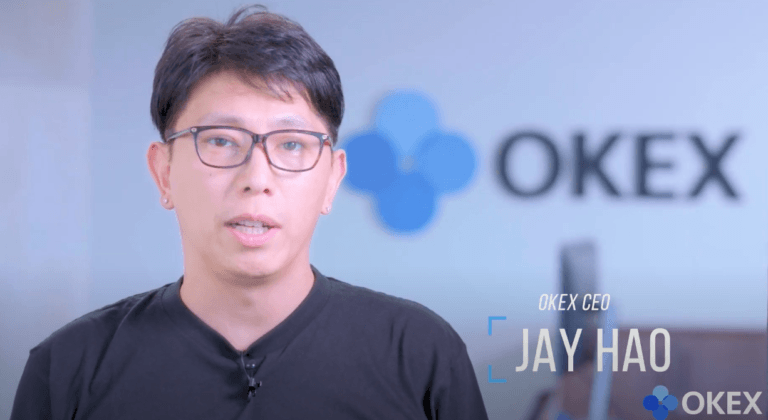

On Friday (June 5), OKEx CEO Jay Hao kindly agreed to take part in an Ask Me Anything (AMA) session on Twitter hosted by leading digital asset data provider CryptoCompare. This article provides a recap of the highlights of this AMA session.

In the May 2020 edition of CryptoCompare’s “Exchange Review” report, which was released on June 4, we found that in May, Binance and OKEx were the largest “Top Tier” exchanges by daily and monthly trading volumes.

Below, we highlight some of the most important questions that Jay answered.

Q: “Congratulations on yesterday’s launch of ETH/USD options! What can OKEx do to become the dominant player in the rapidly growing crypto options market? It looks like EOS/USD option are coming on June 18. Any plans for launching options for other cryptoassets, such as XRP?”

A: “Thank you Siamak! Our ultimate goal is to build a comprehensive product ecosystem where every trader can find what they need for trading crypto. So that’s what we do – #Buidl Exactly $EOS option will go live on 18th, we’re also looking at other big cap tokens. Name it”

Q: “Could you please tell us what lies ahead for OKChain and OKB, e.g. when do you expect to see the launch of the OKChain mainnet?”

A: “We released OKChain v.0.1.0 last week, introducing several new concepts such as OpenDEX & DEX Operator. We view this as an important step before the upcoming mainnet launch, as it will further clarify the rights and interests that node users will share in the OKChain ecosystem.”

Q: “Hi, thank you for doing this AMA. In your opinion, what is preventing cryptocurrencies from being adopted by the wider public? Did the 2017 rally give the space a bad image?”

A: “Cryptocurrencies are still not as user-friendly as they need to be. Despite ups &downs in 2017, the rally at least shifted more public attention to #crypto. We found out what our industry players need to do – optimize our products&persuade the public with the true value of crypto”

Q: “Do you think crypto markets in the 2020s will consolidate into a few top coins – BTC, ETH, LTC, etc. or will we still see 100+ coins trading with reasonable volumes?”

A: “As the crypto industry grows, I think the total trading volume will increase by 10x or even 100x. I feel that under this type of scenario, top coins will make up 90% of the total volumn, but there will always be the need for new coins and some may be able to join the big leagues”

Q: “Mr Hao, as CEO of Okex, how do you view the rise of Derivatives in the cryptocurrency market?”

A: “I think derivatives can offer tremendous value for miners to hedge their bitcoin exposure. We believe derivatives is still an infant -despite the skyrocketed growth since 2018 – should you compare with the size of traditional deriviatives market right now. That’s why @OKEx we keep optimizing our derivative products, futures, swaps, and options to stay ahead on the market.”

Q: “Hello Mr.Jay Hao Can you briefly say how the OKEx system is designed to be stable and reliable for Derivatives traders, even in volatile times?”

A: “The combination of OKEx’s existing insurance fund and risk management system, including the tiered maintenance margin ratio system, mark price, price limit, and other features give us the capability to avoid the damage brought by extreme markets in #crypto.”

Q: “How will you introduce Okex to a non crypto user? Why we choose Okex? Do you have plan to recruit Community Ambassador? if it exists, how do you join?”

A: “We usually self-promote via our friendly, one-stop crypto ecosystem. New users can start off browsing content in our OKEx Academy, try out our Buy Crypto feature to get a taste of what OKEx is like. From a glossary to insights, there is a lot of useful info in our online library.”

Q: “Hi Jay, How dominant is high frequency trading in the crypto space or in OKEx? Is the market retail or institutional driven? Thank you :)”

A: “~70% volume on okex volume is contributed by institutionals – depends on the volatility of the market of coz : ) As we countinue to improve our latency and stabilty of our trading architecture, we believe the contribution on volume by HFT shall increase. Overall I think our market profile is healthy and having a good mix between retails vs. institutionals”

Featured Image Courtesy of OKEx