On Wednesday (September 9), Bitcoin has moved comfortably above the $10,000 level thanks to a welcome bounce in U.S. stock futures.

In particular, according to CME Group, E-mini Nasdaq-100 futures (NQ), which offer “liquid benchmark contracts to manage exposure to the 100 leading non-financial U.S. large-cap companies that make up the Nasdaq-100,” are currently (as of 12:10 UTC) at 11226.00, up 165.50 (+1.5%).

Per a report by CNBC, “the Nasdaq Composite was down more than 10% in three days from a record high, officially entering correction territory and “the S&P 500′s three-day loss was its worst since June.”

Kristina Hooper, Invesco’s Chief Global Market Strategist, told CNBC:

“Some are suggesting this is the start of another dramatic sell-off, similar to the spring of 2000 when the ‘tech bubble’ burst. I highly doubt that.

“I think of this rout not so much as a correction, but as a digestion given that the Nasdaq Composite rose more than 60% from its March bottom in the course of less than six months.All In all, I think this is a healthy period of consolidation after a dramatic run-up.”

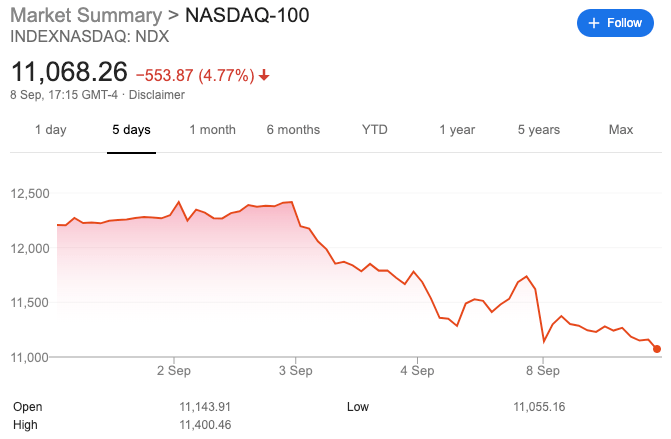

As you can see in the chart below by Google Finance, on Thursday (September 3), NASDAQ-100 closed at 12,416.77, and yesterday (September 8), it closed at 11,069.35, i.e. it has lost 10.85% over the past two trading sessions.

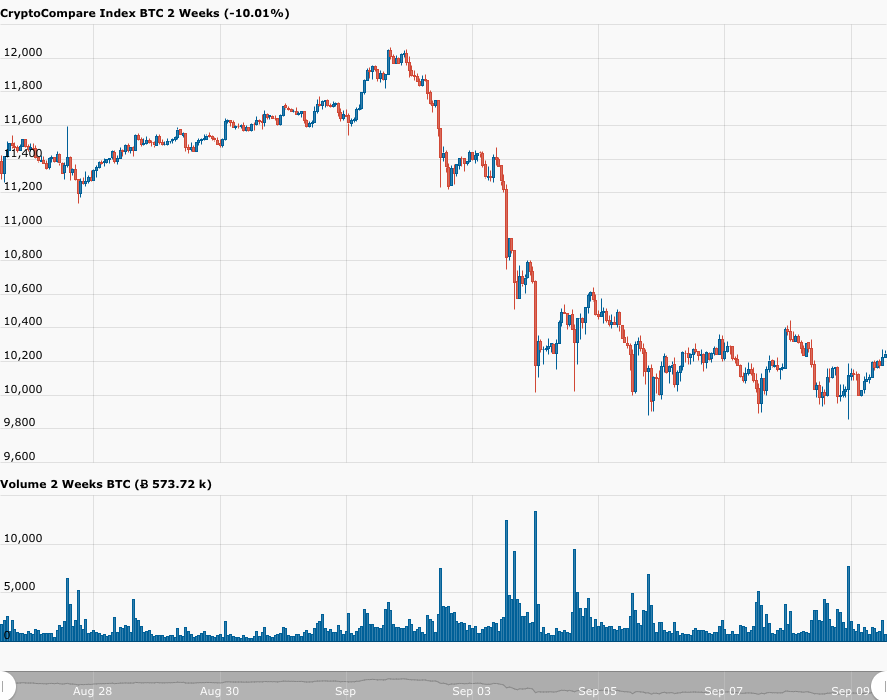

As for Bitcoin, according to CryptoCompare, as of 12:27 UTC on September 9, BTC-USD is trading at $10,183, up 1.6% in the past 24-hour period:

