This article provides an update on the cryptoasset market, with a particular focus on the following digital assets: Bitcoin (BTC) and Ethereum (ETH).

To give you a rough idea of how well the crypto market is doing today, half of the top 20 cryptoassets (by market cap) are currently in the green (i.e. up against USD).

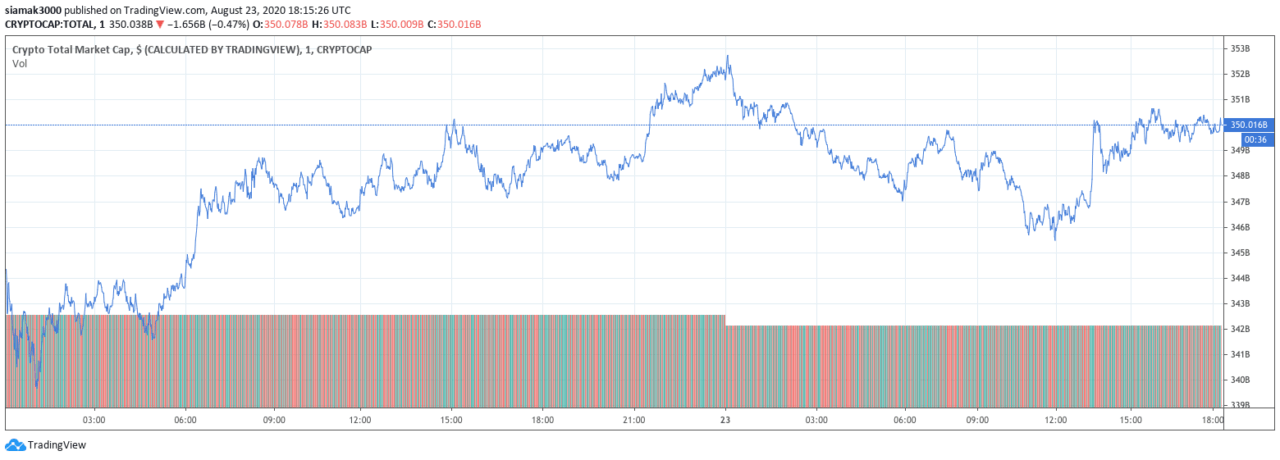

According to data from TradingView, during the past 24-hour period, the total crypto market cap has increased by $0.56 billion, and as of 18:10 UTC on August 23, it stands at $349.75 billion.

The Crypto Fear & Greed Index, which is based on an analysis of “emotions and sentiments from different sources”, is currently telling us that we are in “Extreme Greed” category:

All market data used in the remainder of this article was taken from CryptoCompare around 18:25 UTC on 23 August 2020.

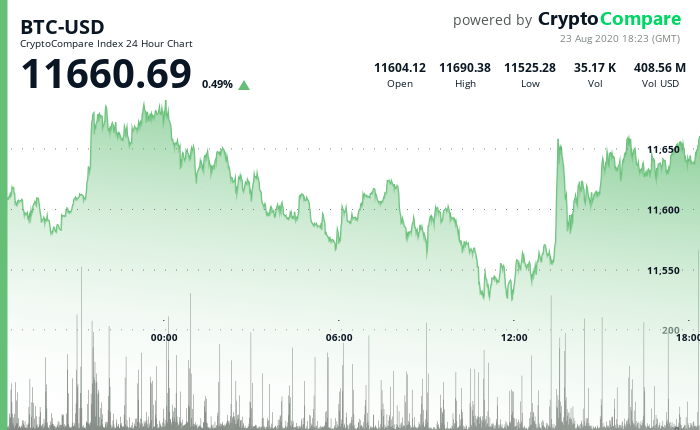

Bitcoin (BTC)

Bitcoin is trading around $11,660, up 0.49% in the past 24-hour period:

In the year-to-date period, Bitcoin is up 62.32% vs USD.

