On Thursday (September 24), the prevailing risk-off sentiment is continuing to punish risk assets, such as stocks and Bitcoin, as investors flock to the relative safety of the U.S. dollar.

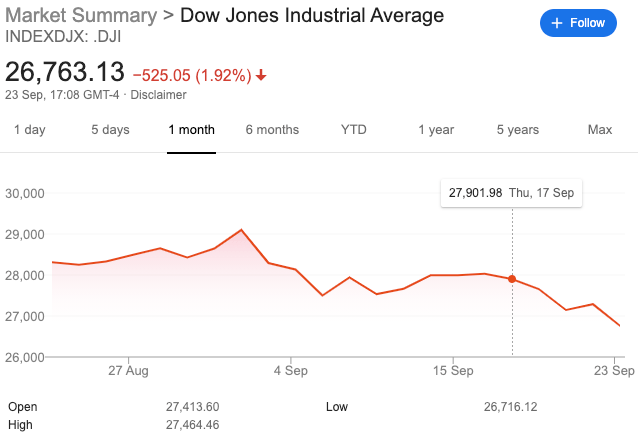

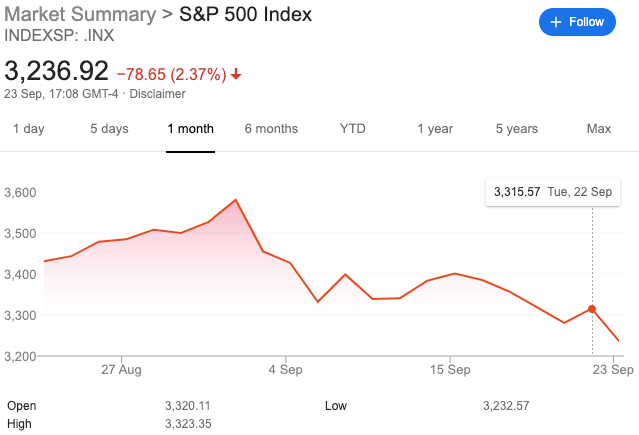

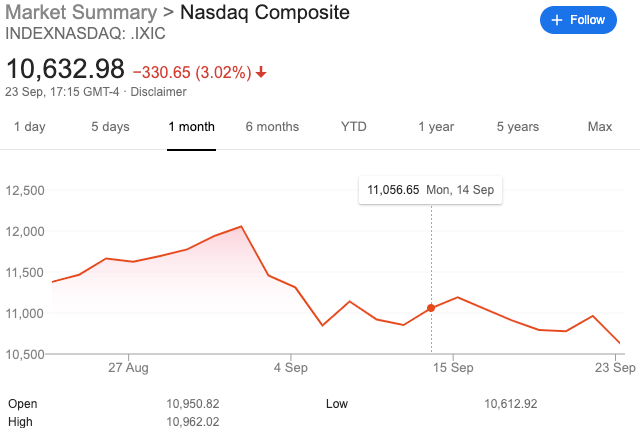

Since 2 September, U.S. stocks have experienced a significant correction. Here are the one-month charts for the three major U.S. stock indexes, i.e. the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite:

In the past three weeks, the Dow, the S&P 500, and the Nasdaq have fallen 8.30%, 9.60%, and 11.81% respectively.

And today looks like might be another down day, with the futures on the Dow, the S&P 500, and the Nasdaq all currently (as of 0817 EDT or 12:17 UTC on September 24) in negative territory, trading at 26634 (-0.19%), 3222.25 (-0.28%), and 10746.50 (-0.76%) respectively.

