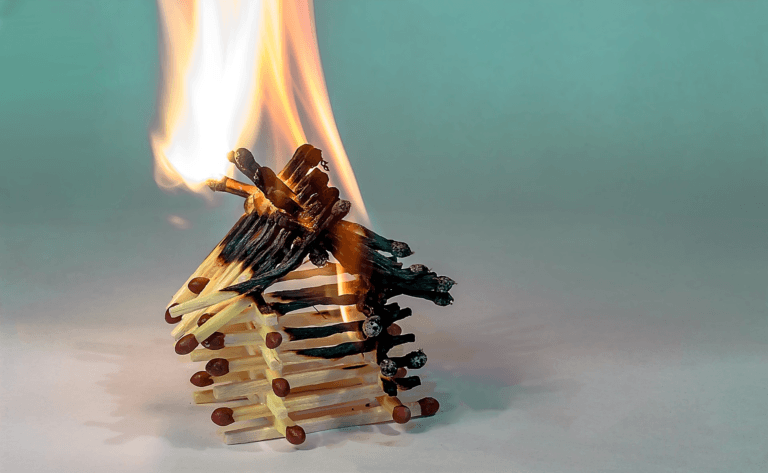

The picture is starting to clear for Bitcoin (BTC) after it broke out of a months-long consolidation pattern last week, and the picture is starting to clear. We can at least say now that its 2019 uptrend appears to be broken, and that a period of further downside seems likely.

We start with the weekly chart, and on last week’s candle which closed last night (September 29). The first things to note here are the exponential moving averages (EMAs). Our first confirmation that a downtrend might be sticking is that the weekly candle closed below the 21-week EMA.

As we’ve often mentioned here, Bitcoin’s price never closed below the 21-week EMA during the 2016-17 bull market; and so, based on this historical precedent at least, we can theorize that the 2019 uptrend is also broken. We note that the price drop was halted exactly at the 55 EMA, another popular trading level, indicating at least that traders are responding to these levels.

If we move to a smaller chart, the 3-day, we look at Bitcoin’s retracement progress within the entire market structure of 2019 since the breakout; that is, from $4,100-14,000. Within this range, Bitcoin’s fall has been held upright within the “golden pocket” Fibonacci retracement range.

And this range also overlaps with a strong support area from the 2019 market, which took a month to crack on the way up and is supported by high volume on the Volume Profile indicator (right of chart).

It is comforting that Bitcoin is holding with this predictable nexus of supports. However, what is not comforting is the bank of open air between the present support and the next one down, roughly between $5,500-5,000. If this support doesn’t hold we could eventually see that support revisited.

But things don’t move in a straight line. Moving to the daily chart with indicators, we see that Bitcoin is quite oversold. Here, we might look for some correction back to the upside. Given that the present support range took a month to break up, it will probably take at least more than a few days to break it down. The moving averages are also completely left behind, and need to catch up to price at any rate.

The views and opinions expressed here do not reflect those of CryptoGlobe.com and do not constitute financial advice. Always do your own research.

Featured Image Credit: Photo via Pixabay.com