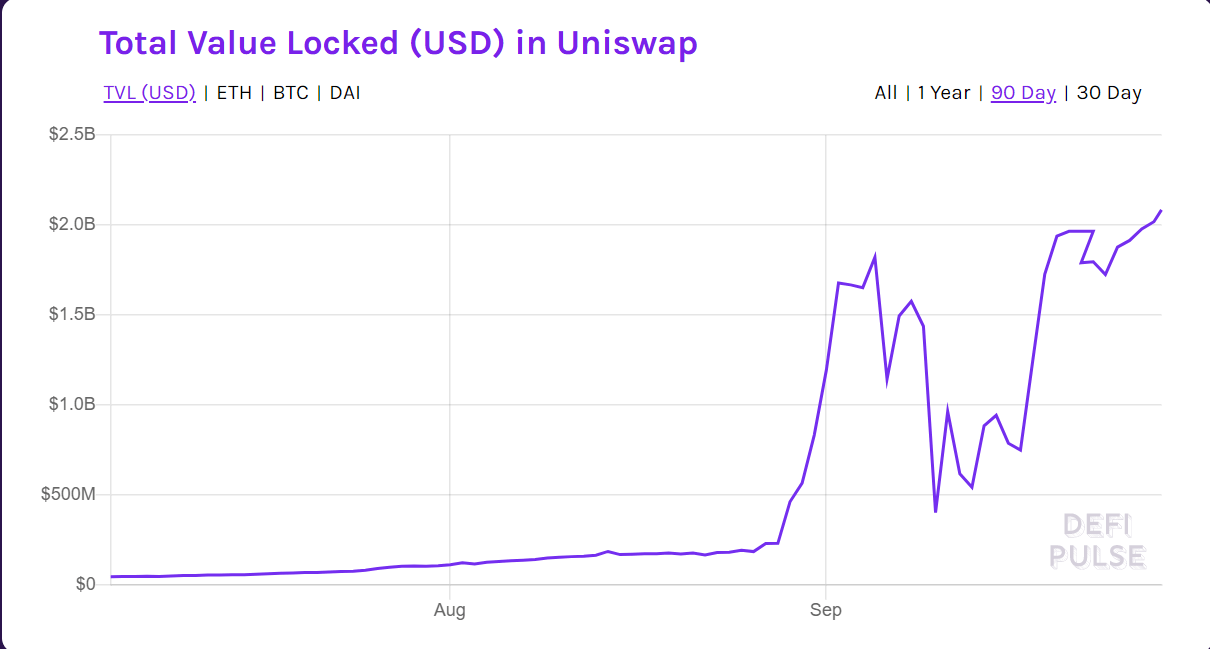

Decentralized cryptocurrency exchange Uniswap has become the first decentralized finance (DeFi) protocol to surpass $2 billion in total value locked as users take advantage of the ongoing yield farming trend.

Uniswap is a decentralized exchange that uses an automated market maker (AMM) model instead of the traditional order books. Users provide liquidity to Uniswap and are rewarded with a portion of the trading fees, and with the protocol’s governance token UNI.

According to DeFiPulse a total of $2.09 billion are currently locked on Uniswap, after its total value locked grew by over 5% in a single day.

Behind it comes Maker, the protocol behind the DAI stablecoin with $1.97 billion locked in it, and it’s followed by lending and borrowing protocol Aave, with $1.6 billion worth of cryptocurrency locked in it.

Data from Uniswap shows that the decentralized cryptocurrency exchanged traded over $250 million in the last 24-hour period, a figure significantly below its all-time high close to $1 billion per day seen earlier this month. Its most liquid cryptoassets are ether, Tether’s USDt stablecoin, and Wrapped Bitcoin (WBTC).

Earlier this month Uniswap was falling behind other decentralized finance protocols in terms of total value locked, as the yield farming trend started when Compound launched its COMP governance token, and others followed. Uniswap moved up to the number one spot after launching its own governance token, UNI, and airdropping 400 tokens to everyone who had interacted with the Protocol.

At press time, Uniswap’s dominance in the DeFi space is of 18.65%, and its UNI governance token is trading at around $4.5 after losing over 5% of its value in the last 24 hours. Uniswap’s total value locked may also be going up thanks to it being integrated into popular cryptocurrency exchanges.

Earlier this month OKEx, a popular cryptocurrency exchange known for supporting DeFi projects, integrated the Uniswap protocol into its Earn program, allowing users to earn interest on various token pairs and earn UNI tokens doing so, without having to leave OKEx.

Accessing Uniswap’s liquidity pools without leaving the comfort of a centralized exchange allows users to steer clear of potential phishing traps while also removing the need for them to use a Web3-compatible wallet and finding the top liquidity pools on their own.

OKEx is well-known for supporting DeFi protocols and their respective tokens. So much so that on its own “DeFi” tokens tab, it now has over 54 different cryptocurrencies, allowing users to gain exposure to the DeFi space’s tokens. It’s worth noting that the nascent space’s tokens may be a risky investment.

Featured image via Pixabay.