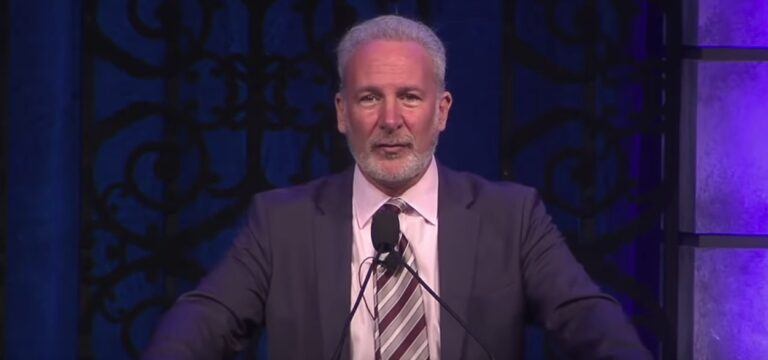

On Tuesday (March 24), famous gold bug and Bitcoin skeptic Peter Schiff talked about how gold and Bitcoin have performed as assets in 2020.

Schiff is the CEO of Euro Pacific Capital, a full-service, registered broker/dealer specializing in foreign markets and securities, and founder and Chairman of SchiffGold, a full-service, discount precious metals dealer. He is also a man who is extremely bullish on gold, bearish on the U.S. dollar, and highly skeptical about Bitcoin.

Schiff started out by pointing out how well gold had performed in the aftermath of the financial crisis of 2007–2008 and the fact that it seems to be doing even in 2020 in the midst of the COVID-19 crisis:

During the 2008 financial crisis, #gold fell about 25% and took 7 months to make a new high. This time gold only fell about 15%, and may make a new high in under a month. This shows how much greater this financial crisis is, and how much more reckless current Fed policy is.

— Peter Schiff (@PeterSchiff) March 24, 2020

According to data from GoldPrice.org, on January 1, gold was trading at $1519.50 per ounce, and when Schiff sent out that tweet, it was trading around $1571.05 per ounce, i.e. during this period, it went up 3.39%.

Schiff believes that gold could make “a new high in under a month.” The gold price reached an all-time high of $1859.20 on 23 August 2011. For gold to set a new all-time high in under a month, it will have to go up at least 16.19% from where is at the moment (i.e. $1600.76), which definitely is possible.

Next, Schiff compared the performance of gold and bitcoin (against the U.S dollar) in 2020:

Only fools are choosing Bitcoin. So far this year gold is up over 7%, while Bitcoin is down 3%. #Gold is only 2% from its 2020 high, while #Bitcoin is 35% below its 2020 high!

— Peter Schiff (@PeterSchiff) March 24, 2020

At the time that Schiff sent out this tweet, gold was trading around $1594.12 per ounce, i.e. up 4.91% for the year-to-date (YTD) period. During the same period, according to data from CryptoCompare, the Bitcoin price has gone from $7189 to $6763, i.e. a loss of 5.92%.

Is Bitcoin 35% “below its 2020 high” as Schiff claims? Well, Bitcoin’s 2020 high came on February 14, when it reached $10360; since then, it has dropped 34.72%, which is 35% when rounded up.

Gold has definitely outperformed Bitcoin so far in 2020.

However, if we look at a longer timeframe, Bitcoin has vastly outperformed gold, which is a fact that Schiff usually likes to ignore. For example, in the past three-year period, Bitcoin has gone up 598.33%, whereas gold has increased only 28.12% in value.