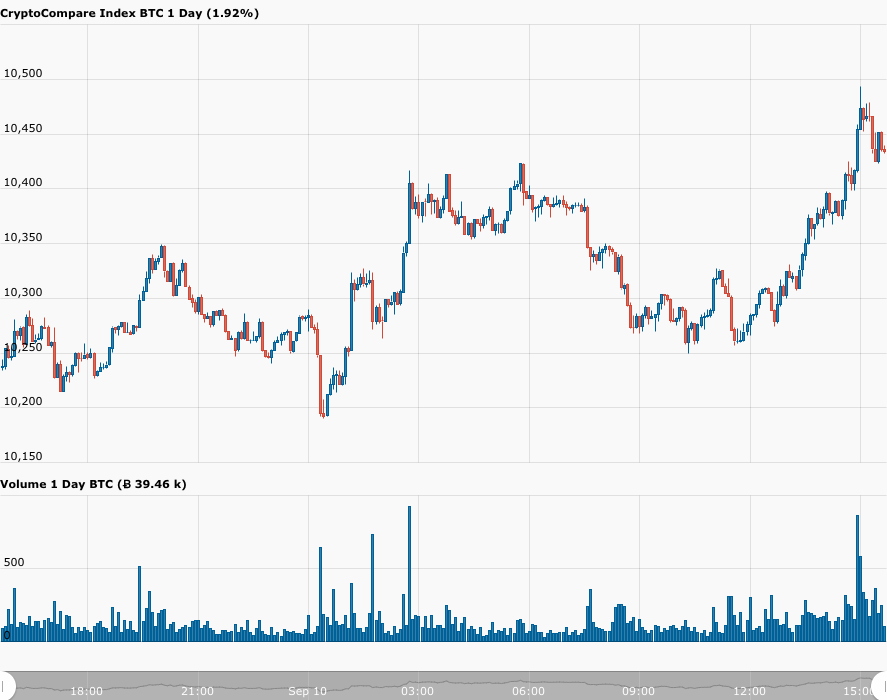

On Thursday (September 10), the Bitcoin price surged past $10,450 for the first time since last Saturday (September), a move that seems to have been made possible by a second rebound rally for U.S. tech stocks.

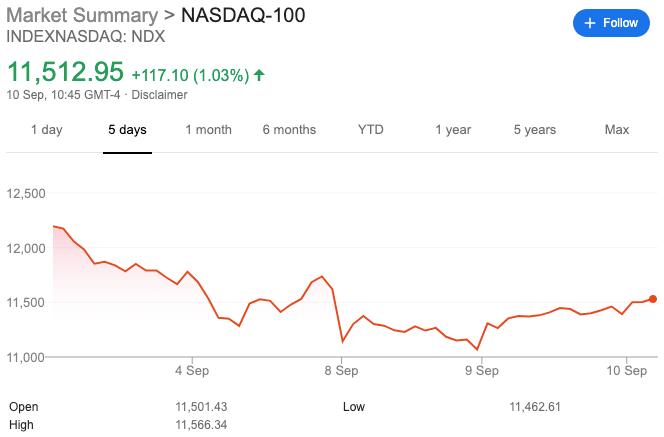

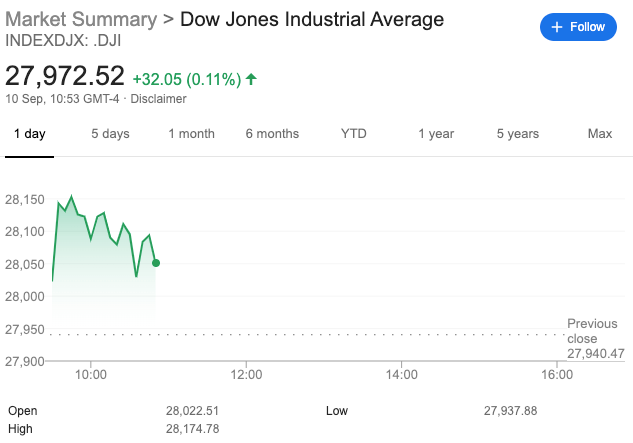

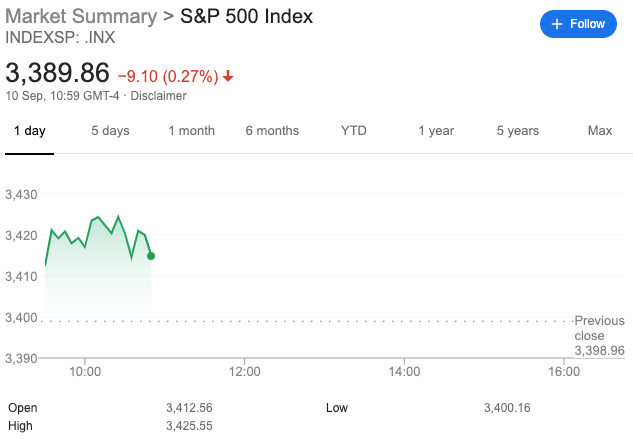

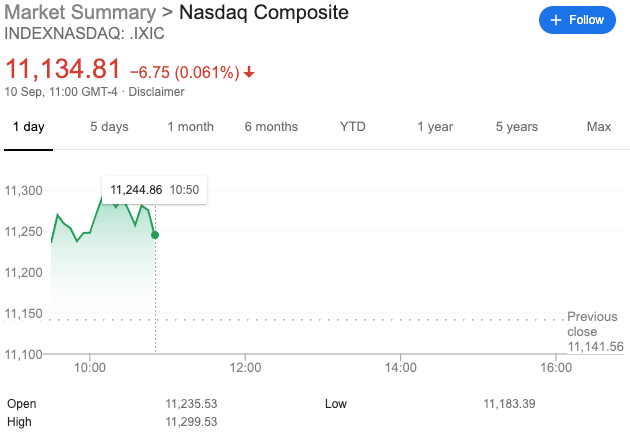

As of 10:53 Eastern Time (or 14:53 UTC), the Dow Jones Industrial Average is trading 32.05 (or 0.11%) higher; the S&P 500 is trading 8.36 (or 0.25%) higher; and the Nasdaq Composite is trading at 11,215.98, up 74.42 (or 0.67%).

According to data from Skew, since last Thursday (September 3), Bitcoin’s one-month realized correlation with the S&P 500 has been higher than +50%, and yesterday it was +53.09%.

Although currently (as of 15:15 UTC) Bitcoin is trading at $10,394 (up 1.34%), within 30 minutes of the opening of the U.S. stock market, the Bitcoin price reached $10,493, a level last seen on September 5.

To give you a rough idea of how well the crypto market is doing today, 13 of the top 20 cryptoassets (by market cap) are currently in the green (i.e. up against USD).

As of 15:35 UTC, here are a few today’s top gainers (by percentage change vs USD):

- Ethereum (ETH): $370.16 (+5.13%)

- Binance Coin (BNB): $25.09 (+6.34%)

- UMA: $16.74 (+7.02%)

- Yearn Finance (YFI): $31,430.87 (+14.63%)

- Synthetix (SNX): $5.43 (+14.61%)

- Loopring (LRC): $0.268 (+29.37%)

According to data from TradingView, during the past 24-hour period, the estimated total crypto market cap has increased by 2.16%, and as of 15:42 UTC on September 10, it stands at $320.39 billion.

Earlier today, Alex Krüger, one of CryptoTwitter’s favorite macro-economists explained why he remained long-term bullish on Bitcoin:

Featured Image by “skeeze” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.