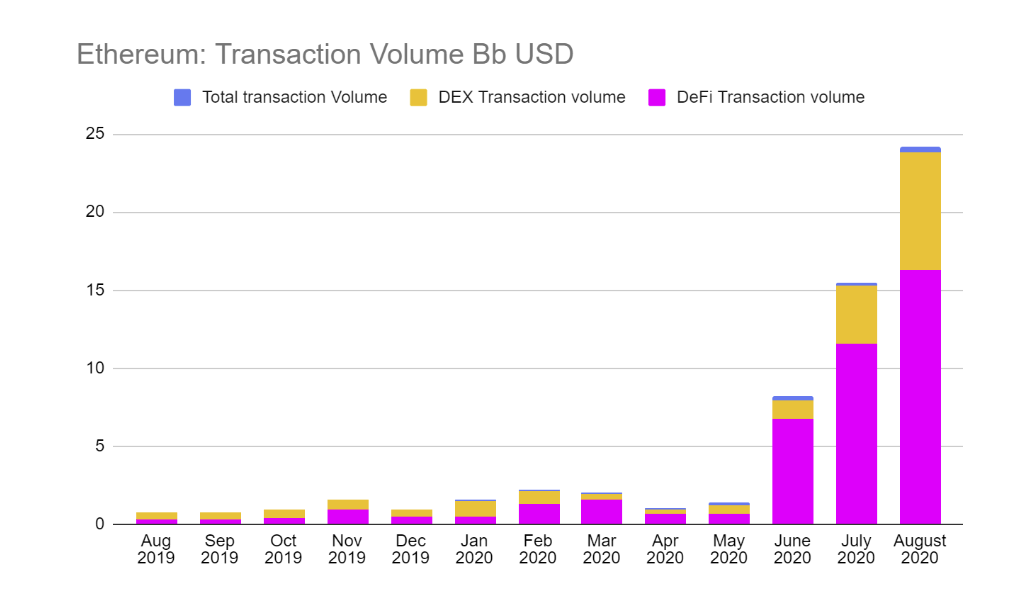

Rising transaction fees on the Ethereum network have reportedly caused a drastic decline in user activity last month, but transaction volumes on the ETH network were nevertheless above $24 billion.

According to decentralized applications tracker DappRadar, the high gas prices being paid to move funds on Ethereum have not affected the decentralized finance ecosystem or decentralized exchanges.

Per the firm, transactions currently cost more than $50, but DeFi enthusiasts haven’t slowed down their activity because of these prices. All the main metrics, it writes, show the “madness surrounding the DeFi ecosystem seems to be increasing.” As a result the price of ether, the main currency on the Ethereum network, moved up in August to $420, and hit $470 this month before declining.

In August, the number of daily active wallets dropped by 6% on average, with gambling and high-risk applications being the most affected. On these wallets, daily activity dropped from 6,700 to 2,393 active wallets. Games and marketplaces were also heavily affected.

Decentralized finance applications and decentralized exchanges, on the other hand, grew 16% month-on-month, with Uniswap being the greatest contributor to that growth. As CryptoGlobe reported the total value locked in the space kept on growing to surpass the $9 billion mark earlier this week. Uniswap has the most value locked in it, with lending protocols and decentralized exchanges following it.

Per DappRadar, transaction volumes “almost doubled in August” and surpassed $24 billion, with DeFi and DEX apps playing a “vital role” in said growth.

Uniswap’s transaction volume grew by $3.8 billion to reach $5.4 billion in August, while Curve saw its volume grow by $3.3 billion to hit $4.9 billion. Lending protocol Aave came in third, with its volumes increasing by $2.1 billion to $3.5 billion.

Notably, attempts to create a DeFi ecosystem on the TRON network seem to have been working, as the firm reports daily active wallets, transaction volumes, and the value of TRX itself all went up thanks to these efforts.

High-risk dapps and gambling applications fuelled most of the growth on the TRON blockchain, however. On average, high-risk apps generated 50,000 daily active wallets last month, DappRadar reports. TRON’s transaction volumes surpassed $300 million, increasing 95% when compared to July 2020.

Featured image via Pixabay