On Wednesday (September 23), the rally in the U.S. dollar, which started on Monday, continued, leading to the U.S. dollar index (DXY) reaching a two-month high, and putting further downward pressure on both gold and Bitcoin.

The “U.S. Dollar Index” (DXY)—which is “designed, maintained, and published by ICE (Intercontinental Exchange, Inc.)”—is “an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies”. These other currencies are EUR, GBP, JPY, CAD, SEK, and CHF.

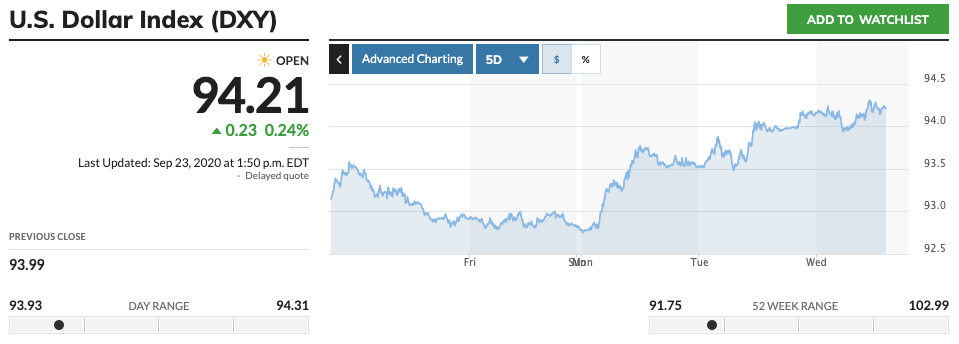

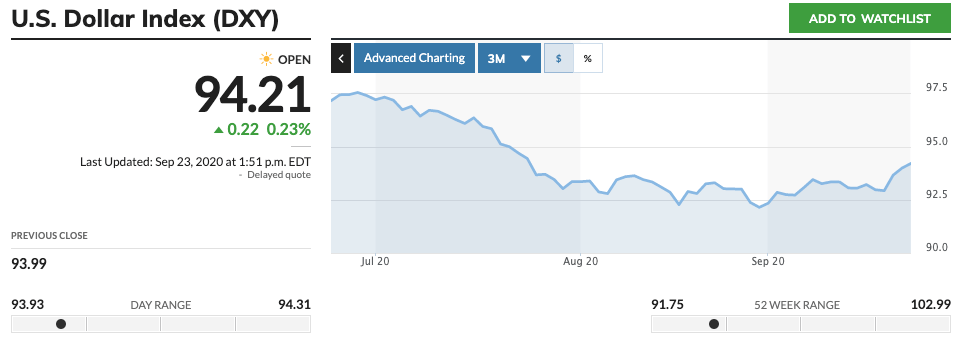

As you can see in the five-day and three-month DXY charts (by MarketWatch) shown below, DXY started its most recent rally, which started on September 21 (when DXY at one point was at 92.75), and this rally continued today, helping DXY to reach (as of 13:50 EDT on September 23) 94.21, its highest value since July 24:

