On Tuesday (April 21), Bank of America Corporation (aka “BofA”) released a report titled “The Fed Can’t Print Gold” in which it explained why it was setting its 18-month price target for gold to $3000 per ounce.

Bloomberg’s Elena Mazneva reported earlier today that BofA had raised its price target for gold from $2,000, which was its previous price target.

BofA’s research report was written by Metal Strategist Michael Widmer, who is head of research in metal markets, and Francisco Blanch, who is the global head of commodities research.

The two analysts/strategists expect the demand for gold to go up as governments around the world use monetary and fiscal tools to combat the economic damage caused by the COVID-19 pandemic:

“As economic output contracts sharply, fiscal outlays surge, and central bank balance sheets double, fiat currencies could come under pressure… Investors will aim for gold.”

BofA believes the spot price of gold to average “$1,695 an ounce this year and $2,063 in 2021”.

According to data by TradingView, currently (around 16:05 UTC on April 21) spot gold is trading at $16775.01, down $19.70 (or 1.16%):

Furthermore, the BofA thinks that “a strong dollar, reduced financial market volatility, and lower jewelry demand in India and China could remain headwinds for gold”:

“But beyond traditional gold supply and demand fundamentals, financial repression is back on an extraordinary scale.”

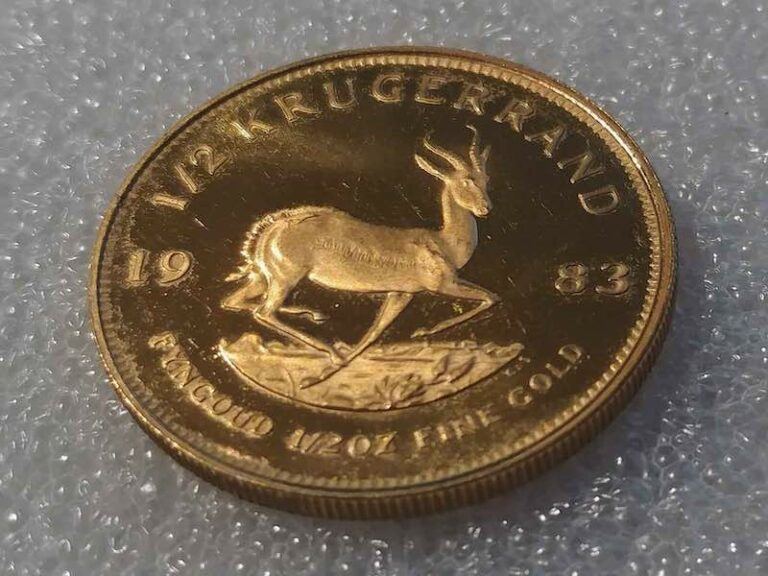

Gold Price Chart Courtesy of TradingView