Joe Weisenthal, the executive editor of news for Bloomberg Digital, commented in today’s Bloomberg Markets newsletter on the surprising degree of positive correlation between Nasdaq-100 and Bitcoin over the past two trading sessions:

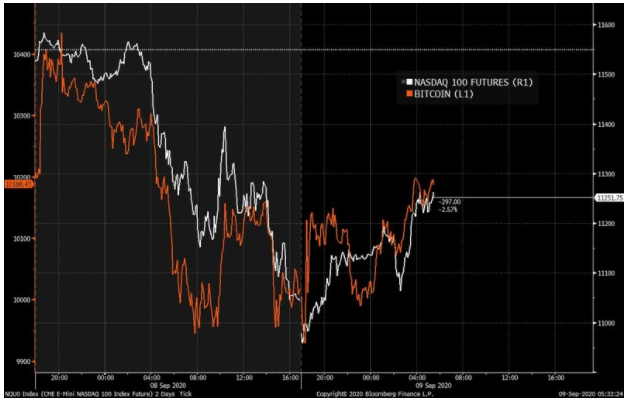

“I continue to be astonished by charts like this one.

“Here’s a look at Nasdaq 100 futures vs. Bitcoin over the last couple of days, and as you can see they display a shocking degree of co-movement.

“Both plummeted around 8 a.m. Eastern Time yesterday before bouncing back a little bit in the morning, and then plunging again in the afternoon. Both made their lows just a little bit after 4 p.m. and then as of 4 a.m. this morning, both had started to rebound in decent fashion.”

Weisenthal then went on to say:

“One of Bitcoin’s big selling points is its diversification benefits, but these days it’s almost tick-by-tick just your standard risky asset. It could be a cloud stock or Tesla. Or heck even gold…

“One might say that, well, Bitcoin is still an uncorrelated asset generally, it’s just that 2020 has been an exceptional year. And that’s true. Except that exceptional years are precisely when you want actual diversification. Nobody needed diversification in 2019 when things just went up.”

There are a couple of more problems with Weisenthal’s most recent criticism of Bitcoin.

First, he is focusing on a very short time frame. Second, although Bitcoin has had episodic bouts of moderate positive correlation with U.S. stocks since the start of the COVID-19 pandemic, perhaps that is not too surprising because, as the old saying goes, “all correlations go to one in times of stress.”

Yesterday, prominent macro-economist and crypto analyst Alex Krüger explained that we are still in a bull market and corrections to the Bitcoin market like the one that started last week are perfectly normal and just need to be risk-managed:

He then went on to say:

Krüger believes that the short to medium term macro drivers for Bitcoin are:

- current: sell-off in equities (led by a sector rotation out tech); disappointment in Fed Chair Powell’s recent speech; and the increasingly likelihood that there will be a hard Brexit, which would weaken the British Pound (and possibly the Euro) and stregethen the U.S. dollar (as measured by the U.S. dollar index)

- upcoming: the two-day FOMC meeting, which is held September 15-16; the fiscal stimulus package being discussed by the U.S. Congress; the re-opening of the U.S. economy; and the U.S. presidential election in November.

Earlier today, popular Dutch crypto analyst/trader Michael van de Poppe, offered this technical analysis of Bitcoin’s recent price action:

Featured Image by “WorldSpectrum” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.