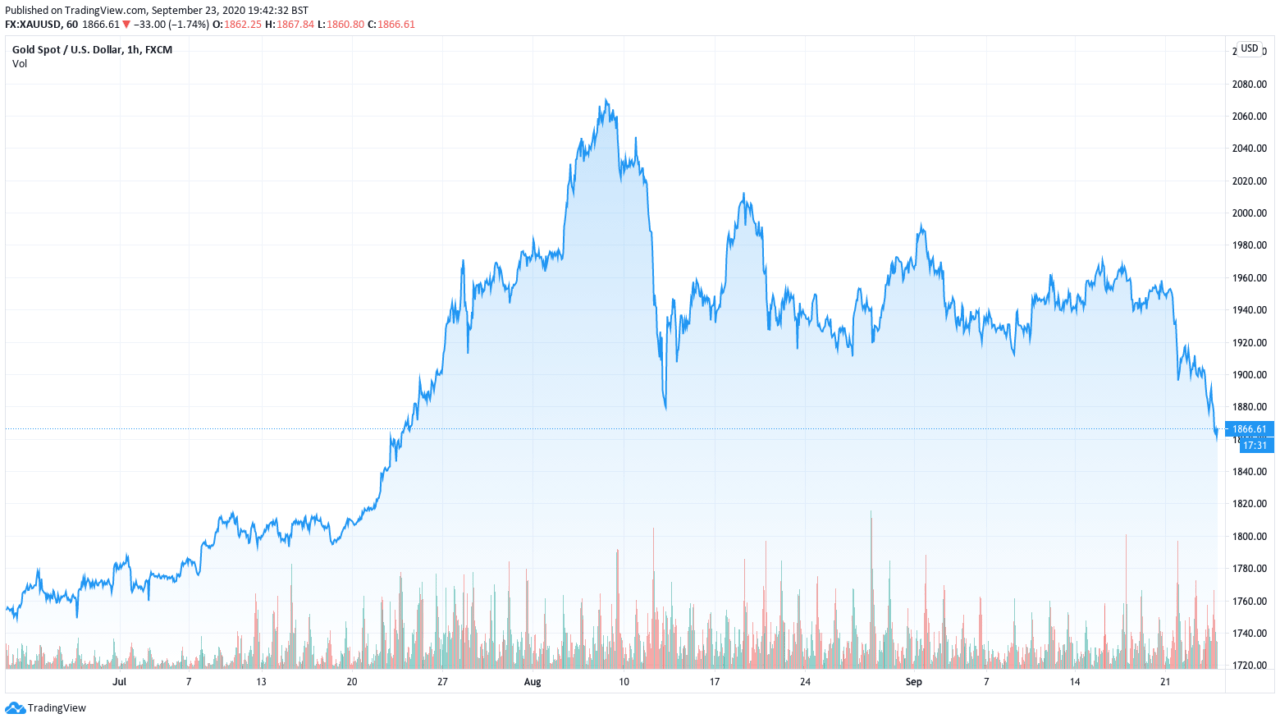

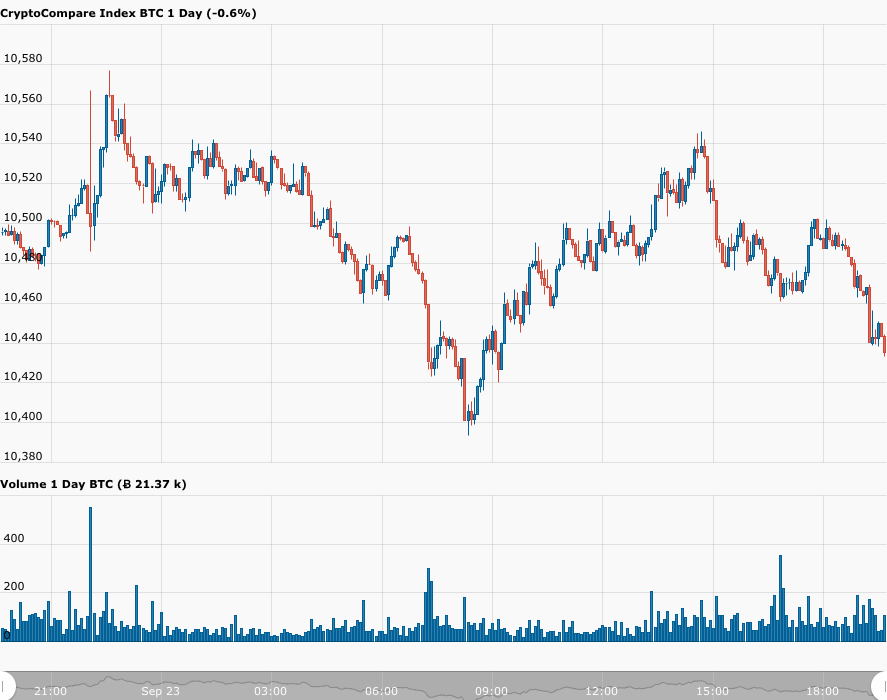

Although some analysts/traders see the DXY’s bullish move as a temporary relief from the weakness we have witnessed since March 20 (when it was at 102.82) due to the economic impact of the COVID-19 pandemic on the U.S. economy, a stronger dollar is generally seen as bearish for precious metals such as gold, which reached a two-month low today, and Bitcoin (aka “digital gold”), which has spent most of the day trading below the $10,500 level.

Other macro factors affecting the price of Bitcoin (and therefore most altcoins, which tend to catch a cold when Bitcoin sneezes) are (1) the ongoing uncertainty surrounding a second COVID-19 fiscal stimulus package and (2) growing concerns over the rapidly rising number of daily new COVID-19 cases in Europe and various other parts of the world.

These two macro events seem to have put traders/investors in a risk-off mood, which is also hurting equities. In particular, in the case of the U.S. market, today, tech stocks once again led the sell-off. As of 14:53 EDT, the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite are down 1.56%, 1.85%, and 2.49% respectively.

According to a report by CNBC, Adam Crisafulli, Founder/President of Vital Knowledge, said in a note:

Investors are being whipsawed by conflicting COVID headlines and the growth vs. cyclical debate. The result is sentiment souring on both growth and cyclical for the moment (which obviously means stocks are for sale broadly).

Although the short-term outlook for Bitcoin may appear grim (especially if the U.S. dollar index rally continues) till at least November’s U.S. presidential election (and possibly beyond depending on how the COVID-19 situation in the U.S. develops), most crypto analysts, investors, and traders seem to be remaining long-term bullish on Bitcoin.

Here are a few examples:

Featured Image by “WorldSpectrum” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.