The number of bitcoin addresses moving BTC to cryptocurrency exchanges has doubled so far this year, as users are seemingly moving their funds off of the blockchain and into centralized platforms.

According to on-chain analytics firm Glassnode, there are currently around 100,00 unique bitcoin addresses sending BTC to cryptocurrency exchanges on a daily basis. The last time these levels were seen was at the peak of the 2017 bull market, which saw bitcoin’s price hit a new all-time high near $20,000.

After the bull run, bitcoin entered a year-long bear market that saw it hit $3,000 in December 2018. At the time the increasing number of addresses sending BTC to exchanges was associated with investors moving their funds to sell them while prices were high.

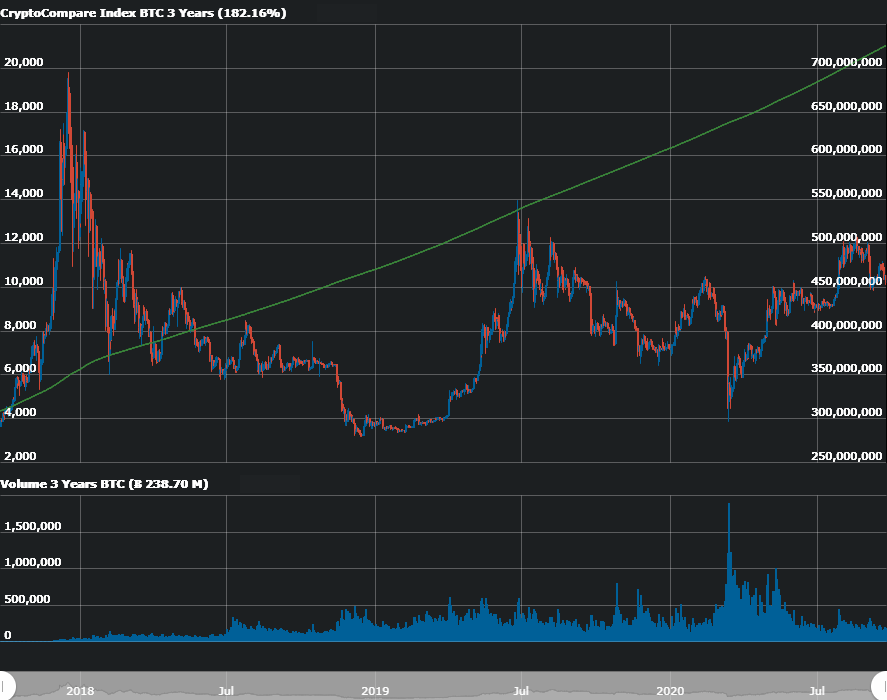

The total number of addresses sending bitcoin to exchanges compared to 2017 doesn’t paint the full picture. CryptoCompare data shows that at the peak of the 2017 bull market there were nearly 350 million unique bitcoin addresses, while now there are over 700 million unique addresses.

Glassnode’s CTO then shared which percentage of addresses are sending BTC to exchanges. The figure is still close to 2017 highs, after seeing an increase from 10% to 15% so far this year. While then there was a sell-off, this time things may be different, however.

Cryptocurrency exchanges have been adding numerous services allowing users to earn interest on their cryptocurrency holdings. From savings products to access to DeFi protocols to farm yield directly from the centralized exchanges’ platform, there are now numerous options.

This could mean BTC holders are simply moving their funds to exchanges to earn interest or gain exposure to the DeFi space.

Featured image via Unsplash.