In this case, we look at how JPMorgan Chase’s stance on cryptocurrency has softened in the past couple of years.

JPMorgan Chase & Co. (aka “JP Morgan”) is the largest bank in the U.S., the sixth largest bank in the world by total assets of around US$2.687 trillion, and the world’s most valuable bank by market capitalization.

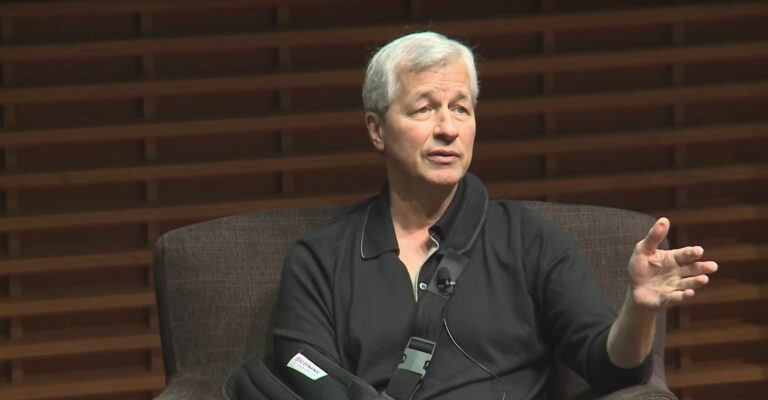

Jamie Dimon, JP Morgan’s Chairman and CEO, has long been a fan of blockchain technology but not cryptocurrencies. In fact, he called Bitcoin a “fraud” as early as September 2017.

According to a report by Bloomberg, on 13 September 2017, after calling Bitcoin “a fraud”, Dimon went on to say that Bitcoin was “worse than tulip bulbs.” And if a JPMorgan trader began trading in Bitcoin, the J.P. Morgan CEO said that he would “fire them in a second.”

He went on to say that:

If you were in Venezuela or Ecuador or North Korea or a bunch of parts like that, or if you were a drug dealer, a murderer, stuff like that, you are better off doing it in bitcoin than U.S. dollars. So there may be a market for that, but it’d be a limited market.

On January 2018, in an interview with FOX Business’s Maria Bartiromo, Dimon said that he regretted his previous comments about Bitcoin, and expressed his faith in blockchain technology: “The blockchain is real. You can have crypto yen and dollars and stuff like that. ICO’s you have to look at individually. The bitcoin to me was always what the governments are gonna feel about bitcoin as it gets really big, and I just have a different opinion than other people. I’m not interested that much in the subject at all.”

In an interview with the Harvard Business Review (July–August 2018 Issue), here is what Dimon had to say about crypto: “I probably shouldn’t say any more about cryptocurrency. But it’s not the same as gold or fiat currencies. Those are supported by law, police, courts. They’re not replicable, and there are strictures on them. Blockchain, on the other hand, is real. We’re testing it and will use it for a whole lot of things.”

Then, on 14 February 2019, CNBC reported that JP Morgan had created its own stablecoin — JPM Coin — “a digital token that will be used to instantly settle transactions between clients of its wholesale payments business.”

And last Friday (February 21), Bloomberg reported that the bank’s Global Research team had released its annual “J.P. Morgan Perspectives” report; this year’s report was titled “Blockchain, digital currency and cryptocurrency: Moving into the mainstream?”.

Here are a few interesting highlights from what the report’s Executive Summary had to say about distributed ledger and blockchain technologies:

- “While blockchain technology has not yet emerged into the mainstream, it has moved beyond experimentation and use in payments, with stock exchanges embracing the efficiency around settlement/clearing and collateral management.”

- “Trade Finance and Payments blockchain solutions offer the most incremental efficiencies in the banking sector relative to other use cases, but widespread implementation is at least three to five years away.”

- “We see the long-term potential for Distributed Ledger Technology (DLT) to transform banks’ business models by providing efficient and resilient information transfer and storage once scale has been achieved…”

- “The crypto market continues to mature with the increased participation by financial institutions and the introduction of new contracts on regulated exchanges.”

However, for our purposes, the most interesting part of the report was the section titled “Cryptocurrencies for portfolio diversification: Struggling to prove uniqueness” (pp. 62-66).

Here, the report makes some interesting acknowledgements:

- “Despite their extraordinary standalone volatility, crypto assets still raise the efficiency of a multi-asset Equity and FICC portfolio (the Sharpe ratio, or return per unit of risk) due to high historical returns and low cross-asset correlations.”

- “While crypto might serve some retail investors with a small asset base as one of several hedge instruments, it could not serve all retail investors nor institutional ones and corporates due to a liquidity constraint tough to circumvent without legal currency status to convey scale.”

So, it seems that we have gone from the bank’s CEO calling Bitcoin “a fraud” in September 2017 to the bank launching its own digital currency in February 2019 to the bank admitting in February 2020 that cryptocurrencies (such as Bitcoin) can “raise the efficiency” of some investment portfolios and that they could be useful to some investors as hedging instruments.