On Monday (September 28), the top two cryptoasets by market cap, perhaps rather surprisingly, are trading higher than they were were before the one of the most significant attacks ever on a crypto exchange.

Over the weekend, around 02:51 UTC+8 on September 26 (or 18:51 UTC on September 25) to be more specific, Singapore-based crypto exchange KuCoin, which had never been hacked before, discovered that there had been a security breach, as the result of which allegedly around $280 million in cryptoassets were stolen.

According to KuCoin Global CEO Johnny Lyu, who hosted a live stream that started at 04:30 UTC on September 26, the losses occurred due to “the leakage of the private key of KuCoin hot wallets” and KuCoin’s insurance fund is large enough to cover them.

This is what Larry Cermak, Director of Research at The Block wrote earlier today about this incident:

On September 26, Paolo Ardoino, Bitfinex and Tether CTO explained how the two companies were helping KuCoin with the recovery of some of the stolen funds:

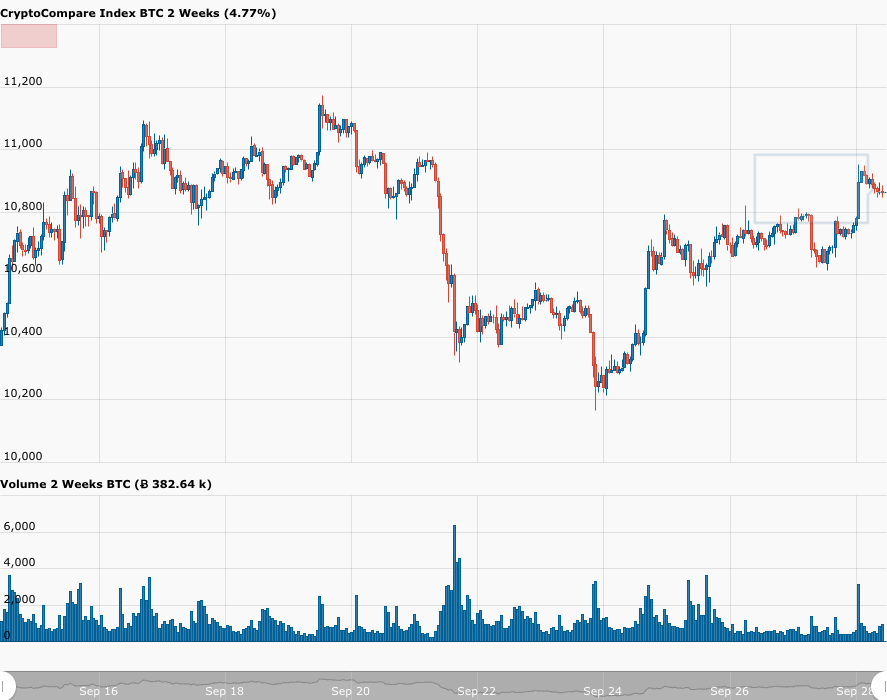

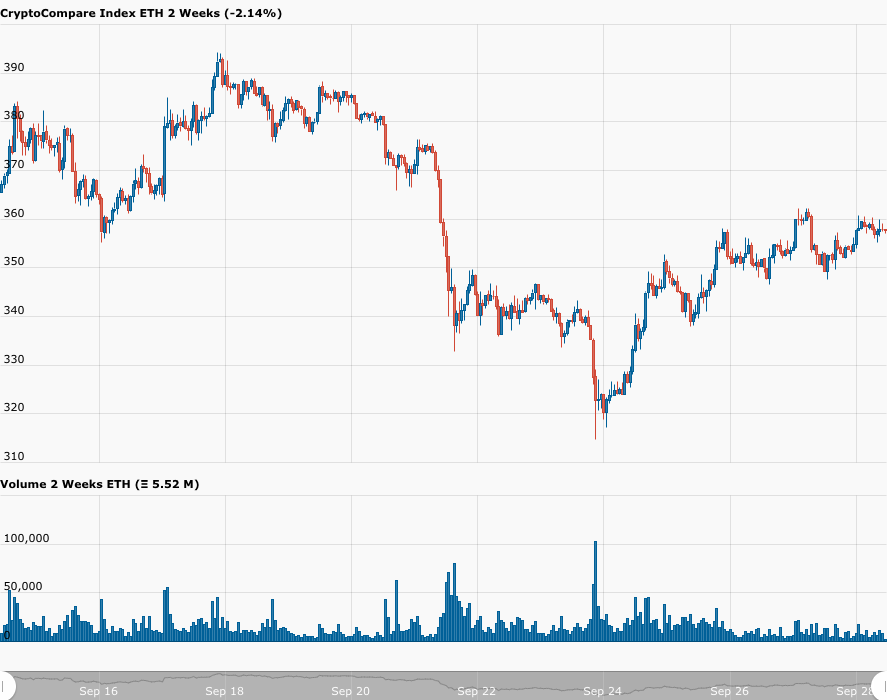

The BTC-USD and ETH-USD price charts below show that both Bitcoin and Ether are trading roughly 1% higher today (as of 10:00 UTC on September 28) than they were shortly before KuCoin got hacked.

