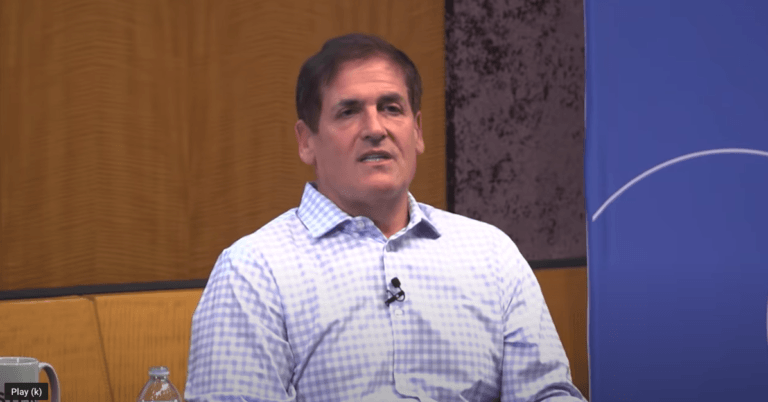

In a recent interview, American billionaire entrepreneur and investor Mark Cuban commented on the future of Bitcoin as a means of payment and a store of value.

He is the majority owner of the professional basketball team Dallas Mavericks, as well as one of the “sharks” on the highly popular reality show “Shark Tank” (which is aired on the ABC television network).

This interview was with Anthony Pompliano (aka “Pomp”), and it was released yesterday as episode #268 of “The Pomp Podcast”.

On Stocks

“Three years from now, five years from now, the market will be up from where we are today. It will be up who knows how much, but it will be better. But I still think we have a leg down. So I’ve gone to cash.

“Even if I’m wrong in the public markets, I think there are going to be companies that need capital in America 2.0, that are going to be some amazing companies, that are going to be created.

“Having access to cash or having cash is going to give me the opportunity to invest in them…”

On Commodities

“I think commodities will go up because we’ll get at least some modicum of inflation.

“As companies try to protect their own manufacturing and try to bring core necessities domestically, I think that could push up the value of commodities.

“I couldn’t tell you which ones to invest in, but just generically on a macro basis.”

On Bitcoin

“It’d have to be so easy to use, it’s a no-brainer. It’d have to be completely friction-free and understandable by everybody first. Then you can say it’s an alternative to gold as a store of value…

“In terms of being a way to transact, whether it’s just transfer of funds or whatever, you’ve got to be able to spend it.

“Right now, you still have to convert it for anything you want, and as long as you have to convert it you’re still dependent on fiat…

“There’s so many peculiarities to Bitcoin: the halving, the mining.

“The fact that blockchain is a great opportunity, but in reality we haven’t seen blockchain applications take off, and there’s uncertainty with all the different types of cryptos and the arguments with all the different types of cryptos.

“These are things that create more and more confusion and diminish the confidence.

“I get all the arguments, I’ve seen all the charts. I understand the potential problems with fiat.

“But to Bitcoin’s potential benefit – if everything goes into the shitter because we’re printing so much money and there’s global implications, Bitcoin has got something to deal with and something to say. And if we don’t, Bitcoin ain’t got nothing.”