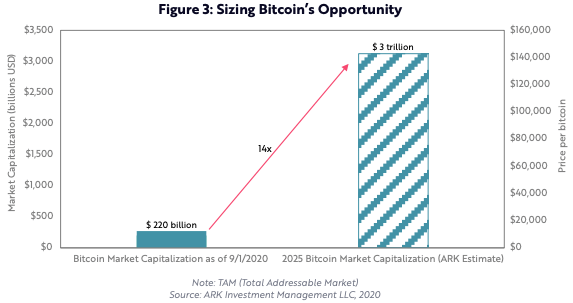

In a recent research report, global asset manager ARK Investment Management LLC (also known as “ARK Invest”) explained how Bitcoin’s market cap, which is currently around $200 billion, could go as high as $3 trillion in the next five years.

This report, which is titled “Bitcoin As An Investment”, is part 2 of a two-part research paper on Bitcoin, and it was published on September 17; the first part, which is titled “A Novel Economic Institution”, was published as a separate report on September 3. Both reports were written by Yassine Elmandjra, an analyst at ARK Invest, in collaboration with Coin Metrics.

Elmandjra argues that Bitcoin is “early on its path to monetization” and has “substantial

appreciation potential”; in fact, he says that ARK believes that Bitcoin’s current (roughly) $200 billion market cap will “scale more than an order of magnitude to the trillions during the next decade.”

Elmandjra says that there are four major market opportunities for Bitcoin.

First, Bitcoin could become “a settlement system for banks and businesses.”

Here is why this is possible:

“Unlike traditional settlement systems, the Bitcoin network is global, it cannot censor transactions, and its money cannot be inflated by institutions like central banks. Instead of facilitating a large volume of low value transactions at point of sale, Bitcoin could evolve to handle large transactions between and among financial intermediaries.”

He then goes on to say that if Bitcoin managed to capture even just 10% of the inter-bank settlements in the U.S., that would be enough to increase the market cap of Bitcoin to $1.5 trillion (which would mean a Bitcoin price of around $75,000).

Second, Elmandjra says that if there was a 5% chance globally of asset seizure (during a person’s lifetime) by “a corrupt or misguided regime”, then since “bitcoin cannot be seized”, that could make this opportunity help increase Bitcoin’s market to $2.5 trillion.

Third, he pints out that if Bitcoin “were to take 10% share of the physical gold market,” its market cap could increase to nearly $1 trillion.

Forth, Bitcoin could “become an important savings vehicle in emerging markets, to such an extent that businesses might demand payment in bitcoin instead of fiat,” and if Bitcoin “were to capture 5% of the global monetary base outside of the four largest fiat currencies,” that would increase Bitcoin’s market cap to “roughly $1.2 trillion.”

Bitcoin pioneer Dr. Adam Back, who is a Co-Founder and CEO of Blockstream, seems to agree with ARK Invest’s assessment of Bitcoin’s potential. Here is what he tweeted earlier today:

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.