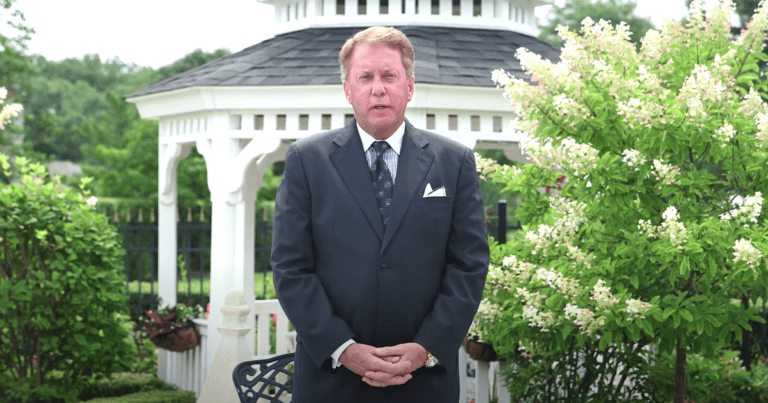

On Wednesday (April 22), Terry Duffy, the Chairman and CEO of CME Group, “the world’s leading and most diverse derivatives marketplace”, commented on Monday’s wild price action in the U.S. crude oil futures market.

Duffy was appearing on CNBC show “Closing Bell” to talk about the day that saw the May 2020 futures contract for the U.S. crude oil benchmark West Texas International (WTI) Crude drop below (going as low as -$38.08 at one point) for the first time ever.

Duffy said during the interview:

“We worked with the government regulators two weeks prior to making our announcement that we were going to allow negative price trading. So this was no secret that this was coming at us.

“We have to do things to allow the market to go to a price that is reflecting the fundamentals of the product. The futures market worked to perfection.”

According to CNBC, this extreme price volatility resulted in U.S. oil ETF “United States Oil Fund” (USO) to “alter the structure of the futures contracts it buys and announce a reverse stock split.”

The CME Group CEO says that this ETF was not holding any May 2020 futures contracts when the price fell into negative territory and that the last few days before the expiration date are for professional investors only; he also pointed out that other commodity futures (e.g. natural gas) have traded in the past below zero.

He then added that the CME Group “futures contracts have always been allowed to trade negative and expose investors to unlimited losses”; furthermore, he says that his firm does not target retail investors:

“The small retail investors are somebody that we do not target. We go for professional participants in our marketplace. But at the same time, they need to make sure they understand the rules and it’s up to their futures commodity merchants to make sure every participant knows those rules.”

According to data from MarketWatch, at press time (10:22 UTC on April 23), the June 2020 contract for WTI Crude is trading at $15.53, up $1.75 (or +12.70%):

On Wednesday (April 22), crypto derivatives exchange FTX, which launched in May 2019, started offering crude oil futures due to “a lot of demand” from its users according to Founder and CEO Sam Bankman-Fried, who told news outlet The Block yesterday:

“The demand was all over the place. It was the most requested product from most of our users.”

This is what FTX says about its latest product:

“OIL contracts are futures that expire to the spot price of WTI oil. In particular, a contract expiring on day X will expire to the published Cushing, OK WTI Spot Price FOB here for day X, plus 100.

“We add $100 to each contract in case the spot price goes negative. Note, however, that if the spot price of oil goes below -$100, FTX OIL contracts can theoretically expire negative.”

As for who is eligible to trade FTX’s OIL contracts, the exchange says:

“You must be at least KYC level 1 to trade OIL contracts, and you must not be a resident (based on KYC or IP address) of the United States, Canada, the European Union, the United Kingdom, Singapore, the UAE, Cambodia, Turkey, or mainland China and Hong Kong SAR.”

Margin and fees work the same as other FTX futures.

Currently (at 10:50 UTC on April 23), Crude Oil 2020-04-27 Futures are up 0.7%:

WTI Crude Price Chart Courtesy of MarketWatch.com.