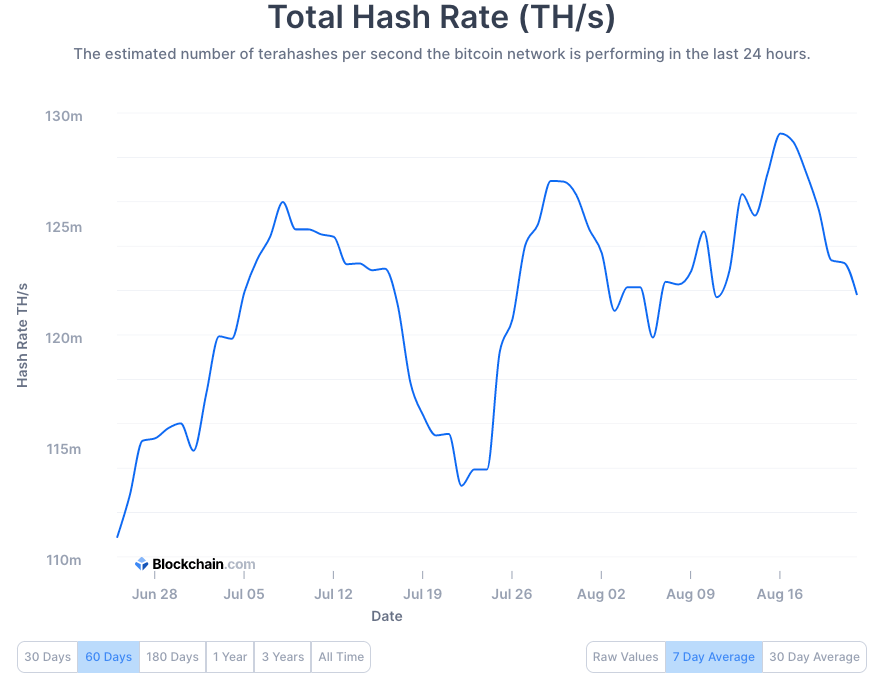

According to data from Blockchain.com, Bitcoin’s seven-day average hash rate reached 121.799 EH/sec on Saturday (August 22).

Popular crypto analyst/trader Josh Rager, who is also a Co-Founder of online crypto learning platform Blockroots, as well as an advisor to several blockchain startups, offered this bit of technical analysis of Bitcoin’s latest price action:

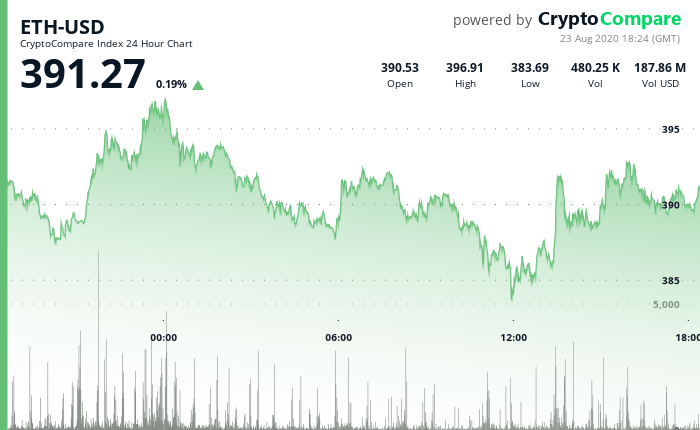

Ethereum (ETH)

Ethereum is trading around $391.27, up 0.19% in the past 24-hour period:

In the year-to-date period, Ethereum is up 203.52% vs USD.

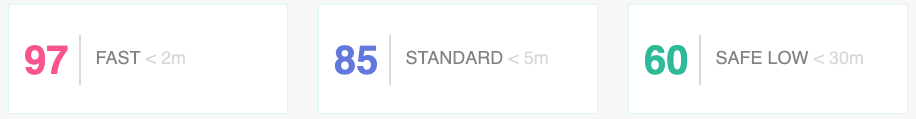

According to data ETH Gas Station, as of 19:00 UTC on August 23, here are the recommended gas prices:

