A total of 4,872 bitcoin options contracts were traded on the Chicago Mercantile Exchange (CME) in September of this year, up from 2,717 in August, according to CryptoCompare’s September 2020 Exchange Review.

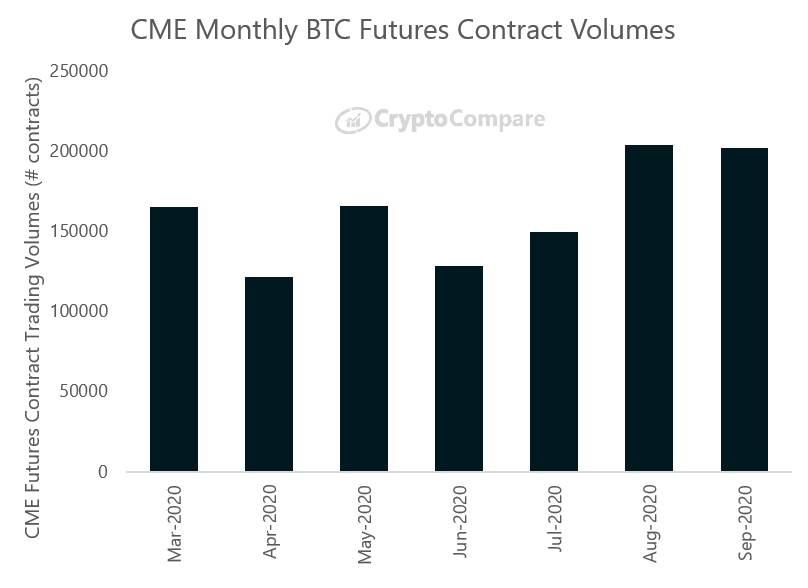

The 79.3% increase came in a month in which the price of the flagship cryptocurrency didn’t move to break its current range between $10,000 and $11,000. Given the price actions, CME’s BTC futures contract volumes remained relatively steady, as last month 201,893 bitcoin futures contracts changed hands on the exchange, down from 203,867 in August.

The report details that in terms of total USD trading volume, CME’s cryptocurrency derivatives products saw a 10.9% decrease to $11.02 billion in December. In contrast the largest crypto derivatives trading platform last month, Binance, traded $164.8 billion throughout the month, even though its volume dropped 10.7% compared to August.

As CryptoGlobe reported, Binance was followed by other top derivatives trading platforms that seemingly took a bigger hit last month. Huobi came in second, trading $156.3 billion, 25.8% less than in August. Next came OKEx, down 18.5% at $155.7 billion, and in fourth place came BitMEX, down 30.7% to $56.4 billion.

CryptoCompare’s report details that cryptocurrency derivatives trading volumes went down 17.5% in September to $634.9 billion, while spot trading volumes decreased by 17.5% to $676.6 billion. Derivatives exchanges, as seen above, did not escape the downward trend, with one exception.

Derivatives exchange FTX bucked the trend, seeing its trading volume go up by 12% in September to $23.89 billion. It’s worth noting BitMEX’s volumes may drop further, as last week the U.S Commodity Futures Trading Commission (CFTC) announced that it had brought charges against “five entities and three individuals” that own and operate it.

This led to traders immediately withdrawing a large part of the funds they had on the exchange.

Featured image via Pixabay.