Bitcoin’s mining difficulty has hit a new all-time high of 17.3 trillion after a new increase that was likely sustained thanks to its price remaining above the $11,000 mark since the beginning of the month.

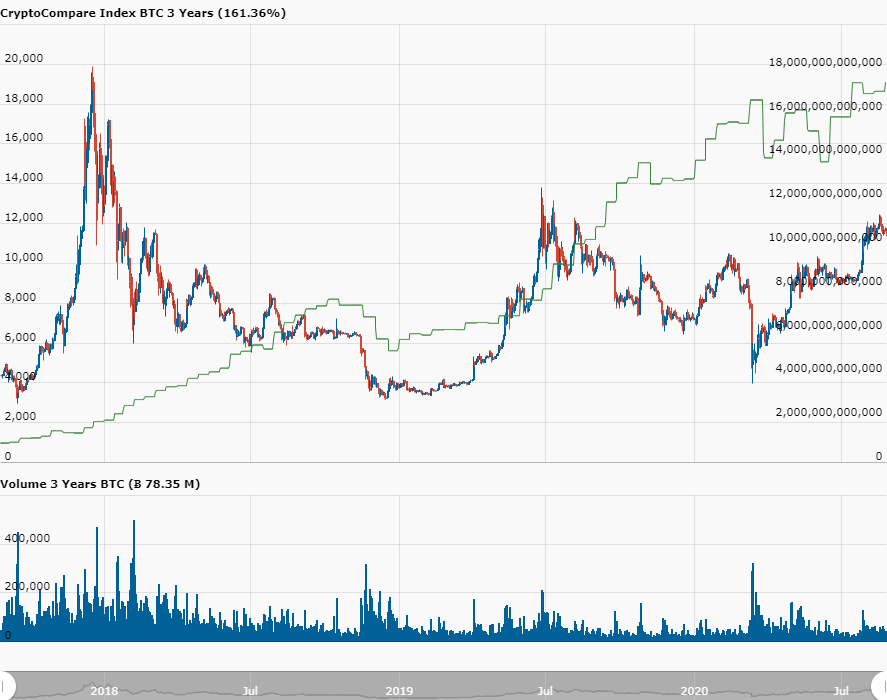

According to CryptoCompare data, BTC’s mining difficulty has been steadily moving up for the last three years, but faced short corrections whenever the price of the flagship cryptocurrency dropped. This year it plummeted in March, shortly after the price of BTC dropped to less than $3,000 after top U.S. stock market indices entered bear market territory, and in June after bitcoin failed to break into five-figure territory.

In late July, however, bitcoin’s price surpassed the $10,000 mark and moved up to face resistance at $12,000. IT has since remained above $11,000 and with the price increase miners are seemingly betting on BTC, as difficulty kept on increasing.

The mining difficulty on the Bitcoin network increases every two weeks, as it’s a mechanism created to ensure blocks are mined at a steady pace, with 10 minutes separating each block on average. When the hashrate on the network rises and blocks start getting mined fast, difficulty increases, but if the hashrate drops than the difficulty decreases.

Bitcoin’s hashrate has also been steadily increasing, and is now on par with levels seen before the crash that saw its price plummeted by about 50% over a two-day period. If the hashrate on the network keeps on rising, retail miners may however have problems competing with larger operations.

While the cryptocurrency’s price has remained above $11,000, it’s not at an all-time high, while mining difficulty is.

Featured image via Pixabay