a relief package as large as $1.5 trillion, telling the House Select Subcommittee on the Coronavirus Crisis: “Whether it is $1 trillion or $1.5 trillion, again, let’s not get caught on a number… Let’s move forward on a bipartisan basis now. I do not think the right outcome is zero. Nobody does.”

- On September 28, the Democrats unveiled a new $2.2 trillion relief bill that they hoped would help to restart negotiations, and the following day, Pelosi and Mnuchin had a “positive” discussion of this proposal. Two of the measures in this legislation are (1) reinstatement of the $600 per week enhanced unemployment benefit until the end of January 2021; and (2) a second $1,200 stimulus check.

- On September 30, Mnuchin and Pelosi had an “extensive conversation” (in their first in-person meeting since last month) to try to come up with a fifth relief package that would pass in both the House and the Senate. According to a report by CNBC, “entering the talks, Mnuchin said the White House and Democrats had reached common ground on issues including direct payments, small business loans and airline aid.”

Although a relief package getting approved before election day (November 3) would probably be a lot more helpful to Trump than Biden, these talks suggest that we might be starting to see some light at the end of the tunnel, and that perhaps the Democrats may be worried that by not making some kind of comprise at this time, they could face a backlash later from people who have been financially hit the hardest during this pandemic.

And it seems that the markets may be starting to price in the possibility of a relief package getting approved within the next few weeks.

Currently (as of 07:05 ET or 11:05 UTC on October 1), futures on the Dow Jones Industrial Average, the S&P 500, and the Nasdaq 100 are all in positive territory, up 0.81%, 0.87%, and 1.28% respectively.

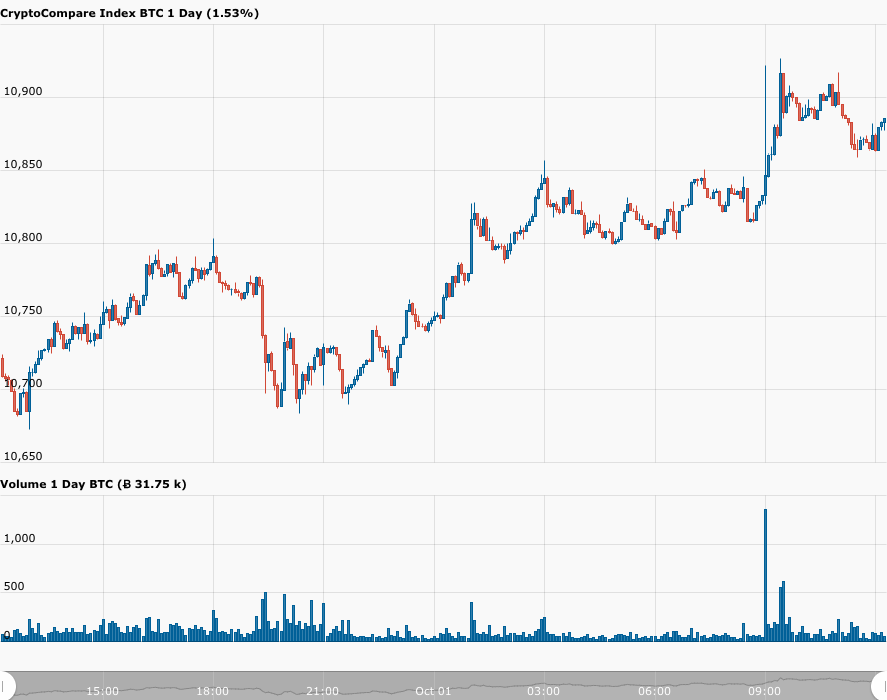

As for Bitcoin, currently (as of 11:20 UTC on October 1) it is trading around $11,883, up 1.85% in the past 24-hour period:

Featured Image by “WorldSpectrum” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.