Around 23:30 UTC on Monday (June 1), the price of Etheruem (ETH), the second-most valuable cryptoasset (by market cap), broke through the $250 level — on crypto exchange Coinbase — for the first time since February 24, as you can see in the six-month ETH-USD price chart for Coinbase:

According to data by CryptoCompare, Ethereum’s move above the $250 level took place at 23:30 UTC (or 19:30 EDT) on June 1, i.e. approximately 40 minutes after President Trump finished delivering his “law and order” speech from the White House’s Rose Garden.

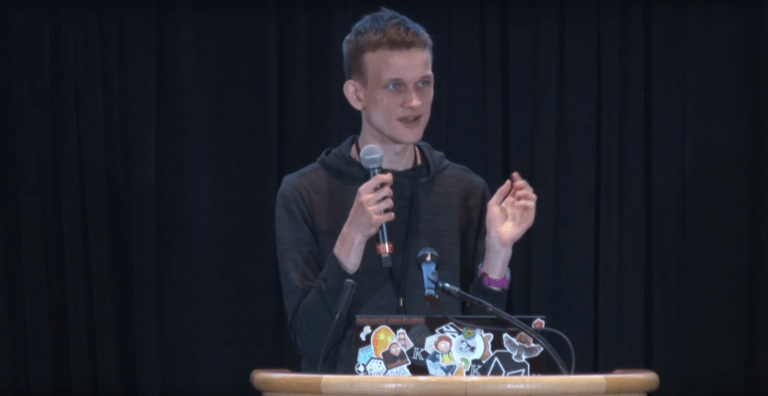

Yesterday, Vitalik Buterin, the Russian-Canadian programmer who is a co-creator of Ethereum, tweeted about how Ethereum’s “layer 2 scaling strategy” had “basically succeeded”:

While everyone wasn't looking, the initial deployment of ethereum's layer 2 scaling strategy has *basically* succeeded. What's left is refinement and deployment. A thread: https://t.co/30Dfr9XmFs

— vitalik.eth (@VitalikButerin) June 1, 2020

Buterin made several noteworthy comments about the present and the future of Ethereum layer 2 (L2) scaling:

- “First, the systems that are near-ready today are by and large limited to payments and DEX.”

- “But even still, token transfers / DEX are a large part of ethereum activity.”

- “The challenge is that users would need to have wallets where their coins are stored in a rollup (or plasma). This is an adoption challenge, not a technical challenge”

- “The operator can’t steal; that’s the point of L2s instead of sidechains. If it’s correctly designed, the operator also can’t disappear and permanently freeze the funds. But the L2s should be designed so that if the L2 disappears, you can withdraw funds *as fast as possible*”

- “So if the wallet detects that the operator is offline, it withdraws your coins and seamlessly switches to being an on-chain wallet. ZK rollups in particular can theoretically allow withdrawals even in the uncooperative-operator case within minutes; imo they should do this.”

- “And the various optimistic systems (incl plasmas) can achieve fast in/out movement with a liquid secondary market for withdrawals-in-progress. We need to start setting up this infrastructure!”

- “Also a suggestion: every L2 should do a drill where the team suddenly shuts down all centralized components that they are running. Verify that the ecosystem can seamlessly recover from such a situation.”

When asked to explain these comments in “digestible English”, Buterin replied:

Squish the transactions together so they don't take up too much space. Instead of everyone checking everything, have a few people check things and raise an alarm if they see something wrong. Or use fancy math to check everything at the same time.

Before: 15 TPS

After: 2500 TPS— vitalik.eth (@VitalikButerin) June 1, 2020

The Twitter thread referred to in the initial tweet by Buterin was by Philippe Castonguay, who does Ethereum research/development at Toronto-based gaming startup Horizon Blockchain Games.

What Castonguay tried to do yesterday was point out seven recent examples of Ethereum’s L2 strategy at work:

Incredible time for Ethereum's L2 scaling, all within ~1 month:

1. @StarkWareLtd L2 ZK chain for transfers (0.003$/tx) is now live

2. @loopringorg L2 ZK-rollup for transfers going live in June

3. @Tether_to just integrated with OMG network

4. @maticnetwork went live yesterday pic.twitter.com/GTfJ1yVlRs

— Philippe Castonguay {✘} (@PhABCD) June 1, 2020

5. @Dharma_HQ announces Tiramisu last Friday

6. @optimismPBC concluded their successful ORU testnet integration with @synthetix_io

7. @fuellabs_ awesome ORU based transfers for @reddit tokens

I am most likely forgetting many and if so, please add them in the comments below.

— Philippe Castonguay {✘} (@PhABCD) June 1, 2020

And earlier today, cryptoasset data provider CryptoCompare commented on how Ethereum has outperformed Bitcoin during the past one-month period:

All eyes are on #bitcoin as it recently surged above the $10,000 as protests in cities throughout the U.S. continue to intensify. Surprisingly $ETH outperformed $BTC over the last 30 days, as bullish sentiment grows.

Which one are you betting on? pic.twitter.com/zcl45guVGr

— CryptoCompare (@CryptoCompare) June 2, 2020

Last week, crypto-focused behavior analytics startup Santiment made the following interesting observations about Ethereum whale addresses:

1/ $ETH whale addresses have just hit a 10-month high with the cumulative holdings of the top 100 non-exchange wallets now owning over 21,800,000 #Ethereum (About $4.5 billion at current price).

This is the largest collective balance held within the top pic.twitter.com/AJgfgsYFE5

— Santiment (@santimentfeed) May 28, 2020

2/ 100 addresses since May, 2019.

In the last two days alone, these top $ETH whale addresses have added an additional 145,000 $ETH (about $30,300,000) as the price of #Ethereum grew by a bit over 4% in this timeframe. pic.twitter.com/XGERW53POB

— Santiment (@santimentfeed) May 28, 2020