Bitcoin-only crypto brokerage River Financial Inc., which is based in San Francisco, has raised $5.7 million in a seed funding round led by Polychain Capital after seeing rapid growth in its number of clients this year thanks to a large part by baby boomer investors.

River Financial, which was founded in October 2019 by Alexander Leishman (Chief Executive Officer) and Andrew Benson (Chief Operating Officer), launched its Bitcoin investment service (for both private clients and institutions) on 16 December 2019.

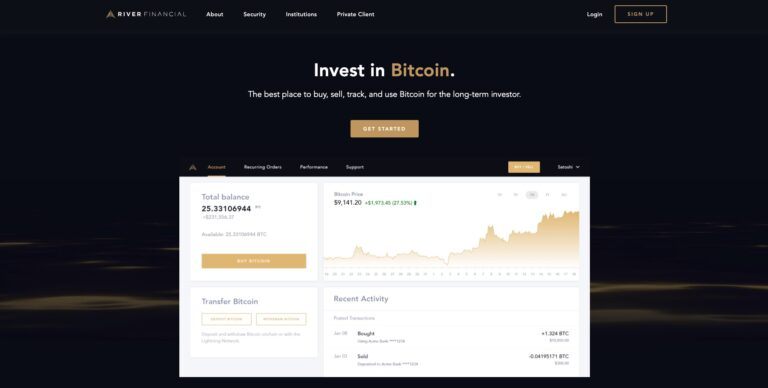

Leishman said back then that they had “built a platform exclusively for Bitcoin investors.”

This is the reason he gave for his startup not supporting investing in any cryptoassets other than Bitcoin:

“For economic and technical reasons, we believe that Bitcoin is the only cryptocurrency on a trajectory to become a global currency.”

Leishman also explained in his December 2019 blog post that his company’s platform was “not built for traders” and instead was aimed at long-term investors.

One interesting feature of River Financial’s platform was support for withdrawal/deposit of Bitcoin via the Lightning Network.

Yesterday (June 17), the River Financial CEO announced via another blog post that his company had completed a $5.7 million seed fundraising round led by Polychain Capital, with participation also by Slow Ventures, Castle Island Ventures, DG Lab Fund, Cygni Capital, Pfeffer Capital Ltd, IDEO CoLab Ventures, and various angel investors, one of which was Steve Lee, Product Manager at Jack Dorsey’s Square Crypto.

According to Leishman, River Financial operates in 19 U.S. states, has 13 full-time employees, and thousands of happy clients.

He also says that their volume “has grown an average of 80% month over month” since their launch in December 2019.

Bloomberg reported yesterday that the rapid growth in River Financial’s client base had been “fueled” by what the company calls “Bitcoin Boomers” (i.e. “new cryptocurrency investors over the age of 55”).

Bloomberg’s report went on to say that the River Financial CEO said in a statement:

“The surging activity we’ve seen since the beginning of 2020 has been in part inspired by the Federal Reserve’s unprecedented monetary intervention.”

This report also mentioned that according to River Financial, since March, “Bitcoin Boomers have accounted for 77% of River Financial’s volume growth.”

River Financial’s Private Client service is aimed at multi-generational families, ultra high-net-worth individuals (UHNWI), and family offices. The benefits of this white-glove service include having a designated private client advisor as well as instant liquidity (“no need to wait for funds to settle, buy up to $10,000,000 of Bitcoin immediately”).

Yesterday, one of River Financial’s clients, serial entrepreneur Avichal Garg, who is a co-founder of crypto-focused early stage venture firm Electric Capital, posted this tweet to say how impressed he was with River Financial’s super cute and friendly “new customer on boarding”:

I am a billionaire in Zimbabwe!@RiverFinancial’s new customer on boarding is 💯 pic.twitter.com/EgrpTq9Oa7

— Avichal Garg (Electric Capital) ⚡ (@avichal) June 17, 2020

Featured Image Courtesy of River Financial Inc.