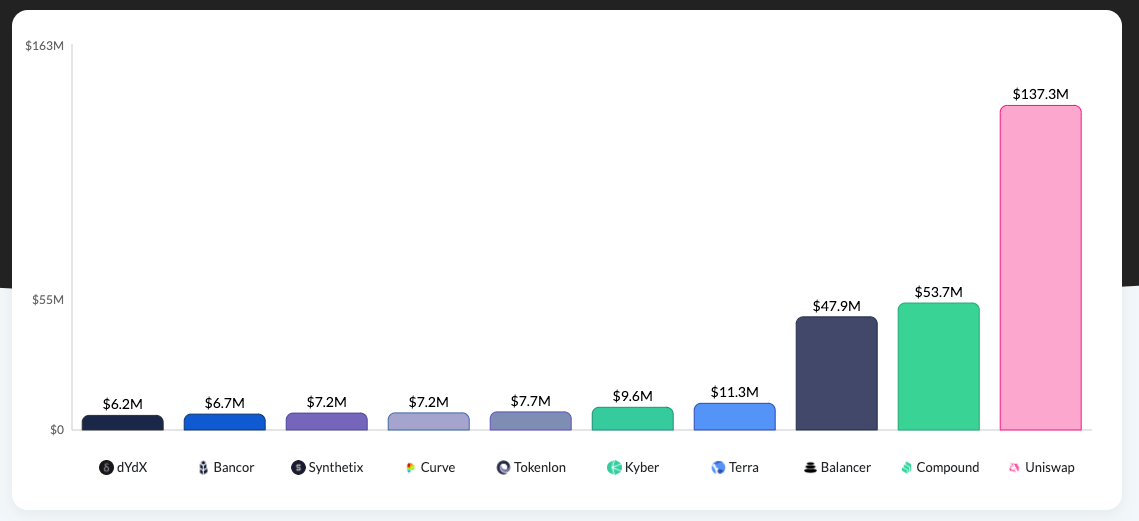

In the last 30 days, the top gas spender was Uniswap V2, with 17.7K ETH spent (or $6.99 million) and an average gas price of 125 Gwei.

According to data from Token Terminal, currently, here are the top decentralized finance (DeFi) projects by annual revenue:

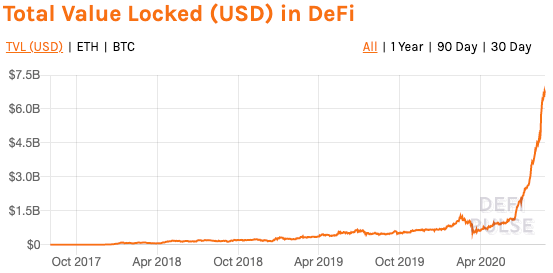

According to DeFi Pulse, at 00:00 UTC on August 23, total value locked in smart contracts on the Ethereum blockchain reached an all-time high of $6.771 billion:

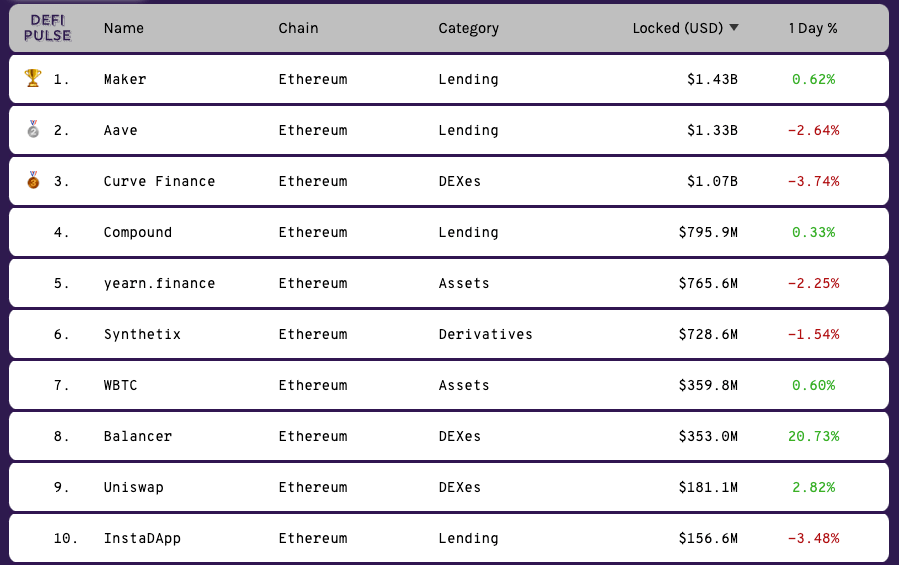

Currently, here are the top 10 DeFi projects by value locked (USD):

Featured Image by “WorldSpectrum” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.