To give you a rough idea of how well the rest of the crypto market is doing today, 46 of the top 50 cryptoassets (by market cap) are currently in the green (i.e. up against USD).

As of 11:15 UTC, here are a few of today’s top gainers (by percentage change vs USD):

- Polkadot (DOT): $4.46 (+8.20%)

- Cardano (ADA): $0.105 (+11.01%)

- Cosmos (ATOM): $5.09 (+12.16%)

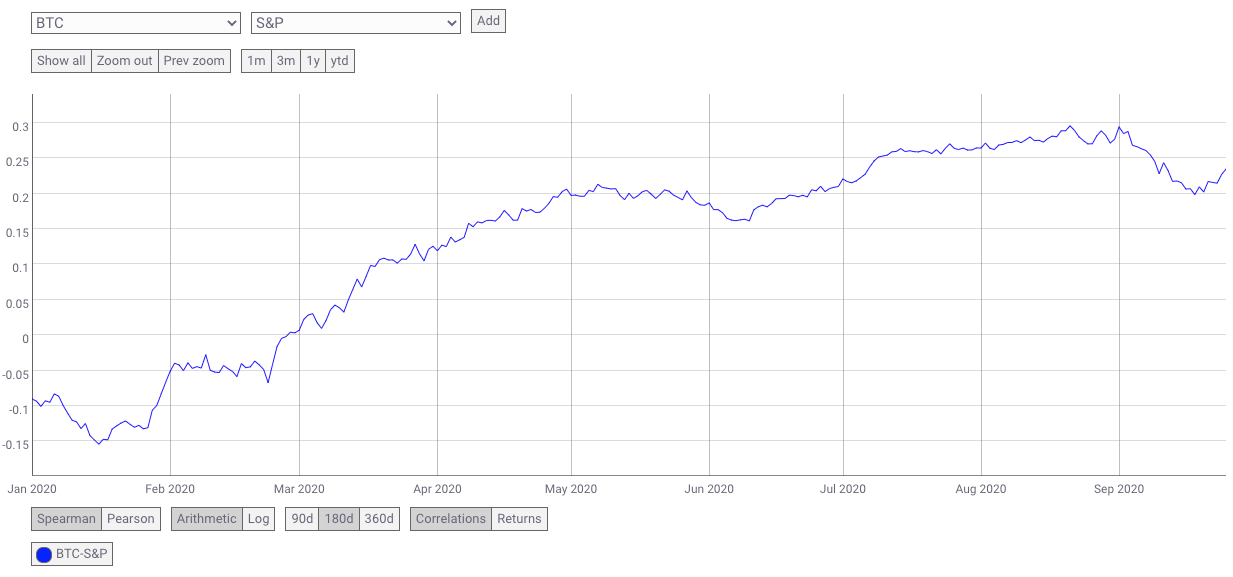

As for what we can expect to happen to cryptoasset prices this week, the U.S. stock market is likely to continue determining the price action due to the current moderate positive correlation that seems to exist. According to data from Coin Metrics, last Friday (September 25), this correlation reached 0.23477:

According to pre-market trading data from CNBC, as of 7:22 EDT (or 11:22 UTC), the futures on the Dow, the S&P 500, and the Nasdaq are all in positive territory, trading at 27385 (+1.26%), 3329.25 (+1.28%), and 11318.00 (+1.63%) respectively, with mega-cap tech stocks likely to lead the entire U.S. stock market higher.

Featured Image by “WorldSpectrum” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.