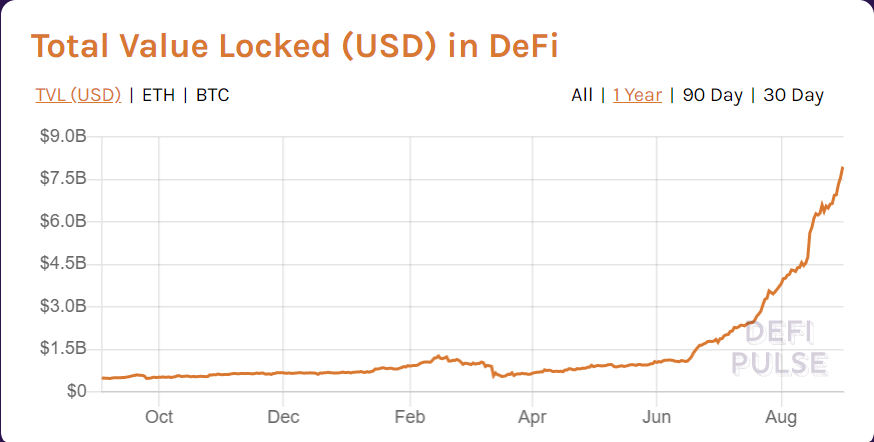

The total value locked (TLV) in the decentralized finance (DeFi) space has jumped by over 85% so far this month, from $4.2 billion to a $7.89 billion high on August 30, before moving back down to $7.79 billion at press time.

According to data from DeFiPulse, in just 27 days the total value of the cryptoassets locked in the space moved from $4.2 billion with several protocols now having over $1 billion locked in them. Available data shows DeFi lending protocol Aave is leading the space with $1.62 billion locked in it.

Behind it is Maker, the protocol used to create the cryptocurrency-backed stablecoin DAI, with $1.44 billion, with Curve Finance coming n third place with $1.12 billion. Decentralized exchange Uniswap follows Curve, with $948 million locked in it.

Another decentralized finance project bringing attention to the space is the Yearn Finance protocol, partly thanks to its native YFI token. Yearn Finance lets users leverage a variety of DeFi protocols to maximize their yield within the DeFi ecosystem.

Its YFI token has bee growing rapidly in value, so much so each token is now worth over $33,000. The token’s total supply is 30,000 and there are 29,963 YFI tokens in circulations. This means that while the token’s price has surpassed bitcoin’s all-time high near $20,000, YFI’s market cap is of little over $1 billion.

Data from Dune Analytics, first reported on by Bitcoin.com, shows decentralized exchanges have seen their trading volumes surge in the last 30 days to $10.42 billion, with the last seven days seeing decentralized applications swap a total of $2.8 billion.

Uniswap is the largest decentralized exchange in the space, capturing 60% of the global DEX trading volume. The number of users in the decentralized space has also moved up from 293,475 on August 1 to 388,011 on August 29.

DeFi users are measured per unique address interacting with each DeFi protocol. It’s worth noting one user may be using several addresses.

Featured image via Pixabay.