On Monday (October 5), U.S. stocks, Bitcoin, and gold are all going higher thanks to justified optimism about President Trump’s recovery from COVID-19 as well as negotiations over the next COVID-19 stimulus bill.

As reported by CNN, earlier today, White House Chief of Staff Mark Meadows talked about President Trump’s “unbelievable progress” during an interview on “Fox and Friends”, and said that it would be decided later today whether he could be discharged from Walter Reed National Military Medical Center:

“Well that determination has not been made yet. Obviously he continues to improve overnight and his health continues to improve. The doctors will actually have an evaluation sometime late morning and then the President in consultation with the doctors will make a decision on whether to discharge him later today…

“We are still optimistic that based on his unbelievable progress and how strong he’s been in terms of his fight against this Covid-19 disease, that he will be released, but that decision won’t be made until later today.”

As for the stimulus talks, the unfortunate fact that last week President Trump contracted COVID-19 may help to revitalize the negotiations over the next fiscal stimulus package. According to a report by CNBC, House Speaker Nancy Pelosi had this to say on Friday about her discussions with U.S. Treasury Secretary Steve Mnuchin: “We continue to work on the text to move quickly to facilitate an agreement.”

Currently (as of 11:33 EDT or 15:33 UTC on October 5), the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite are in green territory, up 1.30%, 1.38%, and 1.71% respectively.

These two catalysts, along with a weaker U.S. dollar index (currently at 93.46, down 0.41%), seem to be helping gold and Bitcoin.

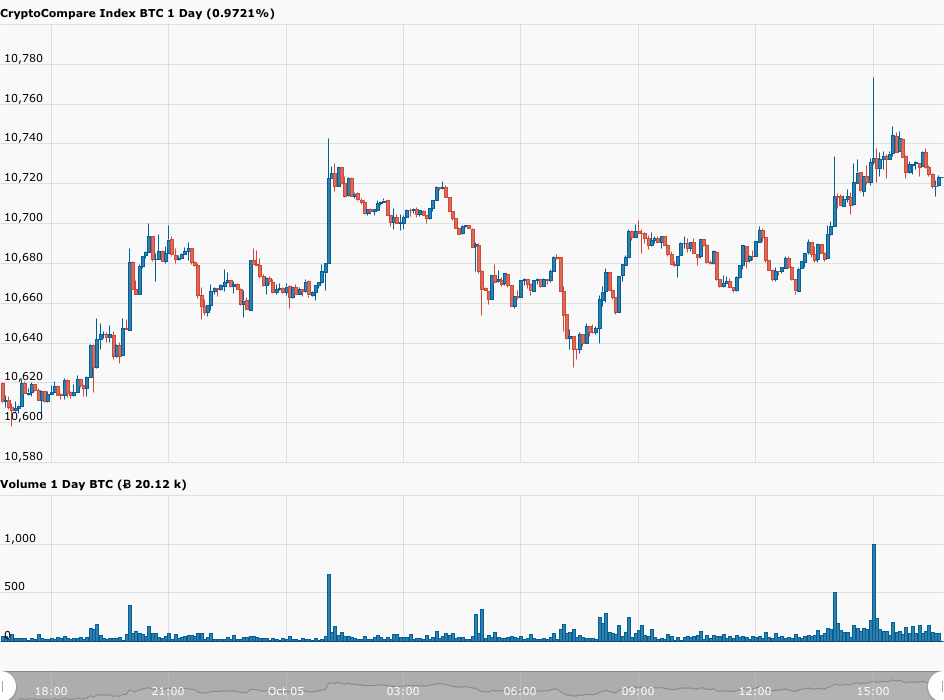

As of 15:37 UTC, spot gold is trading around $1915.11 an ounce, up 0.78% today, and Bitcoin is trading around $10,721, up 1.26%.

Featured Image by “WorldSpectrum” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.