Dave Portnoy, the founder and president of Barstool Sports, says that his out of the crypto market for now because he has realized that “coins don’t always go up.”

Portnoy’s popularity has soared, especially among users of the Robinhood trading platform, over the past few months due to his success with day trading U.S. stocks and his daily vlogs that describe which stocks he has traded and how much profit he has made.

His journey with cryptocurrencies began on August 13, when he bought $200,000 of Bitcoin (BTC) and $50,000 Chainlink (LINK) with the help of the Winklevoss twins—the co-founders of crypto exchange Gemini—who had accepted Portnoy’s invitation and come to his house to explain Bitcoin to him and show him how to buy crypto:

Portnoy bought Bitcoin and Chainlink at a time when they are roughly trading around $11,500 and $18 respectively.

Initially, Portnoy was quite enthusiastic about finally joining the cryptocurrency community.

For example, on August 15, he tweeted about Chainlink:

Then, two days, he put some money into Orchid Protocol (OXT):

On August 17, after finding out that Warren Buffett’s Berkshire Hathaway had decided to invest in gold mining company Barrick Gold (NYSE: GOLD), he mocked Buffett for choosing gold over Bitcoin:

On August 18, when the Chainlink price had dropped to around $17.50, he remained confident that with the support of the LINK “marines” (i.e. LINK HODLers), Chainlink would soon go up again:

Then, yesterday (August 21), around 17:15 UTC (or 13:15 EDT), we found out that via the following two tweets that he has become disillusioned with the crypto market and that he has cashed out after losing around $25,000:

As you can see, Portnoy is especially disappointed with Chainlink and Orchid Protocol since their prices dropped around 23% and 17% after he bought them.

Naturally, members of the crypto community were also disappointed with Portnoy for having such “weak hands” and getting cryptocurrency in the first place without bothering to understand its philosophy, fundamentals, and risks.

Finally, late yesterday, Portnoy released a video that shows him complaining about the crypto community mocking him for getting out of the crypto market after just nine days, blaming the Chainlink and Orchid Protocol traders for his losses, and expressing frustration about the fact that cryptocurrencies—unlike stocks—do not always go up:

However, it seems that Portnoy has not completely given up on the idea of trading cryptocurrencies again at some point in the future since he says in this video that he has kept his Gemini trading account open.

It is understandable why Portnoy does not say bad about Bitcoin or Bitcoiners since according to him he bought Bitcoin on August 13 when it was trading around $11,500 and if he sold around the time of his first tweet on August 21 about cashing out, this means that he sold his BTC holdings when Bitcoin was trading around $11,650, which means that he actually made a small profit (roughly 1.3%) on his Bitcoin trade.

Once Bitcoin starts its next major rally, it would not be too surprising to see Portnoy go back to the Gemini exchange and buy Bitcoin again.

Blockstream Co-Founder and CEO Adam Back, who is a Bitcoin maximalist, had this to say to Portnoy:

Yeah you shouldn’t have bought the shitcoins! They are designed to separate people from their BTC (or their money generally). Bitcoin goes up and down, IMO you are better off to HODL as most of the gains are in a dozen days per year, so your worst risk is being out of the market.

Also day trading Bitcoin is risky, it’s better to hold for a few years at least, but if you want BTC day trading, leveraged BTC perpetual futures on one of the platforms supporting them are a way to really amp risk/reward towards casino, without getting into rigged alt territory.

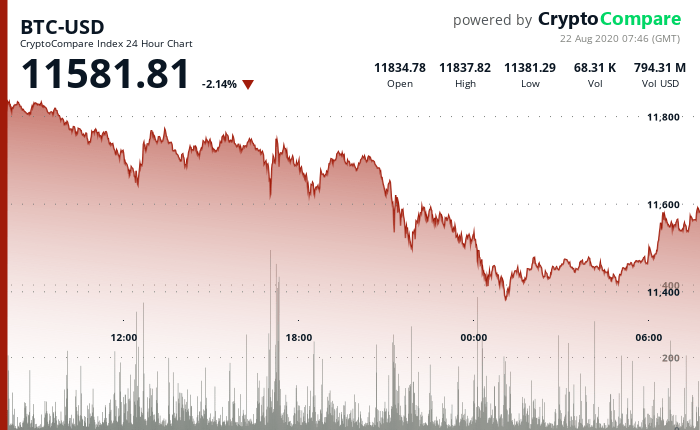

According to data from CryptoCompare, Bitcoin is currently (as of 07:46 UTC on August 22), trading around $11,581, down 2.14% in the past 24-hour period:

It is worth pointing out that although Portnoy may feel like an “expert” in the stock market, his profits from day trading U.S. stocks have come since March 23 (when the S&P 500 index fell to 2,237.40, its lowest point since December 2016), a period during which the U.S. stock market has enjoyed a huge rally (that has resulted in the S&P 500 reaching 3397.16, which is an all-time high) thanks partly to solid performance of tech stocks and partly to quantitative easing (QE) by the Federal Reserve (the central bank of the U.S.).

Featured Image by “Myriams-Fotos” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.