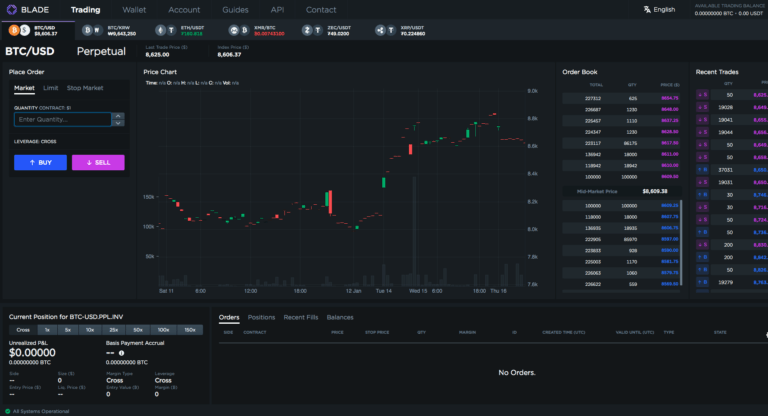

Coinbase-backed crypto derivatives exchange BLADE, which launched last September, plans to offer (starting in February) zero-fee trading for Bitcoin, Ether (ETH), XRP, Zcash (ZEC), and Monero (XMR) perpetual contracts.

What Are Perpetuals?

Here is how BLADE defines perpetuals:

“Perpetuals (aka perpetual swap contracts) are financial derivatives, similar to futures, that enable traders/investors/speculators/hedgers to easily long and short cryptocurrencies with leverage. They are named perpetuals because they never expire and they are classified as swaps because payments are ‘swapped’ between counterparties on a periodic basis. Perpetuals represent the price of a perpetual claim on an index (e.g. the BLADE ZEC/USDT index)…

“Trading perpetuals is analogous to trading the underlying asset/cryptocurrency, but with leverage and a simple and efficient mechanism to short.”

According to BLADE, trading perpetuals offers two advantages over trading regular (i.e. expiring) futures:

- “Since perpetuals never expire, traders never need to roll over their futures contracts from the front month to a further-out month”

- “Perpetuals typically trade closer to spot because of periodic payments which close the gap (or basis) between perpetuals prices and underlying index prices”

BLADE offers both vanilla perpetuals (“simpler contracts in which P&L is denominated in the quote currency”) and inverse perpetuals (“more complex contracts in which P&L is denominated in the underlying currency”):

- vanilla perpetual contracts exist for Ether (ETH/USDT), XRP (XRP/USDT), Monero (XMR/USDT), and Zcash (ZEC/USDT).

- inverse perpetual contracts exist for Bitcoin (BTC/USD and BTC/KRW).

A Little Background Information About BLADE

According to a report by Techcrunch, BLADE was founded by Jeff Byun and Henry Lee, and it has raised $4.3 million in seed funding from a host of investors, including Coinbase, SV Angel, A.Capital, Slow Ventures, Justin Kan and Adam D’Angelo.

Shortly before launch, BLADE CEO Jeff Byun told Techcrunch that perpetuals are “arguably the fastest growing segment of cryptocurrency trading.”

To avoid trouble with U.S. financial regulators, BLADE is “an offshore entity with a U.S. subsidiary,” and it does not allow U.S. investors/traders to use its platform.

BLADE is the only digital asset exchange that focuses exclusively on perpetuals (aka “perpetual contracts”). It allows “leveraged (up to 150X) speculation and hedging on a large selection of cryptocurrency pairs.” Also, it is worth noting that BLADE “does not accept fiat currency; margin, profit-and-loss and settlement are in cryptocurrency – currently Tether and Bitcoin.”

Zero-Fee Trading in Crypto Perpetuals

According to a report by Coindesk, starting next month, BLADE plans to compete with its much larger rivals — the main one of which is BitMEX — by offering “0.00% fee crypto perpetuals trading.”

In contrast, here are the maker and taker fees BitMEX charges for its two perpetual contracts:

- For Bitcoin (up to 100X leverage), the maker and taker fees are 0.0250% and 0.0750% respectively.

- For Ether (up to 50X leverage), the maker and taker fees are -0.0250% and 0.0750% respectively.

Also, Coindesk’s report states that there will be “no restrictions or eligibility requirements.”

Featured Image Courtesy of BLADE Holdings, Inc.