On Tuesday (September 22), Mike McGlone, Senior Commodity Strategist at Bloomberg Intelligence (BI), Bloomberg’s research arm on the Bloomberg Terminal, offered some reassuring words for BTC HODLers.

On Friday (September 18), the three major U.S. stock indexes closed flower for the third straight week.

One reason for the recent poor performance of the U.S. stock market is gradual rotation out of technology stocks (such as Amazon and Tesla) due to concerns about valuations of some of the companies that powered the huge rally we have witnessed since March 23.

Another reason is that it appears that there has not been much progress in Washington during the past several weeks in achieving consensus on a new fiscal stimulus package to fight the economic impact of the COVID-19 pandemic.

As for today, currently (as of 11:12 EDT or 15:12 UTC on September 22), the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite are all in negative territory, down by 0.49%, 0.20%, and 0.23% respectively.

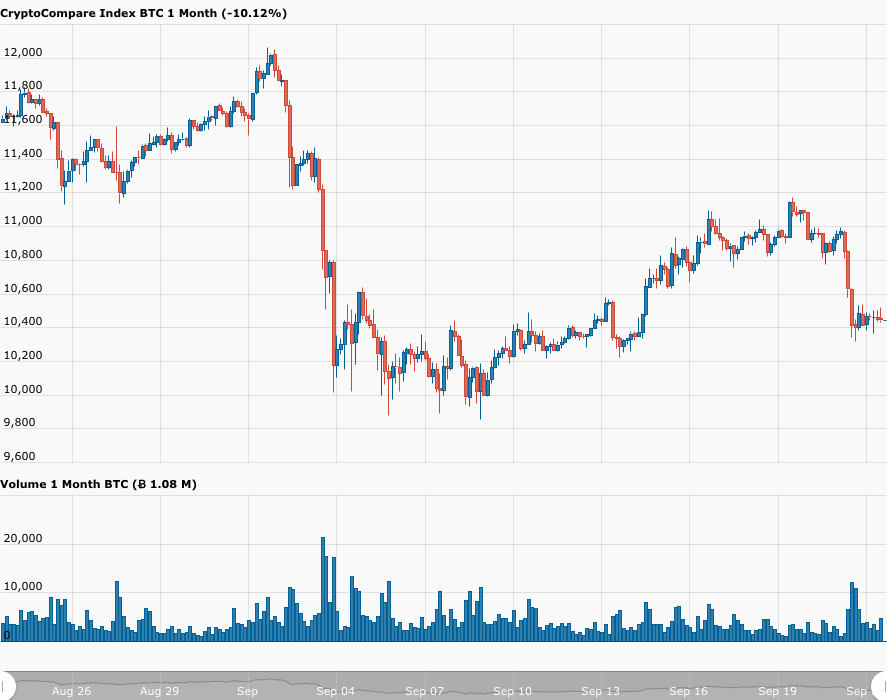

Of course, this risk-off mood negatively affects Bitcoin, which generally tends to behave as a risk-on asset. In the past three weeks, as U.S. stock prices have declined, so has the Bitcoin price.

On September 1, the Bitcoin price reached an intraday high of $12,062. Bitcoin is currently (as of 11:04 UTC on September 22) trading around $10,447, which means since that high on September 1, the BTC price has come down 13.39%.

For those people who think this most recent correction in the Bitcoin price is a cause for serious concern, McGlone, who is long-term bullish on both gold and Bitcoin, has some reassuring words:

And on August 19, McGlone said that it would take “something unexpected” to stop the juggernaut that is Bitcoin since demand for and adoption of Bitcoin keep going up whilst Bitcoin’s supply is limited to 21 million coins:

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.