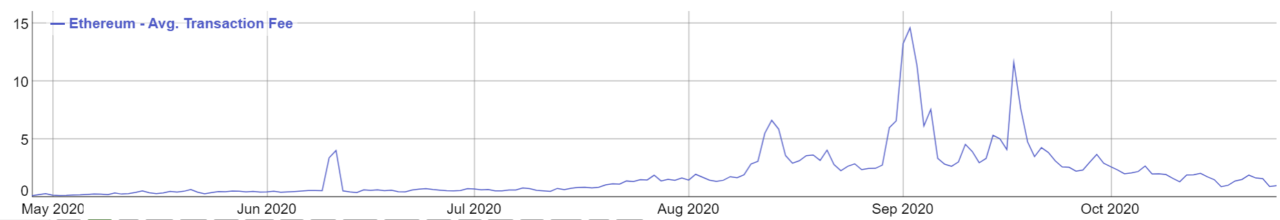

The average transaction fee paid to transact on the Ethereum network has been steadily dropping since mid-September, as interest in the decentralized finance (DeFi) ecosystem has stalled.

According to data from BitInfoCharts, the average transaction fee on Ethereum hit a new all-time high near $15 earlier this year in September, when interest in DeFi protocols was booming and the total value locked in the space got close to $10 billion.

After plummeting shortly after and hitting a new high of $11.6 in mid-September, the average transaction fee paid on Ethereum has been plunging, to the point the average transaction fee is now below $1.

Transaction fees on Ethereum go up as there’s limited space for transactions in the blocks miners find, and if demand exceeds available space users start bidding higher on gas fees to see which transactions are included in the next block.

The total value locked in DeFi has notably started growing at a slower pace since then, hitting a $12 billion all-time high earlier this month before it plunged after DeFi protocol Harvest Finance was exploited out of $24 million worth of cryptocurrency.

The total value locked in ETH, according to DeFi Pulse, hit 9.4 million ETH in mid-September, and only topped that figure on October 19, at 9 million ETH. Since then it has dropped to 8.88 million ETH. The total amount of BTC locked on DeFi protocols has, on the other hand, been steadily rising, going from 100,000 BTC in mid-September to 161,000 BTC at press time.

Interest in the decentralized space has likely been slowing down as some of the top protocols by total value locked have started reducing governance token rewards for yield farmers, and as centralized trading platforms compete with decentralized protocols on yields being offered.

It’s also worth noting that the average transaction fee paid to transact on the Bitcoin network spiked this week after the price of the flagship cryptocurrency hit $13,000.

Featured image via Pixabay.