On Friday (October 30), Bitcoin is trading in green territory even though the vast majority of altcoins are suffering losses (vs USD).

It is tough being a safe haven asset in times of turmoil. The COVID-19 pandemic seems out of control in Europe and the US. And if that was not bad enough, the U.S. presidential election is less than four days away, and if Joe Biden wins by a small margin, there is a good chance that the result of the election will be disputed by President Trump and the U.S. Supreme Court may need to intervene.

Gold, traditionally, has been a good safe haven asset. Between March 19 and August 6, the price of gold went from $1,471 per ounce to $2,062 per ounce, i.e. a gain of 40.17%. However, since then it has fallen 9.11%. Between March 19 and October 30, the price of gold has gone up 27.13% vs USD.

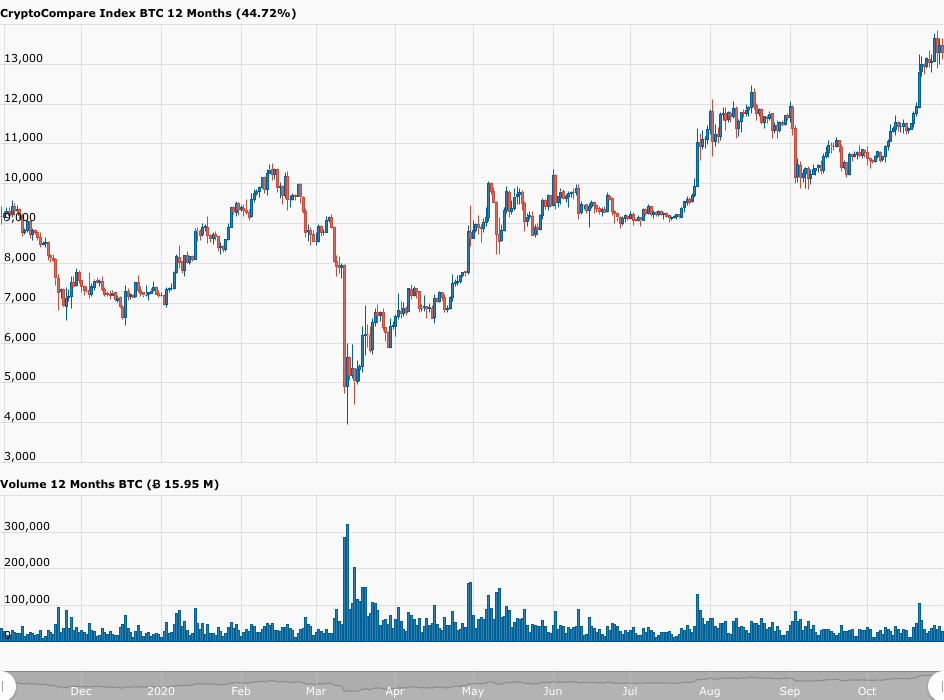

During the same period, i.e. 19 March and 30 October, Bitcoin — gold’s young and nimble competitor — has gone from $6,184 to $13,282, where it is trading today (as of 11:30 UTC), which means a gain of 114.78% vs USD.

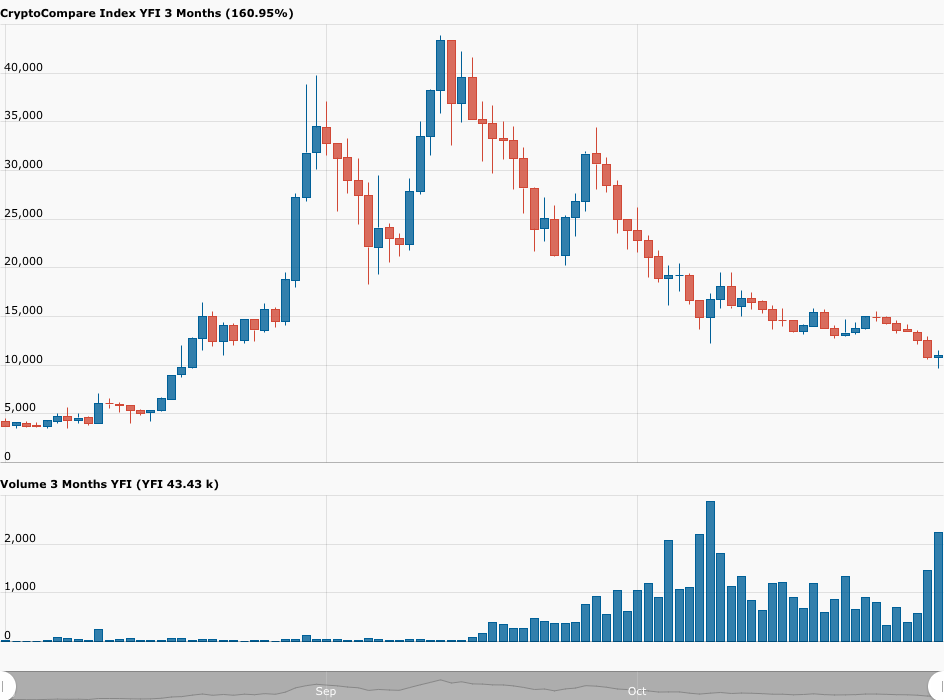

Meanwhile, the vast majority of other cryptoassets — especially those related to decentralized finance (DeFi), which enjoyed an incredible summer as billions of dollars of speculative money went into DeFi projects (some of which had not even had a smart contract audit) — have fallen in equally spectacular fashion in the past couple of months as interest in Bitcoin has grown, particularly after Nasdaq-listed companies MicroStrategy and Square disclosed that they have invested in Bitcoin and want to use it as a treasury reserve asset.

One those DeFi darlings is Compound (COMP), which was trading around $256.74 on September 1. Since then, the COMP price has fallen 63.92%. Another good example is Yearn Finance (YFI); although the price of the YFI token reached its all-time high of $43,915 on September 12, it is now trading around $11,019, which means a drop of roughy 75%.

And angel investor Qiao Wang, a former Director of Products at Messari, expects more pain for DeFi tokens:

Behavior analytics startup Santiment tweeted yesterday:

On Tuesday (October 27), former hedge fund manager Raoul Pal explained why he believes that over the next 18 months it will become more and more apparent that “Bitcoin’s performance is SO dominant” that “holding any other assets makes almost no sense.”

In a tweetstorm sent out yesterday, Pal described Bitcoin as “a supermassive black hole that is sucking in everything around it and destroying it.” He then proceeded to explain what he means. He did so using charts that compared the performance of Bitcoin — during the past three-year period — to gold, the Nasdaq, banking stocks, bonds, commodities, G4 central bank balance sheet, silver, Amazon stock (AMZN), and apple stock (AAPL).

With Bitcoin’s excellent performance during the current pandemic, institutional investment by companies such as MicroStrategy (which has so far invested around $425 million in Bitcoin and which plans to buy even more BTC), and legitimisation of Bitcoin by PayPal (which announced its move into crypto on October 21), despite minor long-term regulatory concerns, the short to medium term outlook for Bitcoin seems bright, especially when you add in the fact that much more monetary and fiscal is coming in 2021 to fight the economic impact of COVID-19.

Featured Image by “PublicDomainPictures” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.