Cryptocurrency exchange, Bitfinex has finally launched its margin trading system, allowing users to wager on the price of Bitcoin (BTC) and Ethereum (ETH) with up to 100x leverage.

Bitfinex announced the completion of its upgrade on Monday, and while the product was relatively underplayed users have been quick to point out the new addition:

Now with extra liquidation

— Riding Japan (@RidingJapan) September 2, 2019

Bitfinex BTC/USDT and ETH/USDT derivatives just went live pic.twitter.com/ptP3P74IS6

— Degam (@ItsMeDegam) September 2, 2019

The derivatives product has been under development since May. Bitfinex revealed details about the leverage increase as well as the chosen collateral within the LEO whitepaper:

Qualified Bitfinex account holders will be able to trade a new hedging product through a derivatives wallet. The product will have USDT-based collateral (unavailable in the rest of the market), up to 100x leverage and isolated margin for individualized risk level.

While margin trading was available on the exchange prior to the upgrade, users were only offered 3.3x leverage.

High-risk High Reward

Margin trading doesn’t come without its price, and the price is often remarkably high. Essentially, Trading using leverage allows users to borrow funds against their existing capital to increase buying power. Win a trade with high leverage, and the rewards speak for themselves. However, with the crypto market’s trademark volatility margin trading is especially risky, particularly when leverage is set at 100x.

Bitfinex is now the third major crypto exchange to implement such a lofty level of leverage, the other two being BitMEX and Deribit.

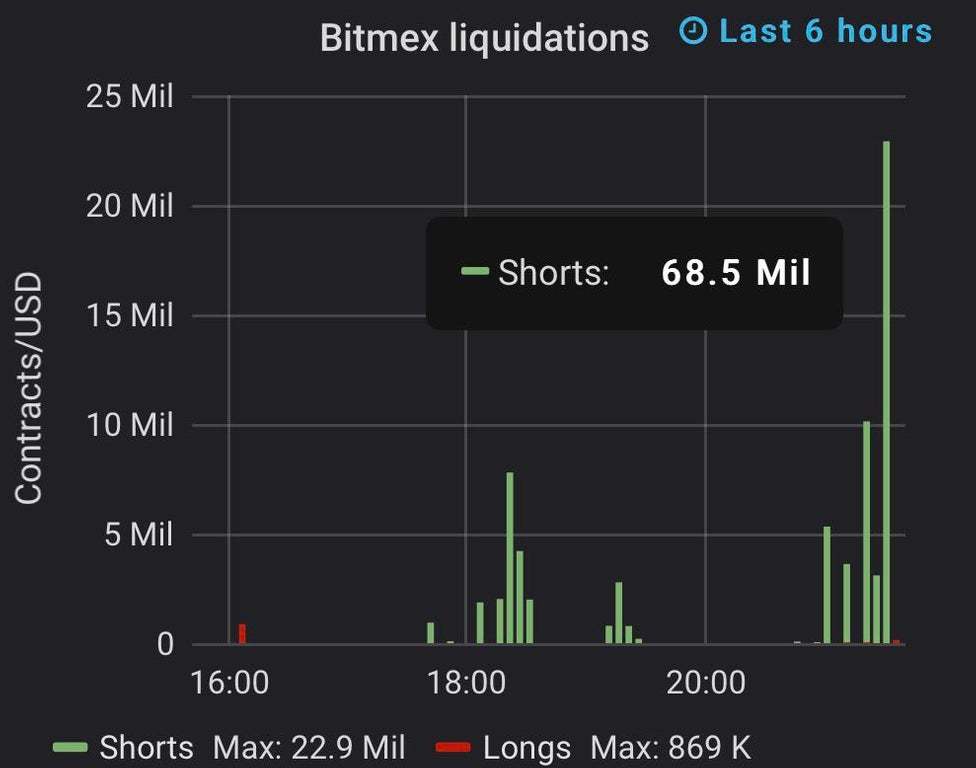

On September 2, $68 million in bitcoin shorts evaporated as BTC exhibited an explosive 6% move up.

$68 million in BTC shorts liquidated on BitMEX. Source: Coin360

$68 million in BTC shorts liquidated on BitMEX. Source: Coin360

BitMEX has often been criticized offering such high leverage, with a plethora of users who can attest to the dangers of margin trading. The exchange’s reputation for liquidating traders is such that there are several twitter accounts dedicated to monitoring each blown position:

Liquidated short on XBTUSD: Buy 1,012,000 @ 10737.5 💯💯💯💯💯💯💯💯💯💯🔥 ~ Double kill

— REKT (@BXRekt) September 3, 2019

Margin trading is becoming an extremely popular instrument. In fact, more and more cryptocurrency exchanges are scrambling to offer some iteration of this derivative product.

Notably back in July, Binance moved to launch its own highly anticipated margin trading platform. Although, unlike Bitfinex, Binance chose to ease users in a little, capping leverage at 3.3x.