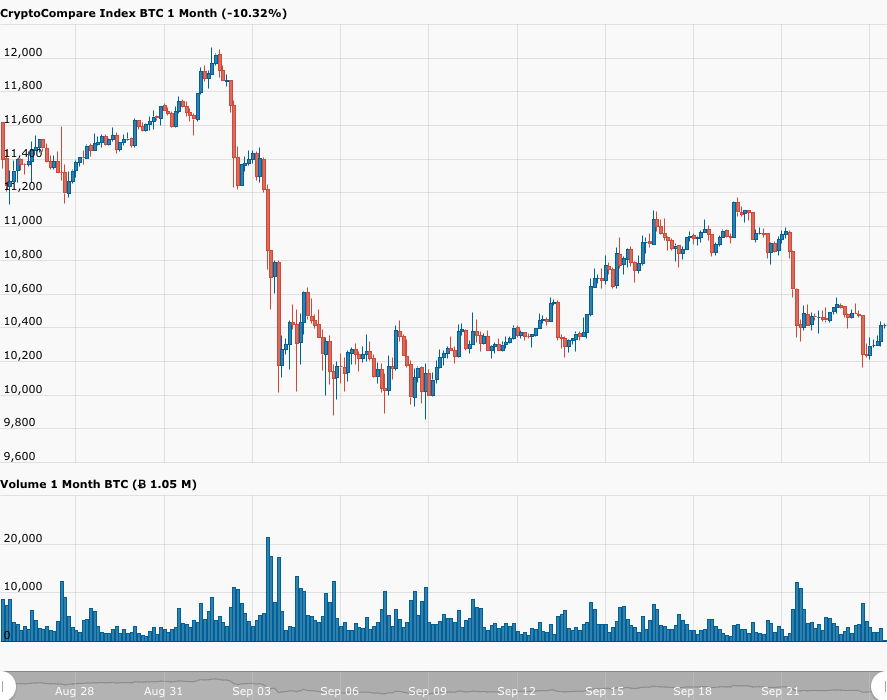

September has not been a good month for Bitcoin either. On September 1, at one point, Bitcoin was trading as high as $12,062. Currently (as of 12:30 UTC on September 24), Bitcoin is trading around $10,441 (down 1.00% in the past 24-hour period), which means that so far this month, Bitcoin’s price has dropped 13.44% vs USD.

Of course, since Bitcoin is the most valuable cryptoasset by market cap (as well as the most well-known cryptoasset), its price action generally determines what happens to other cryptoassets. Although when we consider all asset classes, Bitcoin is viewed as a risk-on asset, within the crypto space, it acts as a risk-off asset. For example, when the Bitcoin price goes up, the price of medium and small market cap cryptoassets tends to go up, usually by even larger percentages.

During times of stress/turmoil, investors tend to become more risk-averse, i.e. we end up with risk-off investor sentiment. So, what are the macro-economic factors that are behind the prevailing risk-off environment?

It seems that there are at least three such macro factors; these are listed below (in the order of decreasing importance).

First, the resurgence of COVID-19 around the world (especially in the UK and the European Union) is quite worrying since a second wave of lockdowns could negatively impact the economic recovery. Also, it seems highly unlikely that either of the two leading COVID-19 vaccines (i.e. from Johnson & Johnson and AstraZeneca) will be ready for the general public anytime this year.

Second, there are concerns that slowly improving U.S. economy may stumble and fall again if there is no further monetary or fiscal stimulus soon, and right now, the chances of Congress approving a new COVID-19 fiscal stimulus package before next January are not looking good, especially since the Democrats and Republicans seem to be much more concerned right now with the issue of when to find a replacement for Supreme Court Justice Ruth Bader Ginsburg (who died from cancer last Friday).

Third, w have the uncertainty of who will win November’s U.S. presidential election. Although Wall Street figures have already signalled that they would be OK with Joe Biden becoming the next U.S. president, at this time, no-one knows who the winner will be. What makes the uncertainty over the result of the election more significant than it would normally be is that President Trump has suggested several times, most recently yesterday, that he may not accept the result of the election since he is concerned about the amount of fraud that is likely to occur with mail-in ballots.

According to a report by CNBC, here is what President Trump said at a press conference at the White House yesterday when asked by a reporter if he would “commit to a peaceful transfer of power”:

Well, we’ll have to see what happens. You know that. I’ve been complaining very strongly about the ballots. And the ballots are a disaster.

Although the U.S. dollar’s long-term fundamentals are not great, in the short to medium term (say, within the next six months or so), it seems that the dollar will be one of the main beneficiaries of this downbeat mood since for now it appears to be the best safe haven asset despite the negative real yields on U.S. Treasurys.

Also helping the U.S. dollar are problems with resolving the mess that is Brexit, as well as the rapidly rising number of COVID-19 cases in the UK and the European Union. These have led to falls in both EUR-USD and GBP-USD. Currently, the U.S. dollar index (DXY) is at 94.50, which is a new two-month high.

Featured Image by “skeeze” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.