In an interview on Tuesday (April 14), Frank Holmes, the CEO of asset management firm U.S. Global Investors, said that the money printing being done to “get the global economy back and functioning” could push the gold price up to as high as $10,000.

U.S. Global Investors, Inc., which is headquartered in San Antonio, Texas describes itself as “an innovative investment manager with vast experience in global markets and specialized sectors.”

Holmes told Kitco News:

“We still have negative real interest rates and that bodes extremely well for gold, so I think gold can be easily $2,700 like palladium was last year. It can be $5,000. I don’t know when the money printing stops, but it could be $10,000 to get the global economy back and functioning.”

He then added:

“What I do see is that the U.S. will spend over $10 trillion… the Senate, and Trump and Congress will spend $5 trillion when this is finished. We’ve seen the Federal Reserve also commit $5 trillion of expanding their balance sheet, so this is going to be unprecedented.”

Holmes also talked about how gold performed in the aftermath of the Financial Crisis of 2007–2008:

“This is going to create unprecedented growth in paper money, and what you’re going to see is like 2008 and 2009, gold ran up, sold off, got a base and all of a sudden it started to march up, as this money printing took place.”

Finally, Holmes said that the disruption in the global supply chain caused by COVID-19 could affect the gold industry:

“I think there’s huge supply disruptions around the world and I think that demand for gold is going to pick up much faster than the supply of gold is going to be coming out.”

In a press release sent out earlier today, the United States Mint said that it had “temporarily suspended production” at its West Point facility “due to the increasing number of COVID-19 cases in Orange County, New York” and “out of an abundance of caution.”

U.S. Mint Director David J. Ryder had this to say:

“My commitment to the health and safety of the Mint workforce is unwavering and continues to be my highest priority.

“These are challenging and unprecedented times, and decisions on Mint operations are made with the best interests of Mint employees first and foremost.”

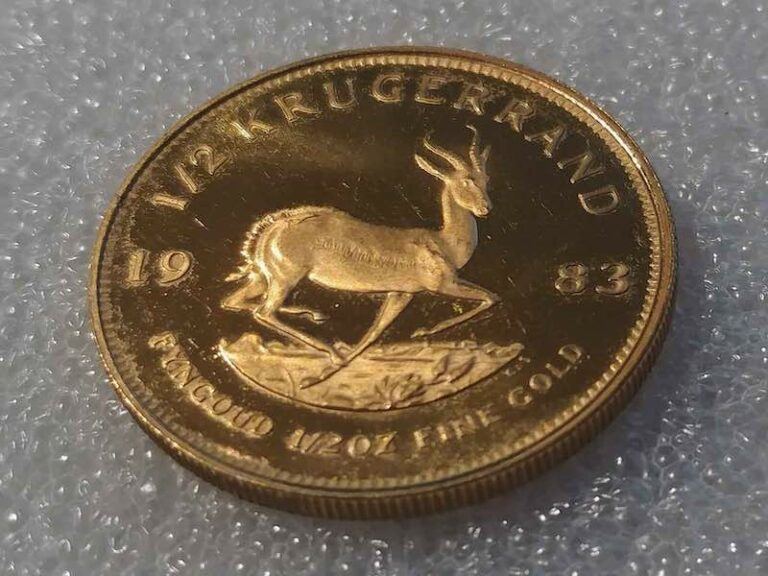

The Mint facility at West Point “produces investment-grade gold, silver, platinum and palladium bullion coins.”

The U.S. Mint’s statement did not say when this facility would re-open again:

“The Mint will resume production once it is deemed prudent to do so.”

Gold is currently trading at $1,714.90, close to its 7.5 year high:

Gold Price Chart Courtesy of TradingView