Volatility has returned to Bitcoin (BTC) in the last few days, after the leading crypto broke down from a consolidation above $9,000. It has slightly altered what was looking like a very bullish picture, although there is still a chance that a larger uptrend may be forming. A very choppy trading period in the last 24 hours has resulted in a strange weekly close, managing to just barely stay above some important support levels.

We start on the weekly chart to observe this erratic price action, and should direct our attention to the 21 EMA (orange line). This is an important moving average, because of Bitcoin’s historical respect of this level during a bull market. Closing below this level for a second time – as it did in September – would not be encouraging.

The interesting thing here is that, although Bitcoin fell below the 21 EMA during last week’s trading, it managed to close above it yesterday; and as we shall see, a surge of buying seemed to come in to secure a close above the 21 at the eleventh hour.

We should also note the weekly histogram indicator, which has been going up flat for the past three weeks. At present it looks quite bad, starting to point down; but we are only on day one of this week’s candle, so the present look can be discarded for now. If the week closes like this, however, Bitcoin will have a big problem.

Moving to the daily, we this event in more detail. Price had been well below the $9,000 level, where the 21-week EMA is (and incidentally where all the important daily EMAs are), but was pushed up just long enough to close the week above it.

Other things to note on the daily: Although the price has clearly taken a slight turn down, the potential for a larger uptrend remains here. The retracement from local highs of about $10,500 is still above the 0.618 “golden pocket” level, which must be taken out before we start to worry. The blue band of support seems to be holding Bitcoin here, which is derived from September-October resistance.

We can also note that volume, in general, continues to decline respective to the dramatic October 25th reversal. All in all, this is a very important week for Bitcoin: The confirmation of a reversal of half a year’s worth of downtrending correction is not yet it, and strength must be shown this week in order to effect such a reversal. If that doesn’t happen, we may have to consider more bearish narratives.

The views and opinions expressed here do not reflect those of CryptoGlobe.com and do not constitute financial advice. Always do your own research.

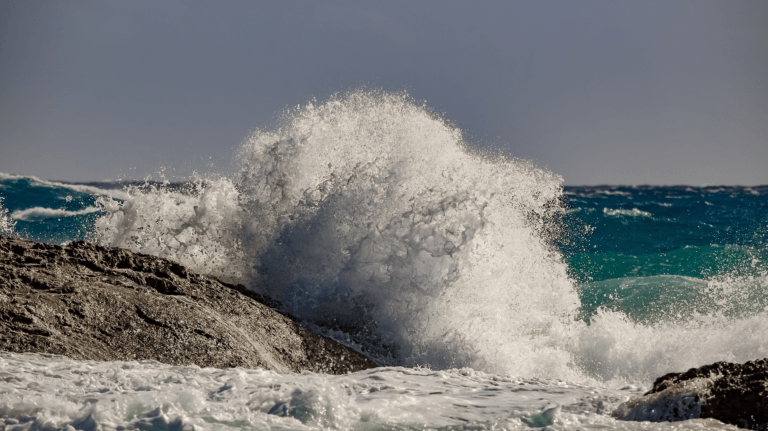

Featured Image Credit: Photo via Pixabay.com