On Monday (October 26), the Dow, the S&P 500, and the Nasdaq Composite are all trading in negative territory after the number of new COVID-19 cases in the U.S. went above 85,000 (a new daily record) on Friday. And sadly Bitcoin is not immune to Wall Street’s cold.

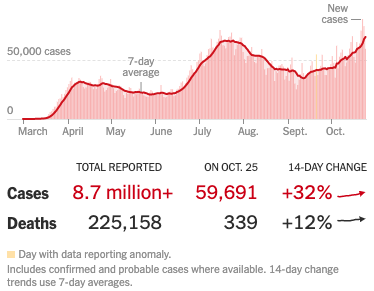

According to the New York Times, the number of new COVID-19 cases reported on Friday (October 23) was 85,085; the previous daily record — which was 75,687 — was set on July 16th. The Times report goes on to say that “over the past week, there have been an average of 69,814 cases per day, an increase of 32 percent from the average two weeks earlier.”

What was perhaps even more scary to some was a comment that White House chief of staff Mark Meadows made during an interview with CNN on Sunday (October 25).

Meadows told CNN’s Jake Tapper on “State of the Union”:

“We are not going to control the pandemic. We are going to control the fact that we get vaccines, therapeutics and other mitigation areas.”

What adds to investors’ concern/frustration is that while the second wave of the pandemic is going on, the fiscal stimulus talks in Washington between the Democrats and the Trump administration seem to have stalled once again, the House of Representatives has suspended sessions until November 16, and the members of the Senate are leaving town later today after they have confirmed the nomination of Supreme Court nominee Amy Coney Barrett.

Larry Kudlow, director of the National Economic Council, told CNBC in an interview earlier today:

“The talks have certainly slowed down, but they’re not ending.”

This has left investors with the realization that it now sadly appears highly unlikely that any kind of stimulus bill will pass in both chambers of the U.S. Congress and get signed into law before November 3 and that it might be late January 2021 (at the earliest) or early February 2021 before we see a comprehensive COVID-19 relief package in the U.S.

Currently (as of 17:20 UTC or 13:20 ET), the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite are trading at 3.12%, 2.57%, and 2.40% respectively.

As for Bitcoin, at least since March, it has been trading during the current COVID-19 pandemic as a risk-on asset, even though some Bitcoin bulls (such as Anthony Pompliano) refuse to accept that Bitcoin does not exist in a vacuum and they still continue to say that Bitcoin is a non-correlated asset (which might well be true over a much longer time frame but not during the past seven months).

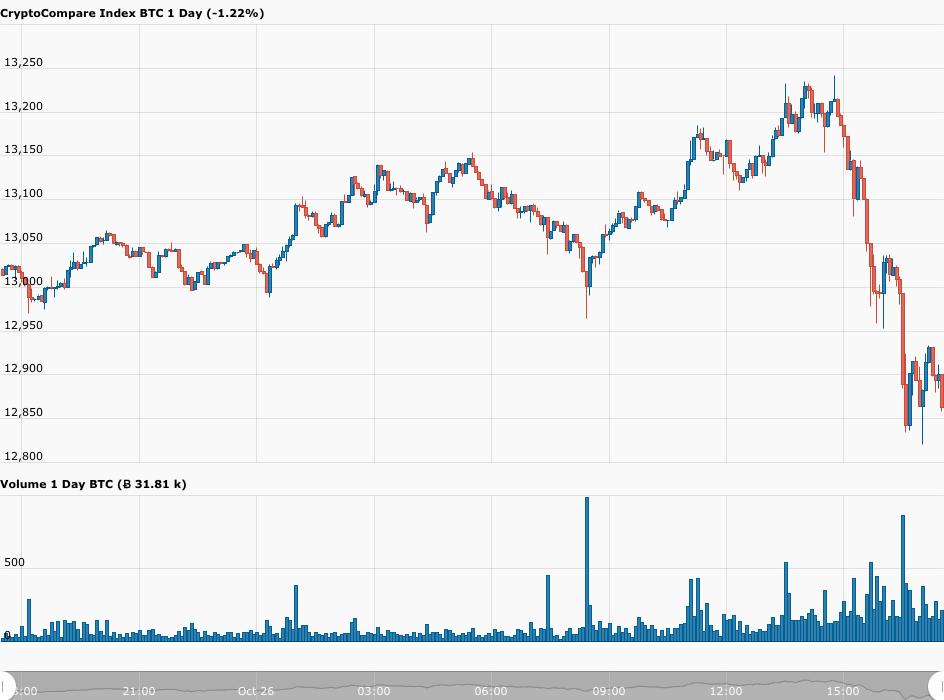

Not surprisingly, although Bitcoin was trading as high as $13,241 at 14:45 UTC (which had some Bitcoin fans prematurely celebrating the decoupling of Bitcoin from stocks), at the time of writing (17:35 UTC), Bitcoin is trading at $12,852, down 1.27% in the past 24-hour period.

The other thing to bear in mind is that Bitcoin is currently inversely correlated to the U.S. dollar:

And the U.S. dollar is stronger today. As of 17:41 UTC, the U.S. dollar index (DXY) is at 93.05, up 0.3% today:

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.