Recently, Dr. Martin Weiss, the founder of Weiss Ratings, the only financial rating agency that grades cryptoassets, spoke about the implications of Bitcoin’s next halving, which is expected in less than two weeks, for Bitcoin and a few other cryptoassets.

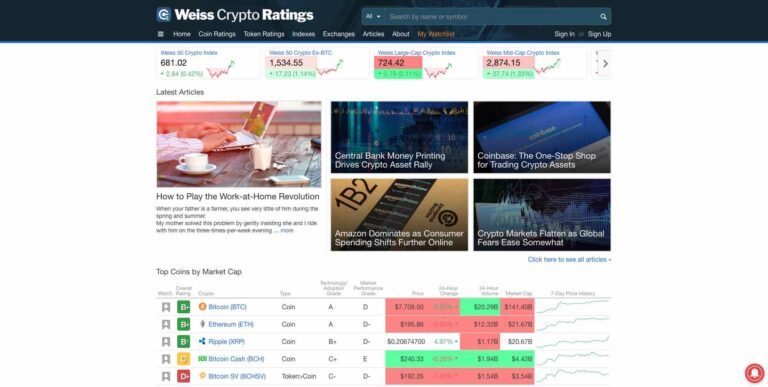

Weiss Ratings, which was founded in 1971 by Dr. Weiss, such as Bitcoin and Ether, which are currently both rated B+, started covering cryptoassets (tokens and coins) on 24 January 2018, when it launched a new website called Weiss Cryptocurrency Ratings.

The idea was to provide a weekly paid report that gave an overall rating for each cryptocurrency (initially only 74 were covered), as well as two component grades: an “Invest Risk/Reward” grade and a “Technology/Adoption” grade. Grades range from A+ (best) to F (worst).

Recently, Dr. Weiss spoke with Gavin Magor, who is the Ratings Director at Weiss Ratings, about Bitcoin’s next block reward halving event, which is expected to take place around May 12, and what it means for the crypto space.

Here is what block reward halving means for Bitcoin’s inflation rate:

- every ten minutes, a new Bitcoin block is mined;

- at every block reward halving, the reward for mining new blocks is halved, i.e. 50% fewer bitcoins are generated by the network;

- block reward halvings are scheduled to occur every 210,000 blocks, i.e. approximately every four years, until Bitcoin’s hard cap (or maximum supply) of 21 million bitcoins has been reached.

Bitcoin’s last block reward halving occurred on 16 July 2016; this was when the block reward was reduced from 25 BTC to 12.5 BTC.

During this interview, Dr. Weiss made two very interesting observations:

- Both previous Bitcoin halving events “unleashed an historic bull market in cryptocurrencies, creating massive wealth for investors”. For example, he says that if you had invested $10,000 into Bitcoin on the date of Bitcoin’s last (i.e. second) halving event, you could have turned that $10,000 into more than $300,000. Furthermore, he says that if you had at the same time invested into certain other cryptoassets, such as Litecoin or Ether, your profits could have been even greater (e.g in the case of ETH, he says “you could have multiplied your money 124 times”).

- How much money you make from these Bitcoin halving events depends on buying the right cryptoassets at the right time and selling them at the right time.

He goes on to say that his company’s Crypto Ratings Model helps investors choose what to buy/sell and that their newly released Crypto Timing Model tell them when to buy/sell.

Both of these models were created by Juan M. Villaverde, an econometrician and mathematician focused on the analysis of cryptocurrencies since 2012.

Dr. Weiss says that historical data tell us that if you had bought $1000 worth of Bitcoin in 2010 and held it till now, your BTC holdings would be wroth around $100 million — which is pretty amazing — but had Villaverde’s Crypto Timing Model been available back then, it could have helped you turn that $1000 into $1.5 billion.

He says that these are the three steps you should to take to maximize your profits when using his firm’s Crypto Ratings Model and Crypto Timings Model:

- Avoiding low-rated cryptoassets.

- Investing only in the highest rated cryptoassets (such as Bitcoin and Ether, which both currently have an overall rating of B+).

- Buy the “best” when Villaverde gives you the “buy” signal and selling when he gives you the “sell” signal.

A video and transcript of the full interview are available on the Weiss Crypto Ratings website.

Featured Image Courtesy of Weiss Ratings, LLC